Question: M N 0 P The data and template for Questions 6-7 are located on this tab: Q6-7. Q6: 1) Calculate the following ratios for both

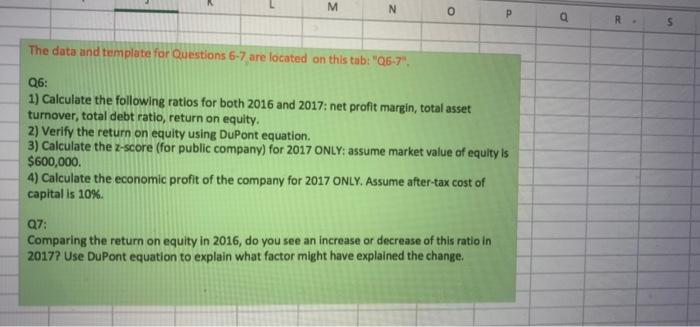

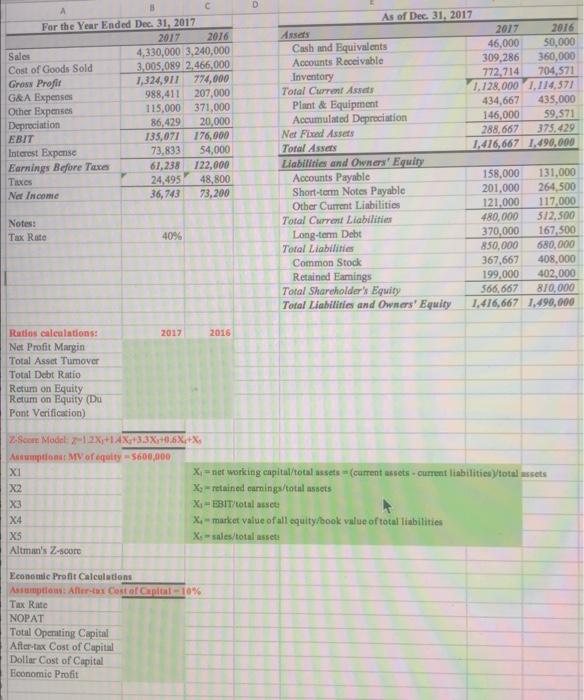

M N 0 P The data and template for Questions 6-7 are located on this tab: "Q6-7". Q6: 1) Calculate the following ratios for both 2016 and 2017: net profit margin, total asset turnover, total debt ratio, return on equity. 2) Verify the return on equity using DuPont equation. 3) Calculate the z-score (for public company) for 2017 ONLY: assume market value of equity is $600,000. 4) Calculate the economic profit of the company for 2017 ONLY. Assume after-tax cost of capital is 10%. Q7: Comparing the return on equity in 2016, do you see an increase or decrease of this ratio in 2017? Use DuPont equation to explain what factor might have explained the change. o R . S C A For the Year Ended Dec. 31, 2017 2017 2016 Sales 4,330,000 3,240,000 Cost of Goods Sold Gross Profit 3,005,089 2,466,000 1,324,911 774,000 G&A Expenses 988,411 207,000 115,000 371,000 Other Expenses Depreciation 86,429 20,000 EBIT 135,071 176,000 73,833 54,000 Interest Expense Earnings Before Taxes 61,238 122,000 Taxes 24,495 48,800 Net Income 36,743 73,200 Notes: Tax Rate 40% 2017 Ratios calculations: Net Profit Margin Total Asset Tumover Total Debt Ratio Return on Equity Retum on Equity (Du Pont Verification) Z-Scom Model: 2-12X+14X+3.3X+0.6X+X Assumptions: MV of equity-$600,000 XI X2 X3 X4 X5 Altman's Z-score Economic Profit Calculations Assumptions: After-tax Cost of Capital -10% Tax Rate NOPAT Total Operating Capital After-tax Cost of Capital Dollar Cost of Capital Economic Profit D 2016 2017 2016 46,000 50,000 309,286 360,000 772,714 704,571 1,128,000 1,114,571 434,667 435,000 146,000 59,571 288,667 375,429 1,416,667 1,490,000 158,000 131,000 201,000 264,500 121,000 117,000 480,000 512,500 370,000 167,500 850,000 680,000 Common Stock 367,667 408,000 Retained Earnings 199,000 402,000 Total Shareholder's Equity 3566,667 810,000 Total Liabilities and Owners' Equity 1,416,667 1,490,000 X=net working capital/total assets (current assets-current liabilities/total assets X-retained earnings/total assets X-EBIT/total asset X-market value of all equity/book value of total liabilities X-sales/total assets As of Dec. 31, 2017 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Owners' Equity Accounts Payable Short-term Notes Payable Other Current Liabilities Total Current Liabilities Long-term Debt Total Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts