Question: M10-19 (Supplement 10D) Preparing Journal Entries from an Installment Note Amortization Schedule [LO 10-S4] The following amortization schedule indicates the interest and principal that Chip's

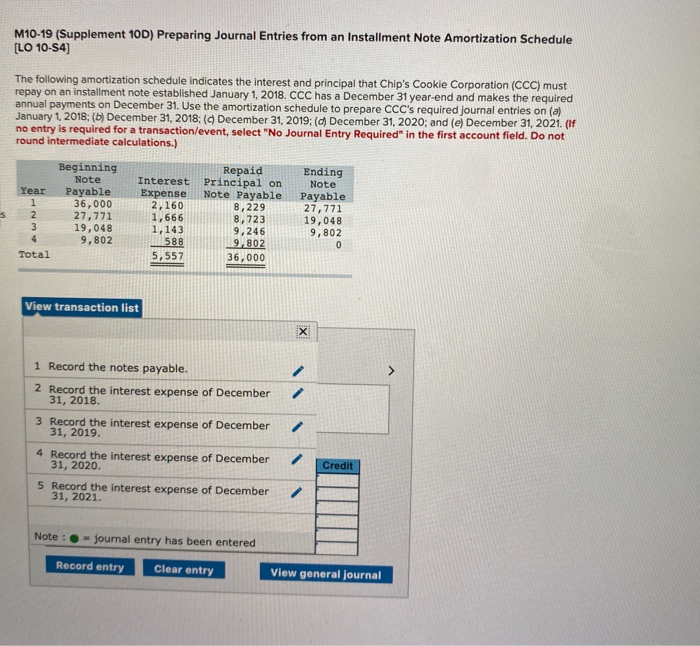

M10-19 (Supplement 10D) Preparing Journal Entries from an Installment Note Amortization Schedule [LO 10-S4] The following amortization schedule indicates the interest and principal that Chip's Cookie Corporation (CCC) must repay on an installment note established January 1, 2018. CCC has a December 31 year-end and makes the required annual payments on December 31. Use the amortization schedule to prepare CCC's required journal entries on (a) January 1, 2018: (b) December 31, 2018: (d) December 31, 2019: (d) December 31, 2020; and (e) December 31, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Beginning Repaid Principal on Note Payable 8,229 8,723 9,246 9,802 36,000 Ending Note Note Interest Year Payable 36,000 27,771 19,048 9,802 Expense 2,160 1,666 1,143 588 Payable 27,771 19,048 9, 802 0 1 2 3 4 Total 5,557 View transaction list X 1 Record the notes payable. 2 Record the interest expense of December 31, 2018. 3 Record the interest expense of December 31, 2019. 4 Record the interest expense of December 31, 2020. Credit 5 Record the interest expense of December 31, 2021. Note: -journal entry has been entered Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts