Question: LO 1 7 - 5 , 1 7 - 6 , 1 7 - 7 1 7 - 2 5 For each of the following

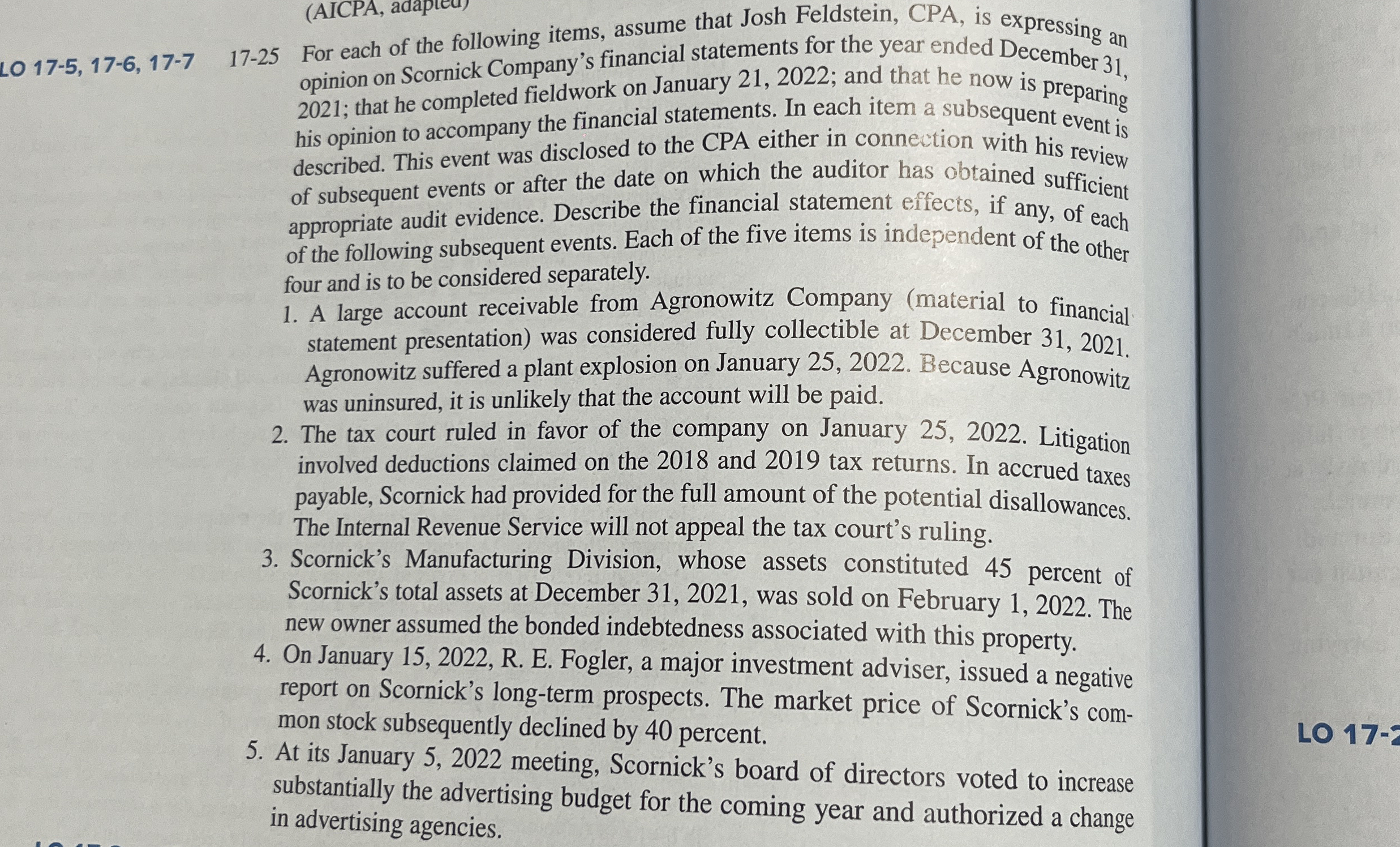

LO For each of the following items, assume that Josh Feldstein, CPA, is expressing an opinion on Scornick Company's financial statements for the year ended December ; that he completed fieldwork on January ; and that he now is preparing his opinion to accompany the financial statements. In each item a subsequent event is described. This event was disclosed to the CPA either in connection with his review of subsequent events or after the date on which the auditor has obtained sufficient appropriate audit evidence. Describe the financial statement effects, if any, of each of the following subsequent events. Each of the five items is independent of the other four and is to be considered separately.

A large account receivable from Agronowitz Company material to financial statement presentation was considered fully collectible at December Agronowitz suffered a plant explosion on January Because Agronowitz was uninsured, it is unlikely that the account will be paid.

The tax court ruled in favor of the company on January Litigation involved deductions claimed on the and tax returns. In accrued taxes payable, Scornick had provided for the full amount of the potential disallowances. The Internal Revenue Service will not appeal the tax court's ruling.

Scornick's Manufacturing Division, whose assets constituted percent of Scornick's total assets at December was sold on February The new owner assumed the bonded indebtedness associated with this property.

On January R E Fogler, a major investment adviser, issued a negative report on Scornick's longterm prospects. The market price of Scornick's common stock subsequently declined by percent.

At its January meeting, Scornick's board of directors voted to increase substantially the advertising budget for the coming year and authorized a change in advertising agencies.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock