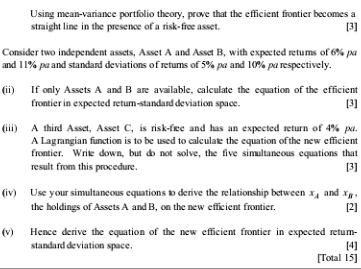

Question: Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the presence of a risk-free asset. [3] Consider two independent

Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the presence of a risk-free asset. [3] Consider two independent assets, Asset A and Asset B, with expected retums of 6% pa and 11% pa and standard deviations of retums of 5% pa and 10% pa respectively. (ii) If only Assets A and B are available, calculate the equation of the efficient frontier in expected return-standard deviation space. [3] (v) A third Asset, Asset C, is risk-free and has an expected return of 4% pa. A Lagrangian function is to be used to calculate the equation of the new efficient frontier. Write down, but do not solve, the five simultaneous equations that result from this procedure. [3] (iv) Use your simultaneous equations to derive the relationship between x and X. the holdings of Assets A and B, on the new efficient frontier. [2] Hence derive the equation of the new efficient frontier in expected return- standard deviation space. [4] [Total 15]

Step by Step Solution

3.44 Rating (141 Votes )

There are 3 Steps involved in it

To prove that the efficient frontier becomes a straight line in the presence of a riskfree asset using meanvariance portfolio theory we need to consid... View full answer

Get step-by-step solutions from verified subject matter experts