Question: Please, I need answer for everything. Thank you Current Attempt in Progress Your answer is incorrect. Carla Company is constructing a building. Construction began on

Please, I need answer for everything. Thank you

Please, I need answer for everything. Thank you

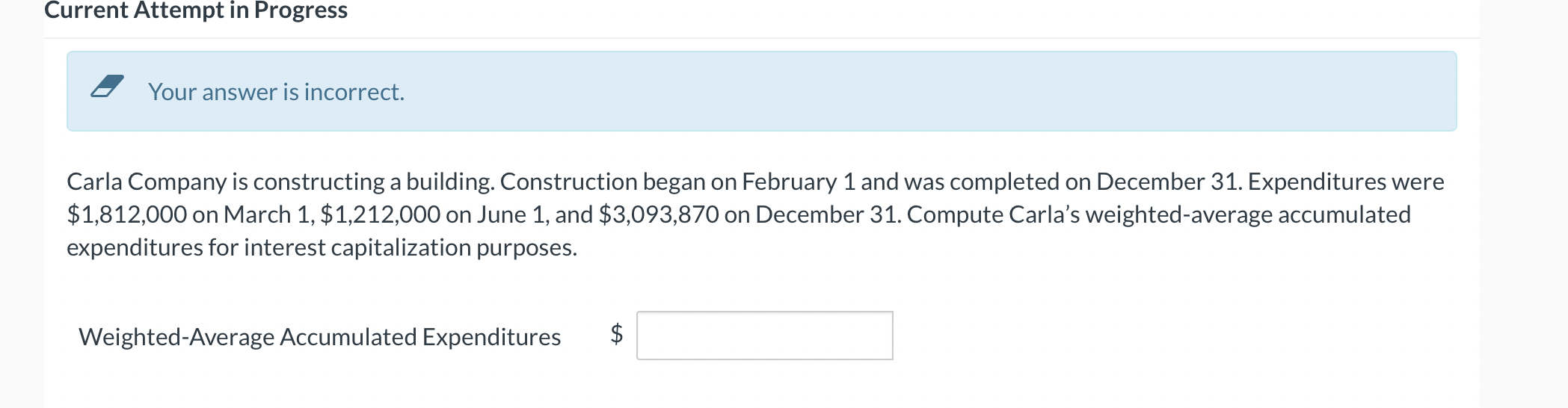

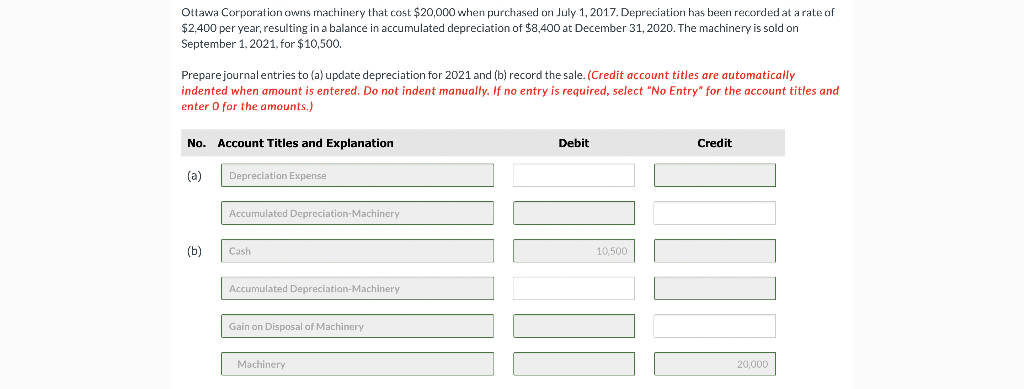

Current Attempt in Progress Your answer is incorrect. Carla Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,812,000 on March 1, $1,212,000 on June 1, and $3,093,870 on December 31. Compute Carla's weighted average accumulated expenditures for interest capitalization purposes. Weighted-Average Accumulated Expenditures ta $ Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2017. Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance in accumulated depreciation of $8,400 at December 31, 2020. The machinery is sold on September 1, 2021, for $10,500. Prepare journal entries to (a) update depreciation for 2021 and (b) record the sale. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit (a) Depreciation Expense Accumulated Depreciation Machinery (b) Cash 10,500 Accumulated Depreciation Machinery Gain on Disposal of Machinery Machinery 20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts