Question: make sure to solve comment and analyze part please Scenario or Tasks The following table of Information is useful for task 1, task 2 and

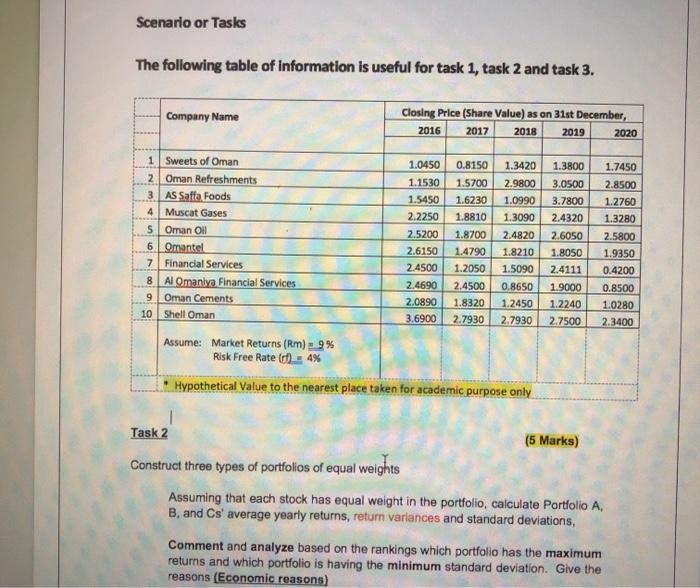

Scenario or Tasks The following table of Information is useful for task 1, task 2 and task 3. Company Name Closing Price (Share Value) as on 31st December, 2016 2017 2019 2020 2018 1 Sweets of Oman 1.0450 0.8150 1.3420 2 Oman Refreshments 1.1530 1.5700 2.9800 3 AS Saffa Foods 1.5450 1.6230 1.0990 4 Muscat Gases 2.2250 1.8810 1.3090 5 Oman OH 2.5200 1.8700 2.4820 6 Omantel 2.6150 1.4790 1.8210 7 Financial Services 2.4500 1.2050 1.5090 8 Almaniya Financial Services 2.4690 2.4500 0.8650 9 Oman Cements 2.0890 1.8320 1.2450 10 Shell Oman 3.6900 2.7930 2.7930 Assume: Market Returns (Rm) 9% Risk Free Rate (0) 4% Hypothetical Value to the nearest place taken for academic purpose only 1.3800 3.0500 3.7800 2.4320 2.6050 1.8050 2.4111 1.9000 1.2240 2.7500 1.7450 2.8500 1.2760 1.3280 2.5800 1.9350 0.4200 0.8500 1.0280 2.3400 Task 2 (5 Marks) Construct three types of portfolios of equal weights Assuming that each stock has equal weight in the portfolio, calculate Portfolio A, B, and Cs' average yearly returns, return variances and standard deviations, Comment and analyze based on the rankings which portfolio has the maximum returns and which portfolio is having the minimum standard deviation. Give the reasons (Economic reasons) Scenario or Tasks The following table of Information is useful for task 1, task 2 and task 3. Company Name Closing Price (Share Value) as on 31st December, 2016 2017 2019 2020 2018 1 Sweets of Oman 1.0450 0.8150 1.3420 2 Oman Refreshments 1.1530 1.5700 2.9800 3 AS Saffa Foods 1.5450 1.6230 1.0990 4 Muscat Gases 2.2250 1.8810 1.3090 5 Oman OH 2.5200 1.8700 2.4820 6 Omantel 2.6150 1.4790 1.8210 7 Financial Services 2.4500 1.2050 1.5090 8 Almaniya Financial Services 2.4690 2.4500 0.8650 9 Oman Cements 2.0890 1.8320 1.2450 10 Shell Oman 3.6900 2.7930 2.7930 Assume: Market Returns (Rm) 9% Risk Free Rate (0) 4% Hypothetical Value to the nearest place taken for academic purpose only 1.3800 3.0500 3.7800 2.4320 2.6050 1.8050 2.4111 1.9000 1.2240 2.7500 1.7450 2.8500 1.2760 1.3280 2.5800 1.9350 0.4200 0.8500 1.0280 2.3400 Task 2 (5 Marks) Construct three types of portfolios of equal weights Assuming that each stock has equal weight in the portfolio, calculate Portfolio A, B, and Cs' average yearly returns, return variances and standard deviations, Comment and analyze based on the rankings which portfolio has the maximum returns and which portfolio is having the minimum standard deviation. Give the reasons (Economic reasons)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts