Question: can someone please help me with this its due in the next few hours guyz y am i not getting help that i asked for

can someone please help me with this its due in the next few hours guyz y am i not getting help that i asked for can you please classify your answers please make its clear question1 and question2 please help help the last person who help i dont understand the format he dii the answers with cause it clears say provide financial statement please help me me plz guyz im in need for your help i wouldnt be paying this money if i dont need help this thing iz due today @12noon

what information do you need please help the last Answer i got didnt understand

its fine i can submitte its they will takenoff sum markx its fine its better late than nothing plz plz plz help

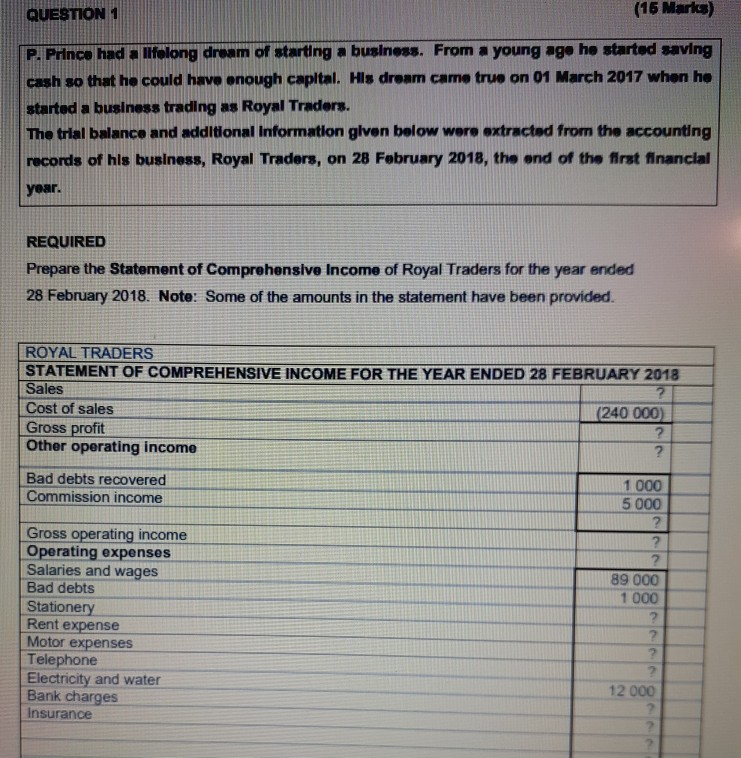

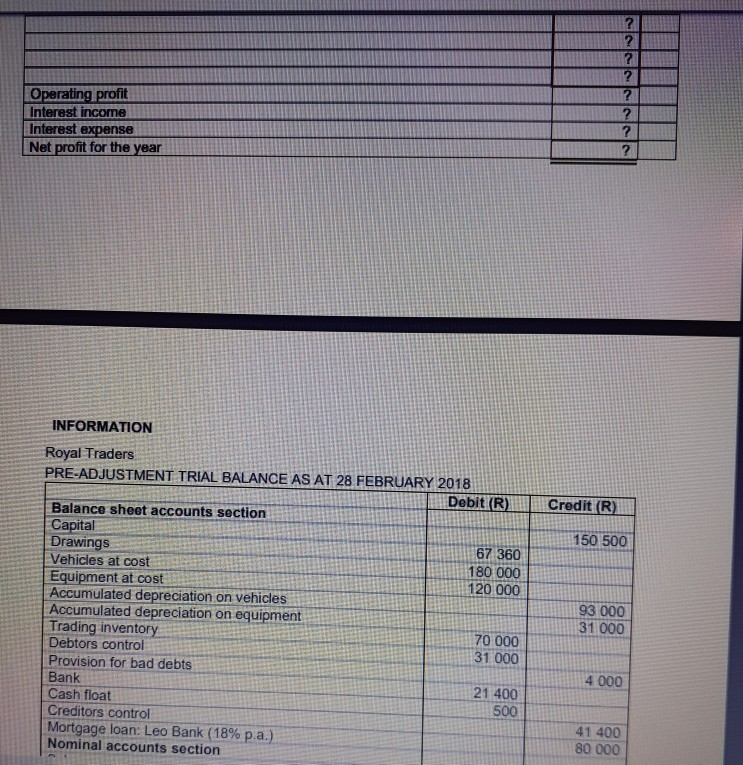

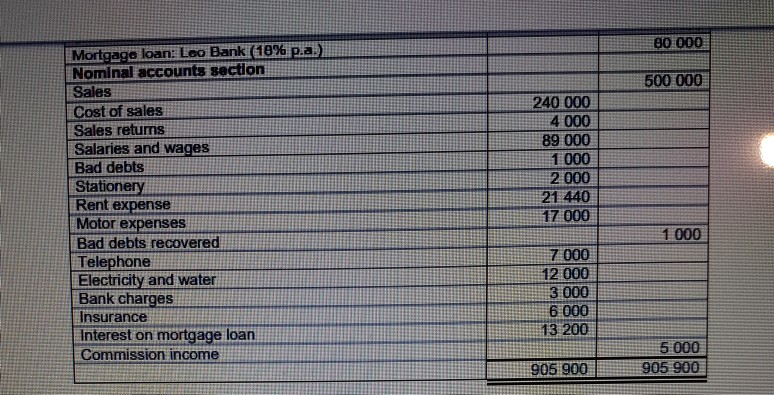

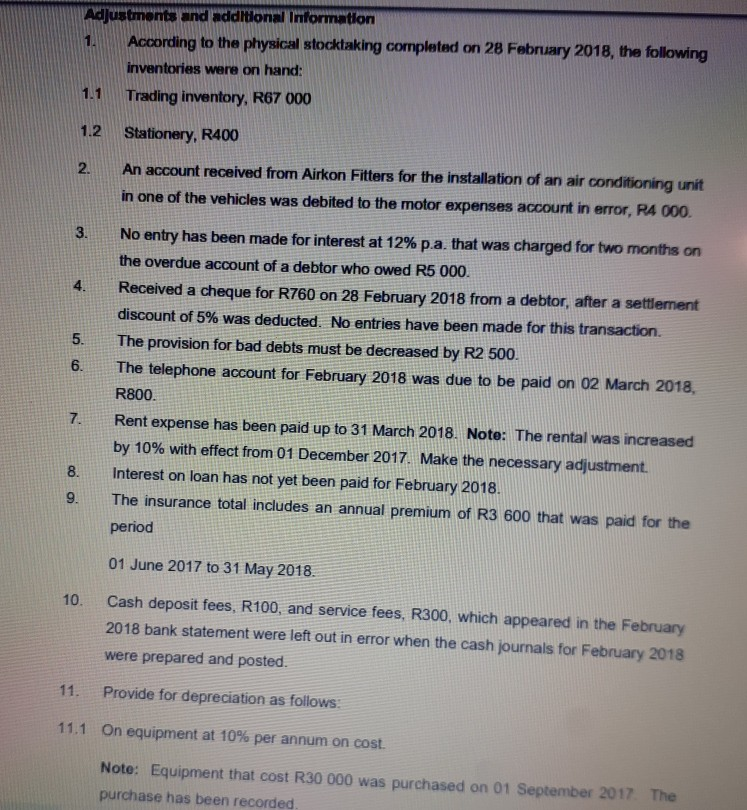

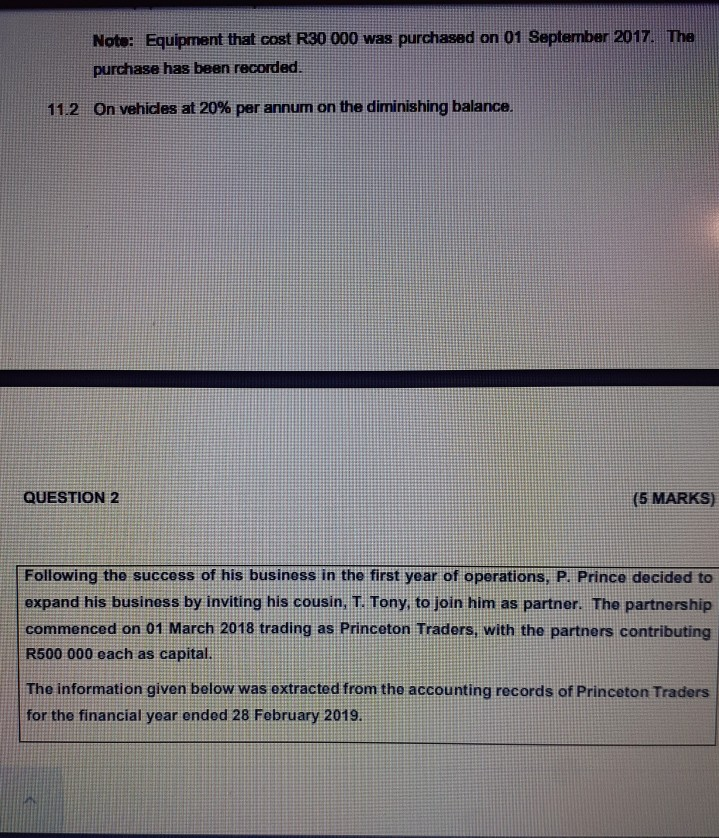

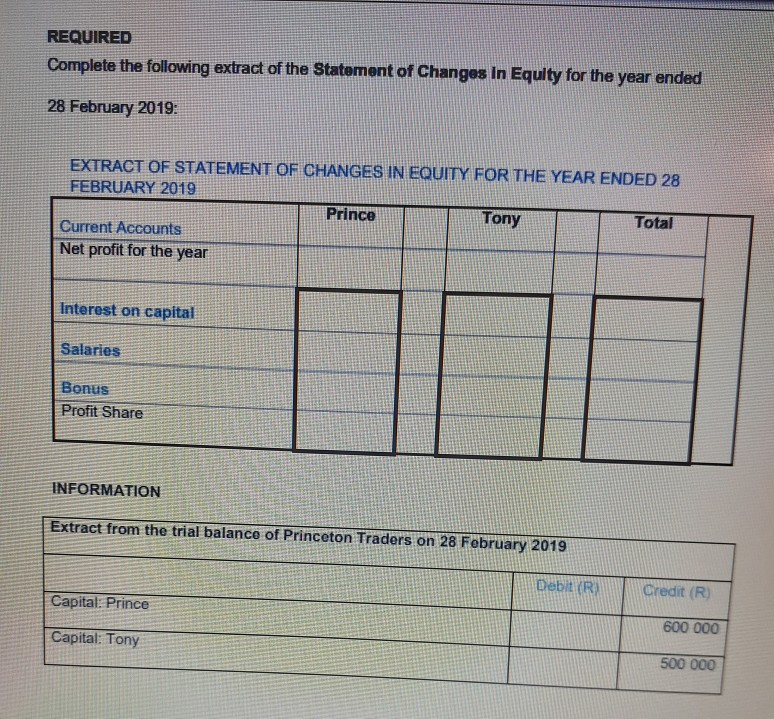

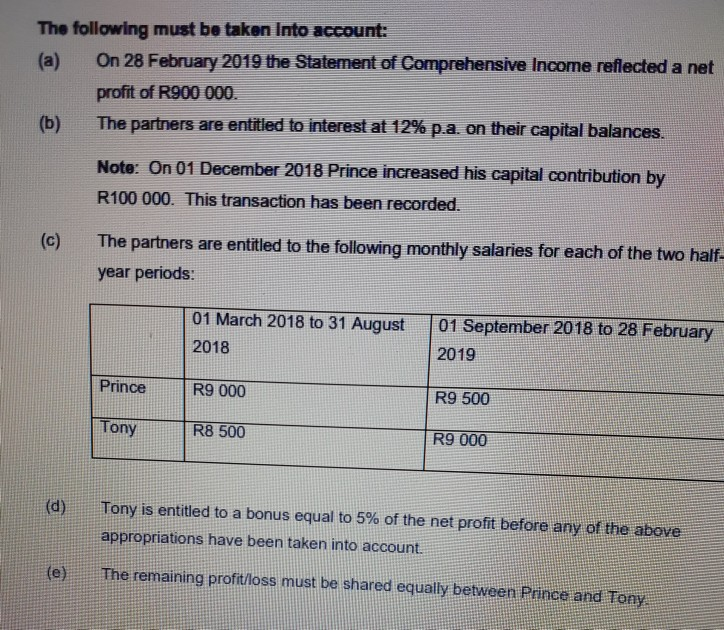

QUESTION 1 (16 Maris) P. Prince had a lifelong dream of starting a business. From a young age he started saving cash so that he could have enough capital. His dream came true on 01 March 2017 when he started a business trading as Royal Traders. The trial balance and additional Information given below were extracted from the accounting records of his business, Royal Traders, on 28 February 2018, the end of the first financial year. REQUIRED Prepare the Statement of Comprehensive Income of Royal Traders for the year ended 28 February 2018. Note: Some of the amounts in the statement have been provided. ROYAL TRADERS STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 28 FEBRUARY 2018 Sales Cost of sales (240 000) Gross profit Other operating income Bad debts recovered 1 000 Commission income 5 000 89 000 1 000 Gross operating income Operating expenses Salaries and wages Bad debts Stationery Rent expense Motor expenses Telephone Electricity and water Bank charges Insurance 12 000 Operating profit Interest income Interest expense Net profit for the year 150 500 INFORMATION Royal Traders PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2018 Debit (R) Balance sheet accounts section Capital Drawings 167 360 Vehicles at cost 180 000 Equipment at cost 120 000 Accumulated depreciation on vehicles Accumulated depreciation on equipment Trading inventory 70 000 Debtors control 31 000 Provision for bad debts Bank 21 400 Cash float 500 Creditors control Mortgage loan: Leo Bank (18% p.a.) Nominal accounts section 93 000 31 000 4 000 41 400 80 000 80 000 500 000 Mortgage loan: Leo Bank (18% p.a. Nominal accounts section Sales Cost of sales Sales retums Salaries and wages Bad debts Stationery Rent expense Motor expenses Bad debts recovered Telephone Electricity and water Bank charges Insurance Interest on mortgage loan. Commission income 240 000 4 000 89 000 1 000 2.000 21 440 17 000 1000 7 000 12 000 3 000 6 000 13 200 5 000 905 900 905 900 Adjustments and additional information According to the physical stocktaking completed on 28 February 2018, the following inventories were on hand: 1.1 Trading inventory, R67 000 1.2 Stationery, R400 2. An account received from Airkon Fitters for the installation of an air conditioning unit in one of the vehicles was debited to the motor expenses account in error, P4 000 No entry has been made for interest at 12% p.a. that was charged for two months on the overdue account of a debtor who owed R5 000. Received a cheque for R760 on 28 February 2018 from a debtor, after a settlement discount of 5% was deducted. No entries have been made for this transaction. The provision for bad debts must be decreased by R2 500. The telephone account for February 2018 was due to be paid on 02 March 2018, R800. Rent expense has been paid up to 31 March 2018. Note: The rental was increased by 10% with effect from 01 December 2017. Make the necessary adjustment. Interest on loan has not yet been paid for February 2018. The insurance total includes an annual premium of R3 600 that was paid for the period 000 01 June 2017 to 31 May 2018. 10. Cash deposit fees, R100, and service fees, R300, which appeared in the February 2018 bank statement were left out in error when the cash journals for February 2018! were prepared and posted. 11. Provide for depreciation as follows: 11.1 On equipment at 10% per annum on cost. Note: Equipment that cost R30 000 was purchased on 01 September 2017. The purchase has been recorded Note: Equipment that cost R30 000 was purchased on 01 September 2017. The purchase has been recorded. 11.2 On vehicles at 20% per annum on the diminishing balance. QUESTION 2 (5 MARKS) Following the success of his business in the first year of operations, P. Prince decided to expand his business by inviting his cousin, T. Tony, to join him as partner. The partnership commenced on 01 March 2018 trading as Princeton Traders, with the partners contributing R500 000 each as capital. The information given below was extracted from the accounting records of Princeton Traders for the financial year ended 28 February 2019. REQUIRED Complete the following extract of the Statement of Changes in Equity for the year ended 28 February 2019: EXTRACT OF STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 28 FEBRUARY 2019 Prince Tony Total Current Accounts Net profit for the year Interest on capital Salaries Bonus Profit Share INFORMATION Extract from the trial balance of Princeton Traders on 28 February 2019 Debit (R Credit (R) Capital: Prince 600 000 Capital: Tony 500 000 The following must be taken into account: (a) On 28 February 2019 the Statement of Comprehensive Income reflected a net profit of R900 000 (b) The partners are entitled to interest at 12% p.a. on their capital balances. Note: On 01 December 2018 Prince increased his capital contribution by R100 000. This transaction has been recorded. (c) The partners are entitled to the following monthly salaries for each of the two half- year periods: The | 01 March 2018 to 31 August 2018 01 September 2018 to 28 February 2019 Prince R9 000 R9 500 Tony R8 500 R9 000 (d) Tony is entitled to a bonus equal to 5% of the net profit before any of the above appropriations have been taken into account. (e) The remaining profit/loss must be shared equally between Prince and Tony

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts