Question: Kindly please help me with this questions End Problem 2 Problem 3: he Early start Learning Essentials company (50 points) The Early Start Essentials company

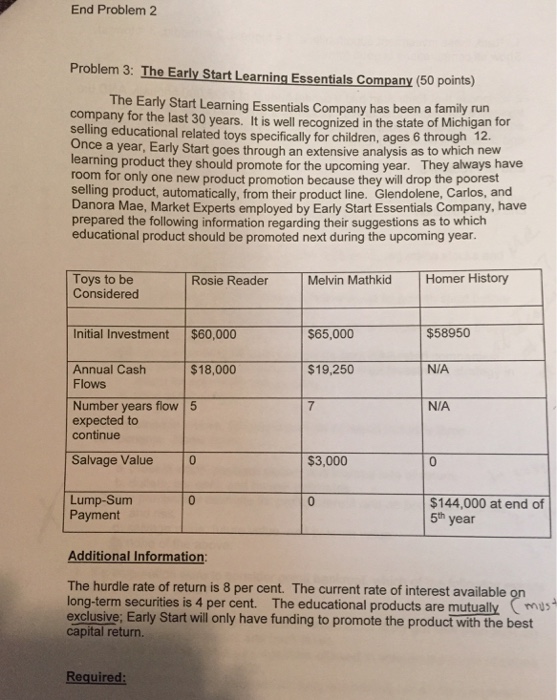

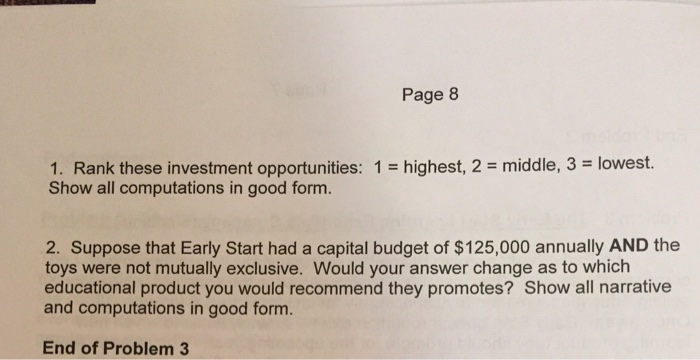

End Problem 2 Problem 3: he Early start Learning Essentials company (50 points) The Early Start Essentials company has been a family run company for the last 30 years. recognized in the state of Michigan for selling educational related toys specifically for children, 6 through 12. ages Once a goes through an extensive analysis as which new learning product they should promote for the upcoming year. They always have room for only one new product promotion because they drop the poorest selling product, automatically, from their product line. Glendolene, Carlos, and Danora Mae, Market Experts employed by Early Start Essentials Company, have prepared the following information regarding their suggestions as to which educational product should be promoted next during the upcoming year. Toys to be Rosie Reader Melvin Mathkid Homer History Considered nitial investment $60,000 $65,000 $58950 $18,000 $19,250 NIA Annual Cash Flows Number years flow 5 NIA expected to continue Salvage Value 0 $3,000 144,000 at end of Lump-Sum Payment 5th year Additional Information The hurdle rate of return is 8 per cent. The current rate of interest available long-term securities is 4 per cent. The educational products are mutually m US exclusive; Early Start will only have funding to promote the product with the best capital return Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts