Question: Looking Under Lock and Key Let's take a minute to review some FLSA information by completing the following statements: - A workweek is defined as

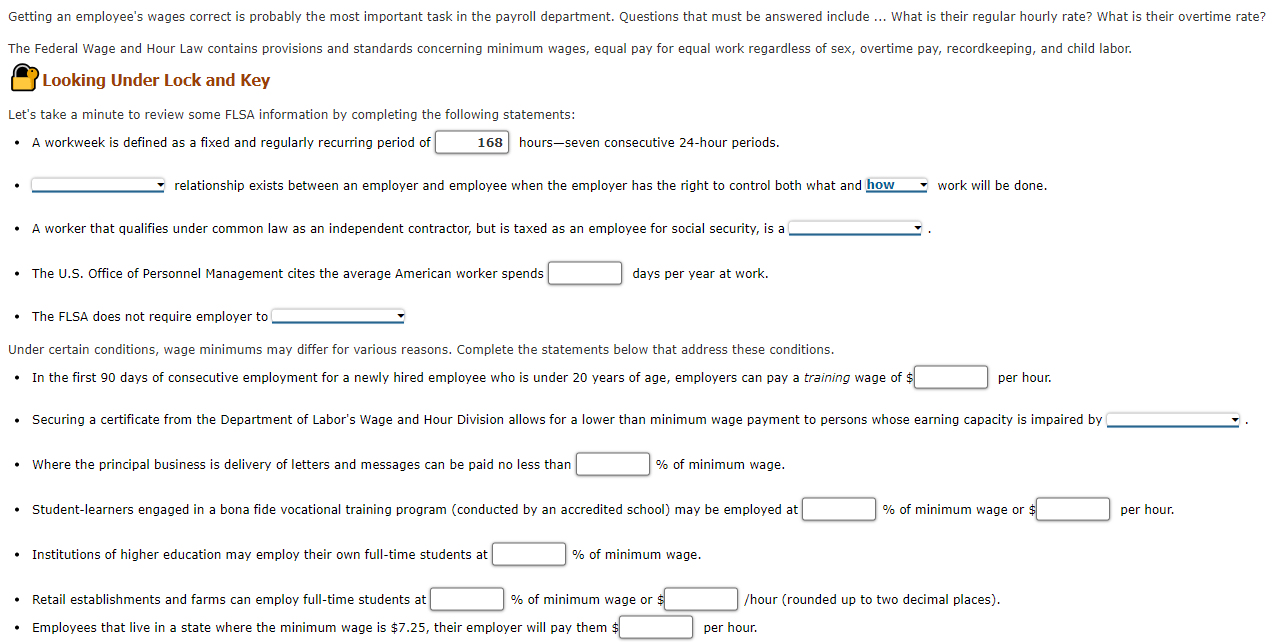

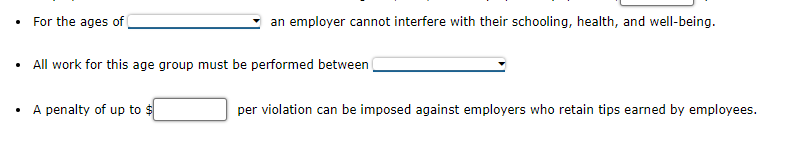

Looking Under Lock and Key Let's take a minute to review some FLSA information by completing the following statements: - A workweek is defined as a fixed and regularly recurring period of hours-seven consecutive 24-hour periods. relationship exists between an employer and employee when the employer has the right to control both what and - A worker that qualifies under common law as an independent contractor, but is taxed as an employee for social security, is a - The U.S. Office of Personnel Management cites the average American worker spends - The FLSA does not require employer to work will be done. Under certain conditions, wage minimums may differ for various reasons. Complete the statements below that address these conditions. - In the first 90 days of consecutive employment for a newly hired employee who is under 20 years of age, employers can pay a training wage of $ per hour. - Where the principal business is delivery of letters and messages can be paid no less than % of minimum wage. - Student-learners engaged in a bona fide vocational training program (conducted by an accredited school) may be employed at % of minimum wage or $ per hour. - Institutions of higher education may employ their own full-time students at - Retail establishments and farms can employ full-time students at - Employees that live in a state where the minimum wage is $7.25, their employer will pay them $ % of minimum wage. % of minimum wage or $ /hour (rounded up to two decimal places). per hour. - For the ages of an employer cannot interfere with their schooling, health, and well-being. - All work for this age group must be performed between - A penalty of up to $ per violation can be imposed against employers who retain tips earned by employees. Looking Under Lock and Key Let's take a minute to review some FLSA information by completing the following statements: - A workweek is defined as a fixed and regularly recurring period of hours-seven consecutive 24-hour periods. relationship exists between an employer and employee when the employer has the right to control both what and - A worker that qualifies under common law as an independent contractor, but is taxed as an employee for social security, is a - The U.S. Office of Personnel Management cites the average American worker spends - The FLSA does not require employer to work will be done. Under certain conditions, wage minimums may differ for various reasons. Complete the statements below that address these conditions. - In the first 90 days of consecutive employment for a newly hired employee who is under 20 years of age, employers can pay a training wage of $ per hour. - Where the principal business is delivery of letters and messages can be paid no less than % of minimum wage. - Student-learners engaged in a bona fide vocational training program (conducted by an accredited school) may be employed at % of minimum wage or $ per hour. - Institutions of higher education may employ their own full-time students at - Retail establishments and farms can employ full-time students at - Employees that live in a state where the minimum wage is $7.25, their employer will pay them $ % of minimum wage. % of minimum wage or $ /hour (rounded up to two decimal places). per hour. - For the ages of an employer cannot interfere with their schooling, health, and well-being. - All work for this age group must be performed between - A penalty of up to $ per violation can be imposed against employers who retain tips earned by employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts