Question: LeBron's Bookstores has two divisions: books and electronics. The electronics division had another great year in 2 0 2 4 with net sales of $

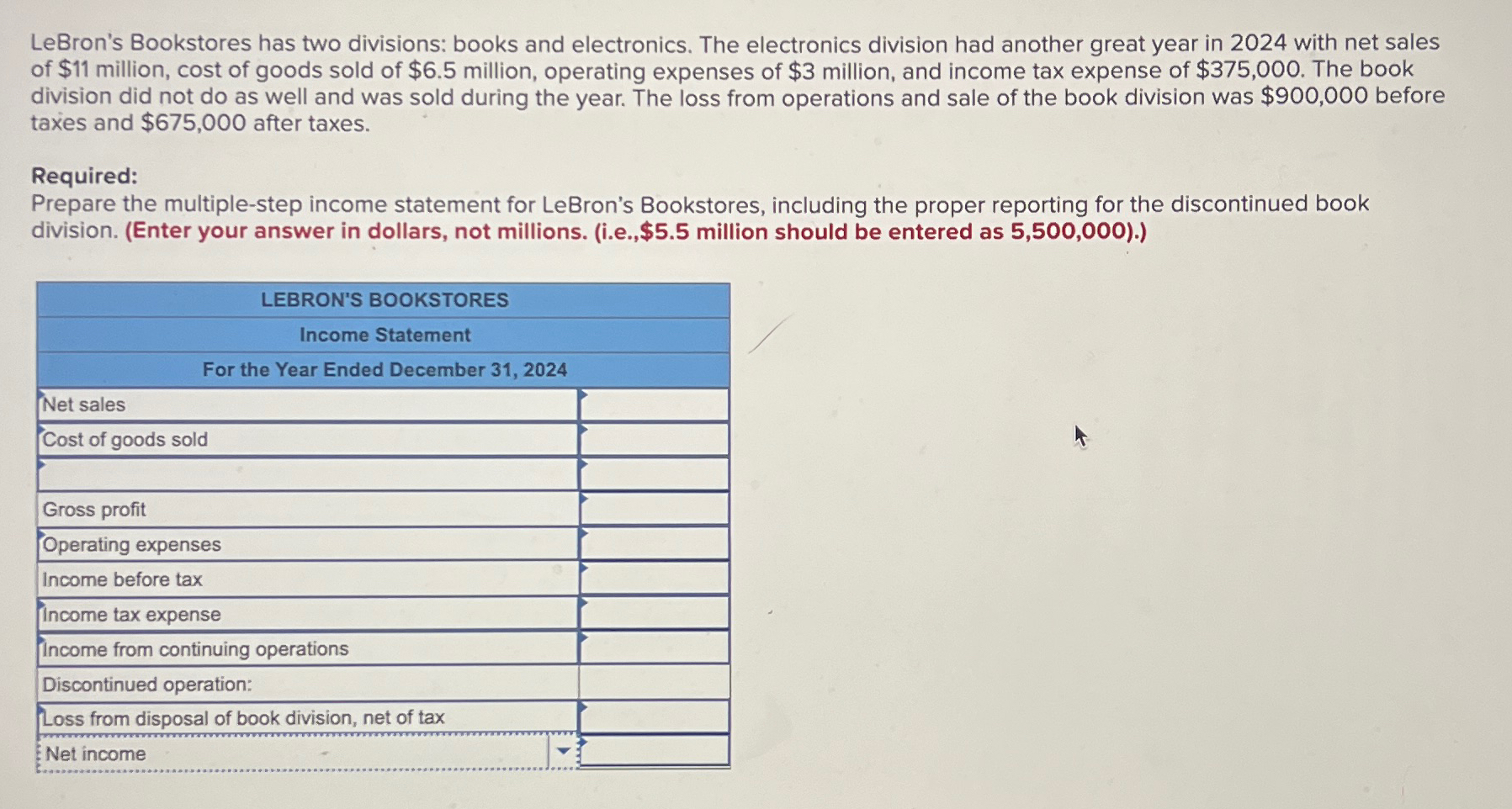

LeBron's Bookstores has two divisions: books and electronics. The electronics division had another great year in with net sales of $ million, cost of goods sold of $ million, operating expenses of $ million, and income tax expense of $ The book division did not do as well and was sold during the year. The loss from operations and sale of the book division was $ before taxes and $ after taxes.

Required:

Prepare the multiplestep income statement for LeBron's Bookstores, including the proper reporting for the discontinued book division. Enter your answer in dollars, not millions. ie $ million should be entered as

tableLEBRONS BOOKSTORES,Income Statement,Net sales,Cost of goods sold,Gross profit,Operating expenses,Income before tax,Income tax expense,Income from continuing operations,Discontinued operation:,Loss from disposal of book division, net of tax,Net income,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock