Question: Lab 9 Ch 14 A Saved Help Save & Exit Submit Check my work Raymond Mining Corporation has 10.0 million shares of common stock outstanding,

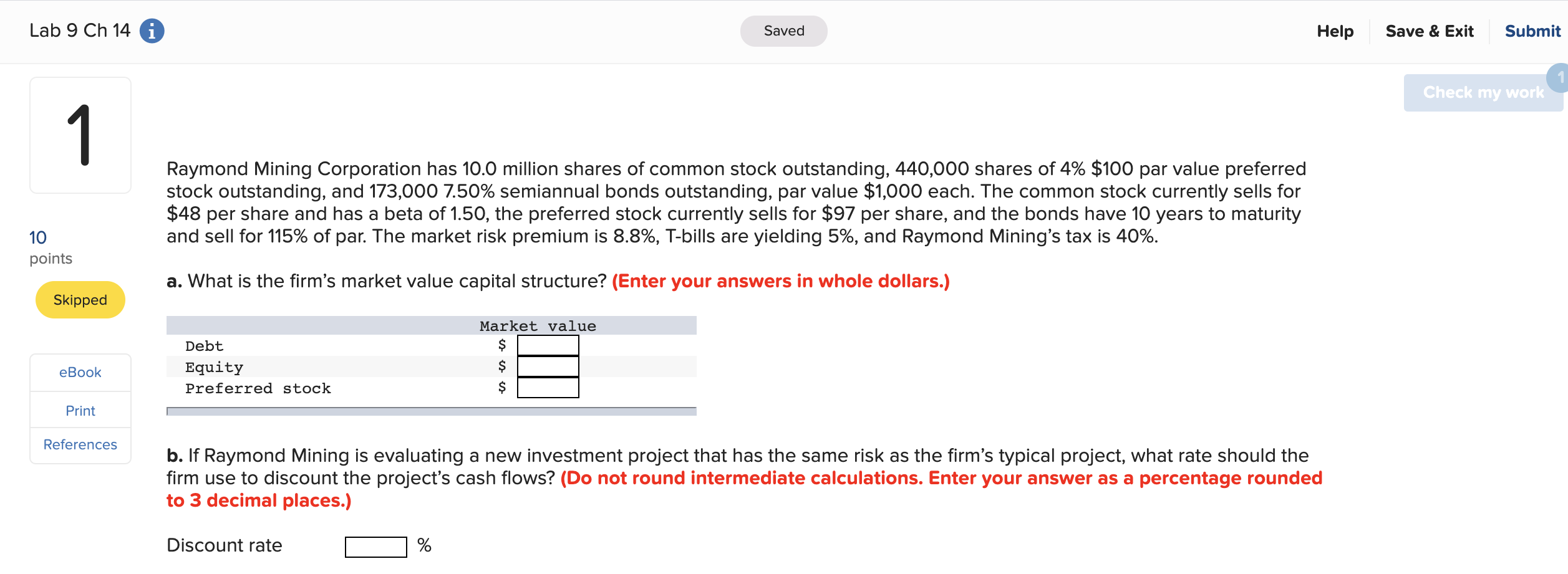

Lab 9 Ch 14 A Saved Help Save & Exit Submit Check my work Raymond Mining Corporation has 10.0 million shares of common stock outstanding, 440,000 shares of 4% $100 par value preferred stock outstanding, and 173,000 7.50% semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $48 per share and has a beta of 1.50, the preferred stock currently sells for $97 per share, and the bonds have 10 years to maturity and sell for 115% of par. The market risk premium is 8.8%, T-bills are yielding 5%, and Raymond Mining's tax is 40%. 10 points a. What is the firm's market value capital structure? (Enter your answers in whole dollars.) Skipped Market value eBook Debt Equity Preferred stock Print References b. If Raymond Mining is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 3 decimal places.) Discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts