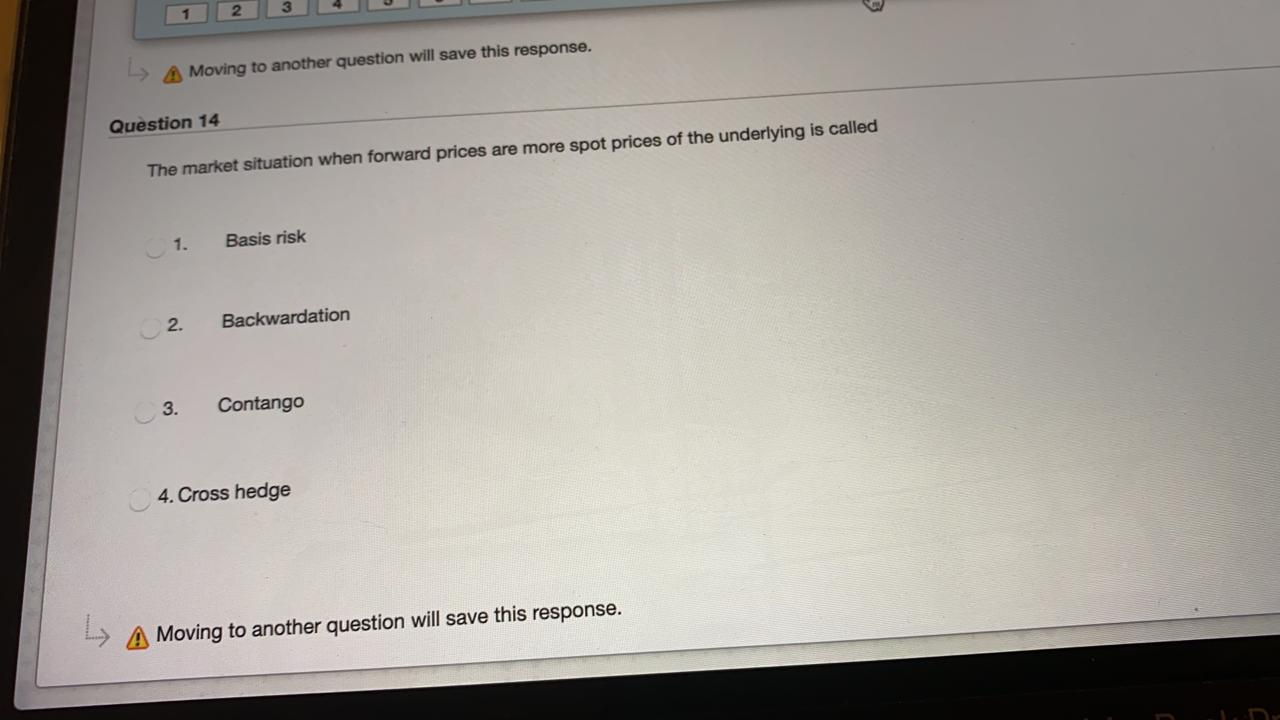

Question: L A Moving to another question will save this response. Question 14 The market situation when forward prices are more spot prices of the underlying

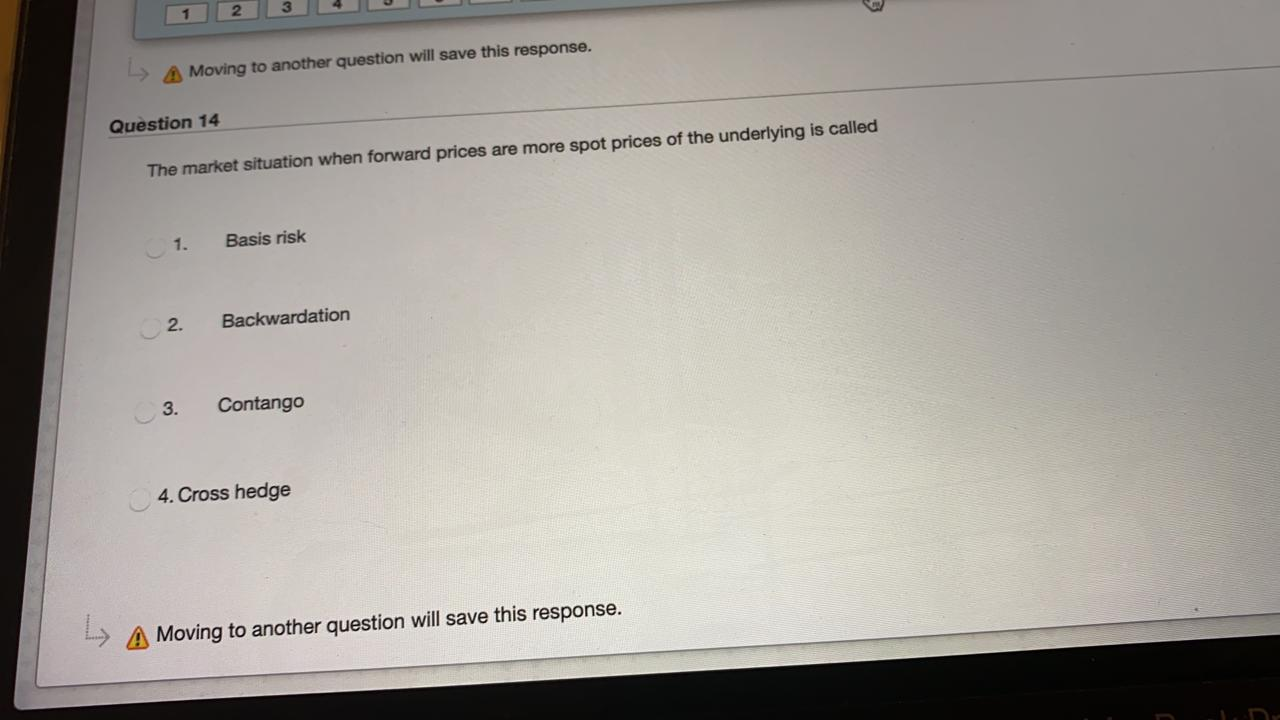

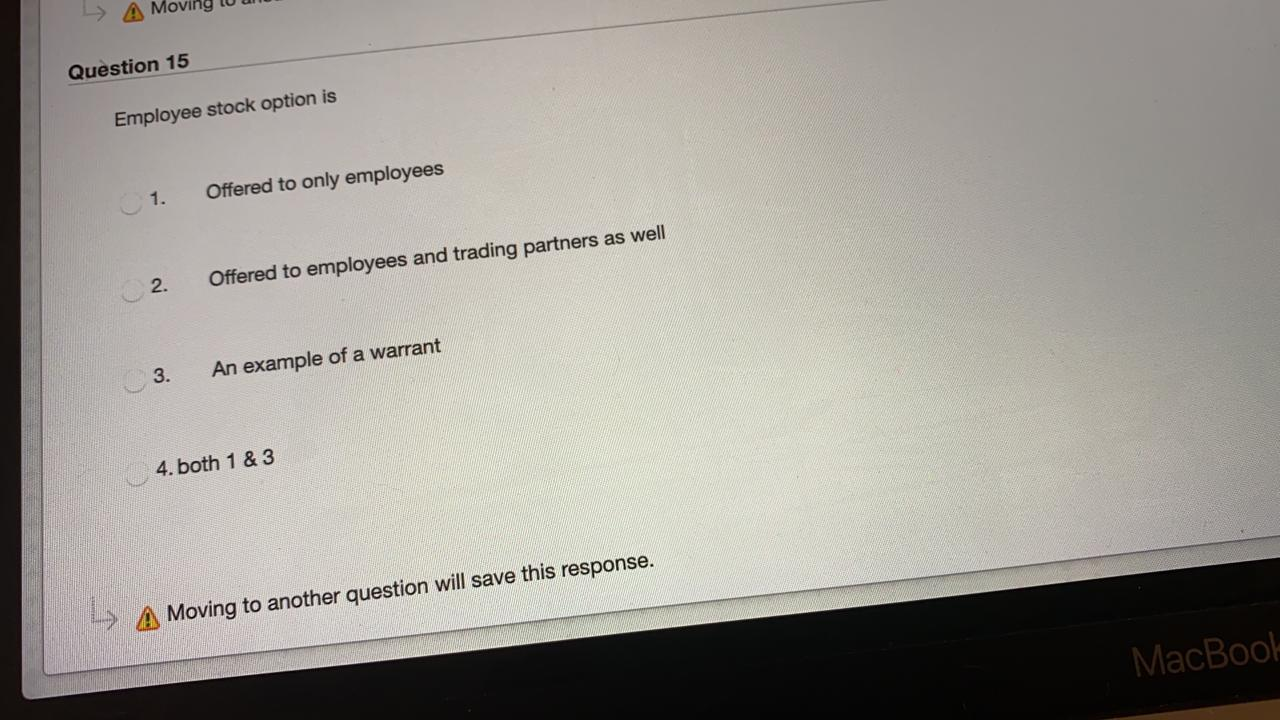

L A Moving to another question will save this response. Question 14 The market situation when forward prices are more spot prices of the underlying is called 1. Basis risk 2. Backwardation 3. Contango 4. Cross hedge L Moving to another question will save this response. L A Moving to another question will save this response. Question 14 The market situation when forward prices are more spot prices of the underlying is called 1. Basis risk 2. Backwardation 3. Contango 4. Cross hedge L Moving to another question will save this response. A MO Question 15 Employee stock option is 1. Offered to only employees 2. Offered to employees and trading partners as well 3. An example of a warrant 4. both 1 & 3 > A Moving to another question will save this response. MacBook 2 3 7 8 9 10 11 12 13 14 15 17 18 19 20 21 22 23 24 26 Moving to another question will save this response. Question 16 Suppose that Nikson International, a hypothetical investment company, issues employee stock option on 1000 stocks at a price of $20 per stock. Which one of the followings is most true? 1. The strike price of the option is $20 2. The option is at the money 3. The current price of the stock of Nikson International is $20 4. All of the above Moving to another question will save this response. MacBook Pro esc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts