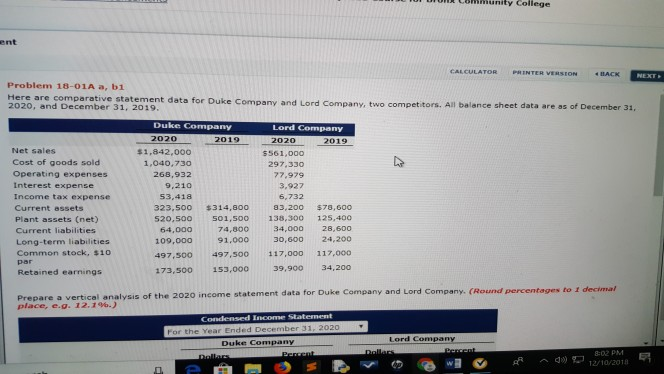

Question: LBMmunity College ent Problem 18-01A a, b1 mparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of

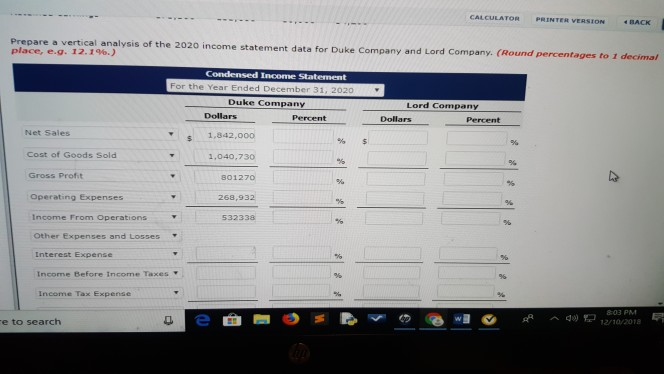

LBMmunity College ent Problem 18-01A a, b1 mparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019 Duke Company Lord Company 2020 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current essets Plant assets (net) Current liabilities Long-term liabilities Common stock, $10 $1,842,000 1,040,730 26B,932 9,210 53,418 561,00o 297,330 7.979 3,927 6,732 323,50O $314,800 83,200 $78,600 1,500 138,300 125,400 34,000 28,600 30,600 24,200 S20,500 50 74,800 91.000 64,00O 109,00o 497,500 497,500 117,000 117,000 173,500 153,000 39,90034,200 Retained earnings 2020 income statement data for Duke Company and Lord Company. (Round percentages to I decimal place, e.g. 12.196.) Lord Company Duke Company CALCULATOR PR INTER VERSION BACK Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company. ( place, e.g. 12.19%.) (Round percentages to 1 decimal d Income Statement Duke Company Lord Company Dollars Percent Dollars Percent Net Sales 1,842,000 Cost of Goods Sold Gross Profit Operating Expenses Income From Operations Other Expenses and Losses 1,040,730 801270 268,932 532338 Interest Expense Income Before income Taxes Income Tax Expense e to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts