Question: Looking for some final help on this HW question I have...really stuck on this one! Any help I could get would be great!! If you

Looking for some final help on this HW question I have...really stuck on this one! Any help I could get would be great!! If you can please show your steps on solving. I am trying to study for a test, and want to understand how the problem works, and not just the answer. If you have a strong futures & hedges background that would be awesome!

BIG THUMBS UP to who can help!!!

See below. Thank you!!

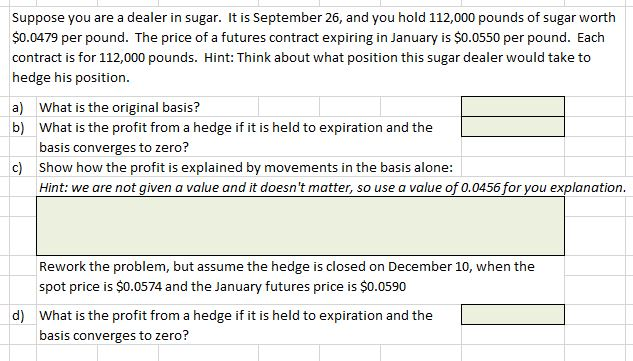

Suppose you are a dealer in sugar. It is September 26, and you hold 112,000 pounds of sugar worth $0.0479 per pound. The price of a futures contract expiring in January is $0.0550 per pound. Each contract is for 112,000 pounds. Hint: Think about what position this sugar dealer would take to hedge his position a) What is the original basis? b) What is the profit from a hedge if it is held to expiration and the basis converges to zero? c) Show how the profit is explained by movements in the basis alone: Hint: we are not given a value and it doesn't matter, so use a value of 0.0456 for you explanation. Rework the problem, but assumethe hedge is closed on December 10, whenthe spot price is $0.0574 and the January futures price is $0.0590 d) What is the profit from a hedge if it is held to expiration and the basis converges to zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts