Question: Looking for some final help on this HW question I have...really stuck on this one! Any help I could get would be great!! If you

Looking for some final help on this HW question I have...really stuck on this one! Any help I could get would be great!!

If you can please show your steps. i am trying to study for a test, and want to understand how the problem works, and not just the answer.

BIG THUMBS UP to who can help!!!

Thank you!!

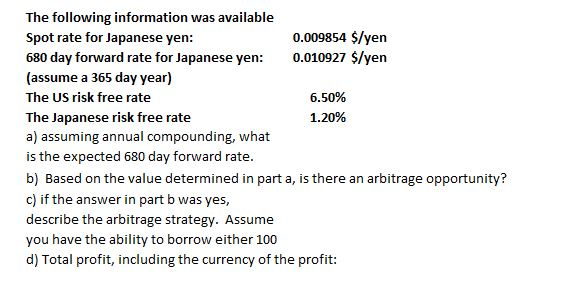

The following information was available 0.009854 $/yen Spot rate for Japanese yen: 680 day forward rate for Japanese yen 0.010927 $/yen (assume a 365 day year) 6.50% The US risk free rate The Japanese risk free rate 1.20% a) assuming annual compounding, what is the expected 680 day forward rate. b) Based on the value determined in part a is there an arbitrage opportunity? c) if the answer in part b was yes, describe the arbitrage strategy. Assume you have the ability to borrow either 100 d) Total profit, including the currency of the profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts