Question: Make External Factor Evaluation and Internal Factor Evaluation Matrix based on the case study of Gillette or Exide Battery and make EFE and IFE Matrix.

Make External Factor Evaluation and Internal Factor Evaluation Matrix based on the case study of Gillette or Exide Battery and make EFE and IFE Matrix. make EFE and IFE Matrix.

make EFE and IFE Matrix.

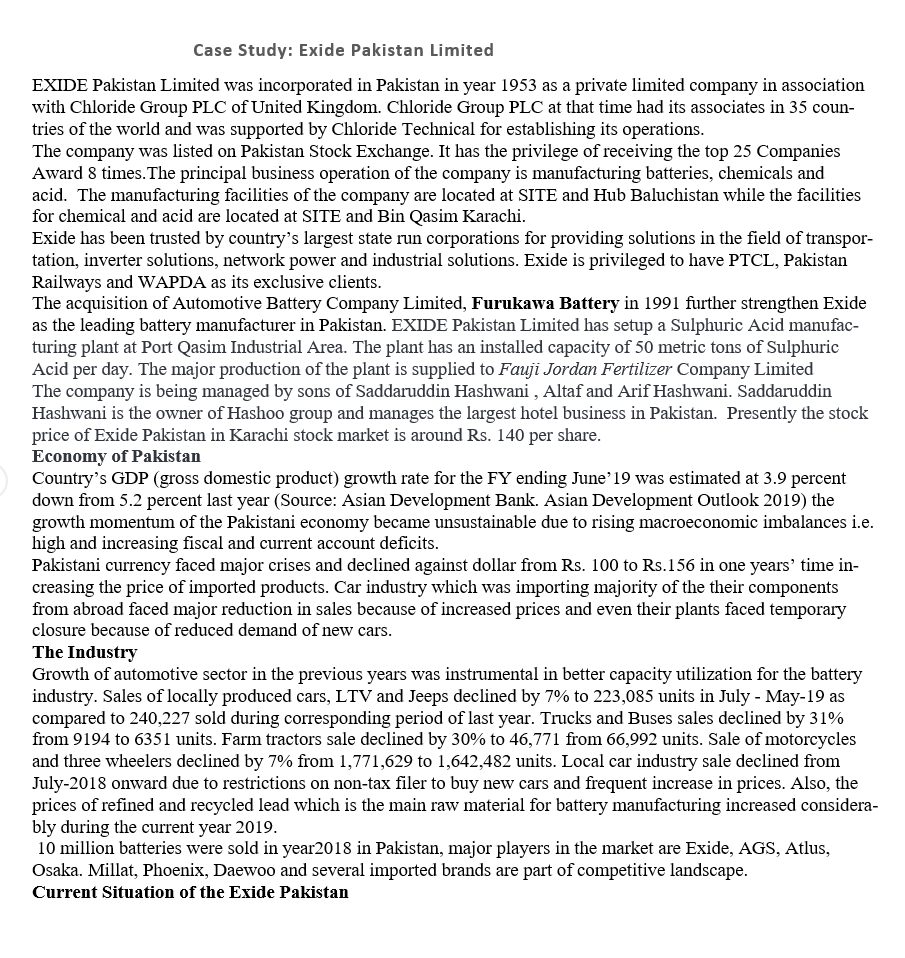

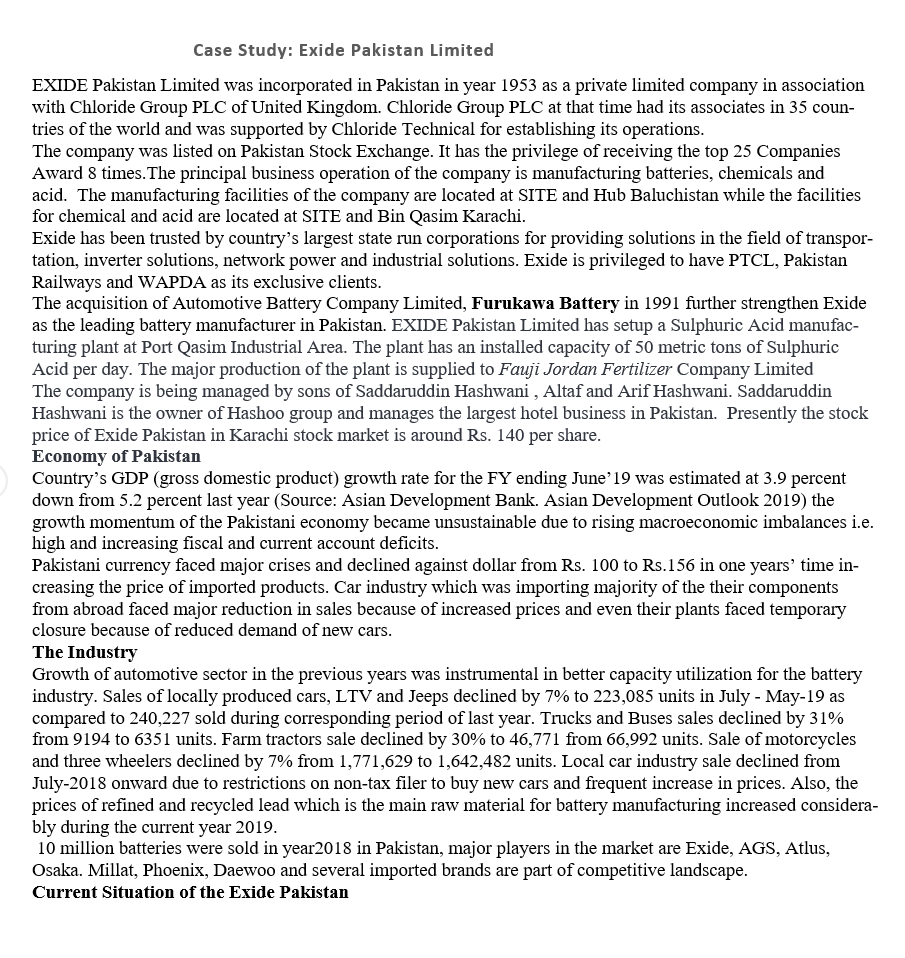

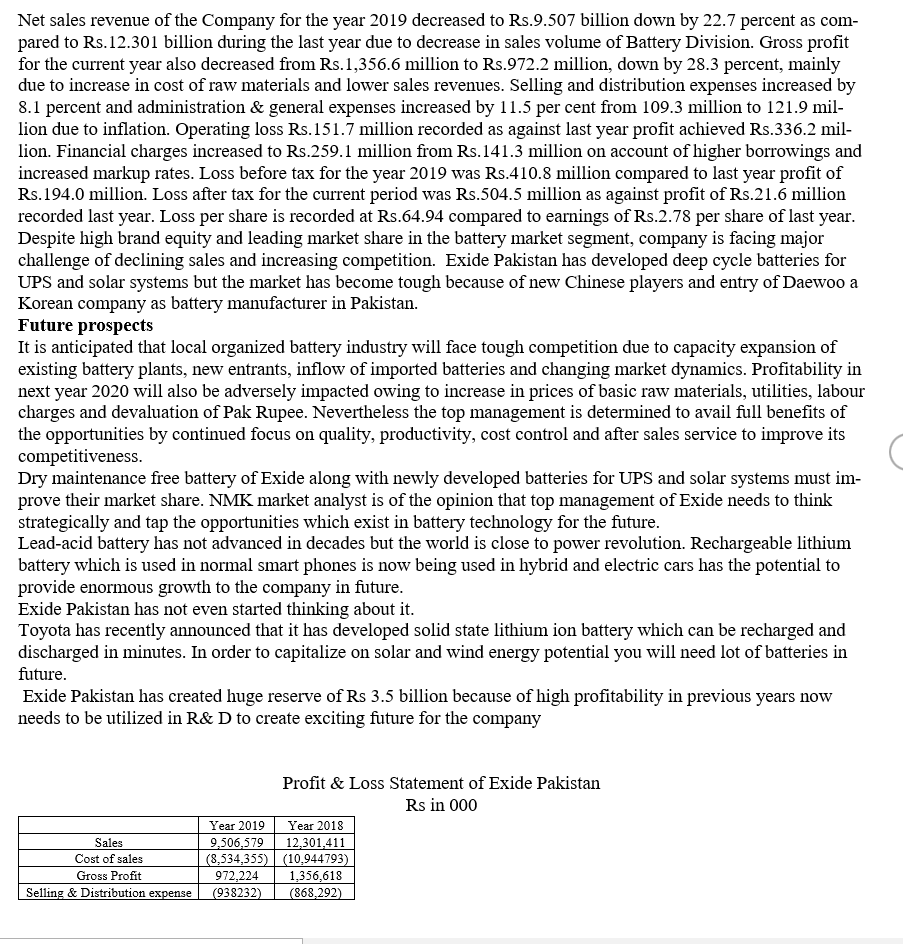

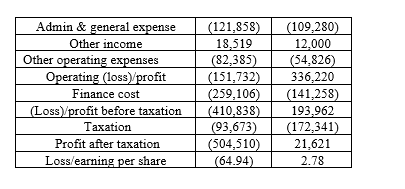

Case Study: Exide Pakistan Limited EXIDE Pakistan Limited was incorporated in Pakistan in year 1953 as a private limited company in association with Chloride Group PLC of United Kingdom. Chloride Group PLC at that time had its associates in 35 coun- tries of the world and was supported by Chloride Technical for establishing its operations. The company was listed on Pakistan Stock Exchange. It has the privilege of receiving the top 25 Companies Award 8 times. The principal business operation of the company is manufacturing batteries, chemicals and acid. The manufacturing facilities of the company are located at SITE and Hub Baluchistan while the facilities for chemical and acid are located at SITE and Bin Qasim Karachi. Exide has been trusted by country's largest state run corporations for providing solutions in the field of transpor- tation, inverter solutions, network power and industrial solutions. Exide is privileged to have PTCL, Pakistan Railways and WAPDA as its exclusive clients. The acquisition of Automotive Battery Company Limited, Furukawa Battery in 1991 further strengthen Exide as the leading battery manufacturer in Pakistan. EXIDE Pakistan Limited has setup a Sulphuric Acid manufac- turing plant at Port Qasim Industrial Area. The plant has an installed capacity of 50 metric tons of Sulphuric Acid per day. The major production of the plant is supplied to Fauji Jordan Fertilizer Company Limited The company is being managed by sons of Saddaruddin Hashwani , Altaf and Arif Hashwani. Saddaruddin Hashwani is the owner of Hashoo group and manages the largest hotel business in Pakistan. Presently the stock price of Exide Pakistan in Karachi stock market is around Rs. 140 per share. Economy of Pakistan Country's GDP (gross domestic product) growth rate for the FY ending June19 was estimated at 3.9 percent down from 5.2 percent last year (Source: Asian Development Bank. Asian Development Outlook 2019) the growth momentum of the Pakistani economy became unsustainable due to rising macroeconomic imbalances i.e. high and increasing fiscal and current account deficits. Pakistani currency faced major crises and declined against dollar from Rs. 100 to Rs.156 in one years' time in- creasing the price of imported products. Car industry which was importing majority of the their components from abroad faced major reduction in sales because of increased prices and even their plants faced temporary closure because of reduced demand of new cars. The Industry Growth of automotive sector in the previous years was instrumental in better capacity utilization for the battery industry. Sales of locally produced cars, LTV and Jeeps declined by 7% to 223,085 units in July - May-19 as compared to 240,227 sold during corresponding period of last year. Trucks and Buses sales declined by 31% from 9194 to 6351 units. Farm tractors sale declined by 30% to 46,771 from 66,992 units. Sale of motorcycles and three wheelers declined by 7% from 1,771,629 to 1,642,482 units. Local car industry sale declined from July-2018 onward due to restrictions on non-tax filer to buy new cars and frequent increase in prices. Also, the prices of refined and recycled lead which is the main raw material for battery manufacturing increased considera- bly during the current year 2019. 10 million batteries were sold in year2018 in Pakistan, major players in the market are Exide, AGS, Atlus, Osaka. Millat, Phoenix, Daewoo and several imported brands are part of competitive landscape. Current Situation of the Exide Pakistan Case Study: Exide Pakistan Limited EXIDE Pakistan Limited was incorporated in Pakistan in year 1953 as a private limited company in association with Chloride Group PLC of United Kingdom. Chloride Group PLC at that time had its associates in 35 coun- tries of the world and was supported by Chloride Technical for establishing its operations. The company was listed on Pakistan Stock Exchange. It has the privilege of receiving the top 25 Companies Award 8 times. The principal business operation of the company is manufacturing batteries, chemicals and acid. The manufacturing facilities of the company are located at SITE and Hub Baluchistan while the facilities for chemical and acid are located at SITE and Bin Qasim Karachi. Exide has been trusted by country's largest state run corporations for providing solutions in the field of transpor- tation, inverter solutions, network power and industrial solutions. Exide is privileged to have PTCL, Pakistan Railways and WAPDA as its exclusive clients. The acquisition of Automotive Battery Company Limited, Furukawa Battery in 1991 further strengthen Exide as the leading battery manufacturer in Pakistan. EXIDE Pakistan Limited has setup a Sulphuric Acid manufac- turing plant at Port Qasim Industrial Area. The plant has an installed capacity of 50 metric tons of Sulphuric Acid per day. The major production of the plant is supplied to Fauji Jordan Fertilizer Company Limited The company is being managed by sons of Saddaruddin Hashwani , Altaf and Arif Hashwani. Saddaruddin Hashwani is the owner of Hashoo group and manages the largest hotel business in Pakistan. Presently the stock price of Exide Pakistan in Karachi stock market is around Rs. 140 per share. Economy of Pakistan Country's GDP (gross domestic product) growth rate for the FY ending June19 was estimated at 3.9 percent down from 5.2 percent last year (Source: Asian Development Bank. Asian Development Outlook 2019) the growth momentum of the Pakistani economy became unsustainable due to rising macroeconomic imbalances i.e. high and increasing fiscal and current account deficits. Pakistani currency faced major crises and declined against dollar from Rs. 100 to Rs.156 in one years' time in- creasing the price of imported products. Car industry which was importing majority of the their components from abroad faced major reduction in sales because of increased prices and even their plants faced temporary closure because of reduced demand of new cars. The Industry Growth of automotive sector in the previous years was instrumental in better capacity utilization for the battery industry. Sales of locally produced cars, LTV and Jeeps declined by 7% to 223,085 units in July - May-19 as compared to 240,227 sold during corresponding period of last year. Trucks and Buses sales declined by 31% from 9194 to 6351 units. Farm tractors sale declined by 30% to 46,771 from 66,992 units. Sale of motorcycles and three wheelers declined by 7% from 1,771,629 to 1,642,482 units. Local car industry sale declined from July-2018 onward due to restrictions on non-tax filer to buy new cars and frequent increase in prices. Also, the prices of refined and recycled lead which is the main raw material for battery manufacturing increased considera- bly during the current year 2019. 10 million batteries were sold in year2018 in Pakistan, major players in the market are Exide, AGS, Atlus, Osaka. Millat, Phoenix, Daewoo and several imported brands are part of competitive landscape. Current Situation of the Exide Pakistan Net sales revenue of the Company for the year 2019 decreased to Rs.9.507 billion down by 22.7 percent as com- pared to Rs.12.301 billion during the last year due to decrease in sales volume of Battery Division. Gross profit for the current year also decreased from Rs.1,356.6 million to Rs.972.2 million, down by 28.3 percent, mainly due to increase in cost of raw materials and lower sales revenues. Selling and distribution expenses increased by 8.1 percent and administration & general expenses increased by 11.5 per cent from 109.3 million to 121.9 mil- lion due to inflation. Operating loss Rs.151.7 million recorded as against last year profit achieved Rs.336.2 mil- lion. Financial charges increased to Rs.259.1 million from Rs.141.3 million on account of higher borrowings and increased markup rates. Loss before tax for the year 2019 was Rs.410.8 million compared to last year profit of Rs.194.0 million. Loss after tax for the current period was Rs.504.5 million as against profit of Rs.21.6 million recorded last year. Loss per share is recorded at Rs.64.94 compared to earnings of Rs.2.78 per share of last year. Despite high brand equity and leading market share in the battery market segment, company is facing major challenge of declining sales and increasing competition. Exide Pakistan has developed deep cycle batteries for UPS and solar systems but the market has become tough because of new Chinese players and entry of Daewoo a Korean company as battery manufacturer in Pakistan. Future prospects It is anticipated that local organized battery industry will face tough competition due to capacity expansion of existing battery plants, new entrants, inflow of imported batteries and changing market dynamics. Profitability in next year 2020 will also be adversely impacted owing to increase in prices of basic raw materials, utilities, labour charges and devaluation of Pak Rupee. Nevertheless the top management is determined to avail full benefits of the opportunities by continued focus on quality, productivity, cost control and after sales service to improve its competitiveness. Dry maintenance free battery of Exide along with newly developed batteries for UPS and solar systems must im- prove their market share. NMK market analyst is of the opinion that top management of Exide needs to think strategically and tap the opportunities which exist in battery technology for the future. Lead-acid battery has not advanced in decades but the world is close to power revolution. Rechargeable lithium battery which is used in normal smart phones is now being used in hybrid and electric cars has the potential to provide enormous growth to the company in future. Exide Pakistan has not even started thinking about it. Toyota has recently announced that it has developed solid state lithium ion battery which can be recharged and discharged in minutes. In order to capitalize on solar and wind energy potential you will need lot of batteries in future. Exide Pakistan has created huge reserve of Rs 3.5 billion because of high profitability in previous years now needs to be utilized in R& D to create exciting future for the company Profit & Loss Statement of Exide Pakistan Rs in 000 Year 2019 Year 2018 9,506,579 12,301,411 (8,534,355) (10.944793) 972,224 1,356,618 (938232) (868,292) Sales Cost of sales Gross Profit Selling & Distribution expense Admin & general expense Other income Other operating expenses Operating (loss) profit Finance cost (Loss) profit before taxation Taxation Profit after taxation Loss/earning per share (121,858) 18,519 (82,385) (151,732) (259,106) (410,838) (93,673) (504,510) (64.94) (109,280) 12.000 (54,826) 336,220 (141,258) 193.962 (172,341) 21,621 2.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts