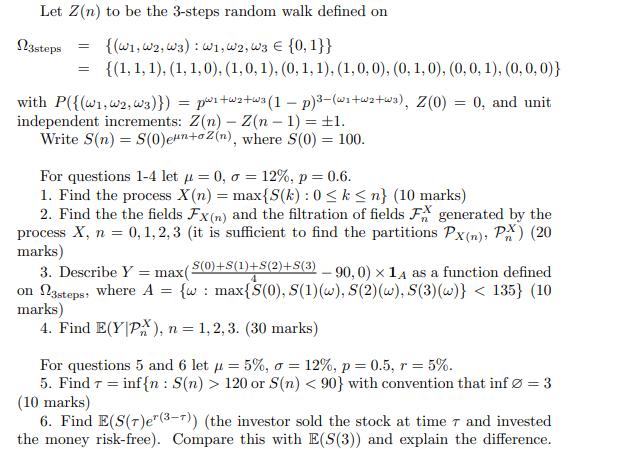

Question: Let Z(n) to be the 3-steps random walk defined on {(W1, W2, W3): W1, W2, W3 {0, 1}} {(1, 1, 1), (1, 1,0), (1,

Let Z(n) to be the 3-steps random walk defined on {(W1, W2, W3): W1, W2, W3 {0, 1}} {(1, 1, 1), (1, 1,0), (1, 0, 1), (0, 1, 1), (1, 0, 0), (0, 1, 0), (0, 0, 1), (0, 0, 0)} 3steps = = with P({(W1, W2, W3)}) = pw+wa+w3 (1 - p)3-(w+wa+wa), Z(0) = 0, and unit independent increments: Z(n) - Z(n-1)= 1. Write S(n) = S(0)en+o2(n), where S(0) = 100. For questions 1-4 let = 0, 0 = 12%, p = 0.6. 1. Find the process X(n) = max{S(k): 0 k n} (10 marks) 2. Find the the fields Fx(n) and the filtration of fields FX generated by the process X, n = 0, 1, 2, 3 (it is sufficient to find the partitions Px(n), PX) (20 marks) 3. Describe Y = max(S(0)+S(1)+5(2)+S(3) - 90,0) 14 as a function defined on 23steps: Where A {w max{S(0), S(1)(w), S(2)(w), S(3)(w)} < 135} (10 = marks) 4. Find E(YPX), n = 1, 2, 3. (30 marks) For questions 5 and 6 let = 5%, o = 12%, p = 0.5, r = 5%. 5. Find 7 = inf{n: S(n) > 120 or S(n) < 90} with convention that inf=3 (10 marks) 6. Find E(S(7)er (3-7)) (the investor sold the stock at time 7 and invested the money risk-free). Compare this with E(S(3)) and explain the difference.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

1 Xn maxSk 0kn By the properties of the geometric Brownian motion w... View full answer

Get step-by-step solutions from verified subject matter experts