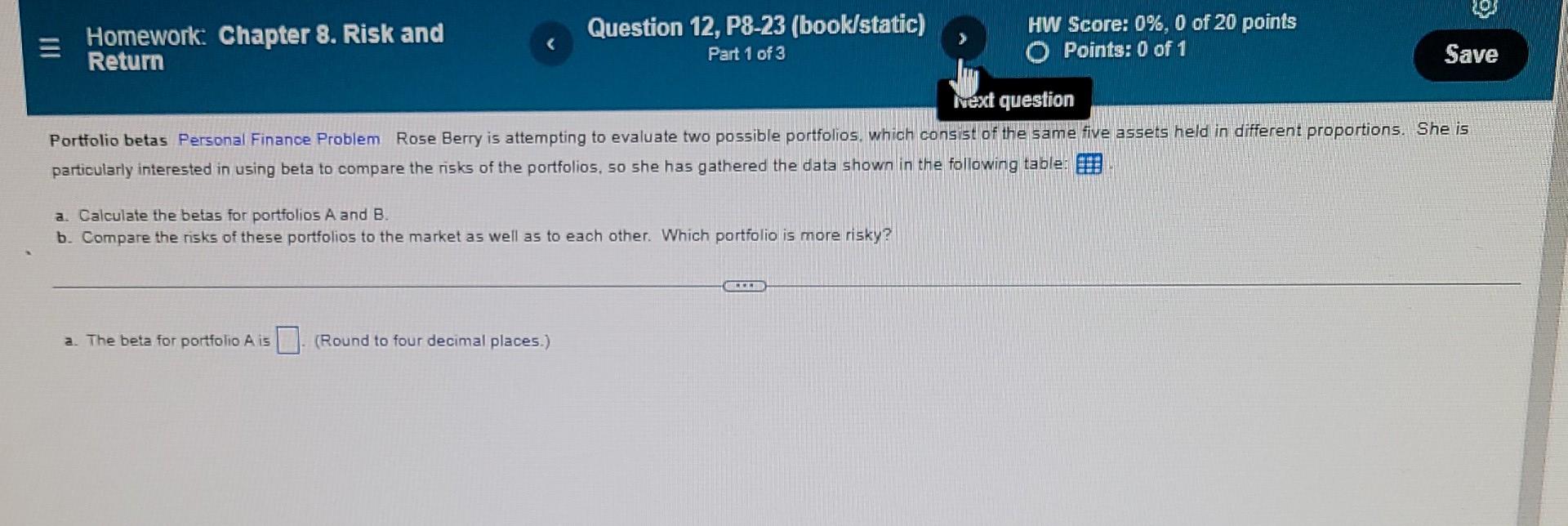

Question: Homework: Chapter 8. Risk and Return Question 12, P8-23 (book/static) Part 1 of 3 HW Score: 0%, 0 of 20 points O Points: 0 of

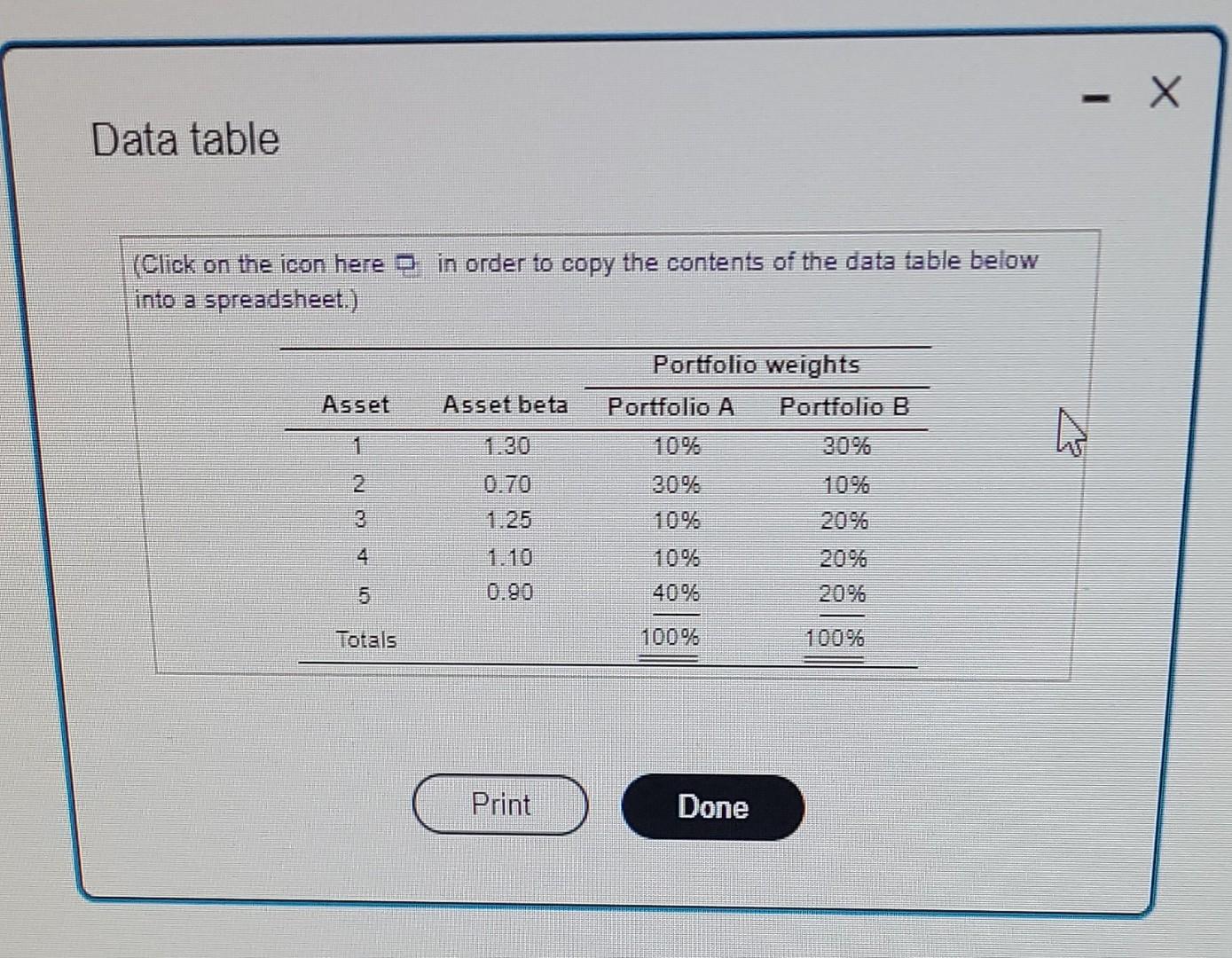

Homework: Chapter 8. Risk and Return Question 12, P8-23 (book/static) Part 1 of 3 HW Score: 0%, 0 of 20 points O Points: 0 of 1 Save Next question Portfolio betas Personal Finance Problem Rose Berry is attempting to evaluate two possible portfolios, which consist of the same five assets held in different proportions. She is particularly interested in using beta to compare the risks of the portfolios, so she has gathered the data shown in the following table: a. Calculate the betas for portfolios A and B. b. Compare the risks of these portfolios to the market as well as to each other. Which portfolio is more risky? BER a. The beta for portfolio A is (Round to four decimal places.) - Data table (Click on the icon here 3 in order to copy the contents of the data table below into a spreadsheet.) Portfolio weights Portfolio A Portfolio B. Asset Asset beta 1 2 10% 0.70 1.25 3 4 5 0.90 20% Totals 100% 100% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts