Question: Make the computations that the problem asks for. When the problem asks you to adjust the net income for the Tax Cuts and Jobs Act

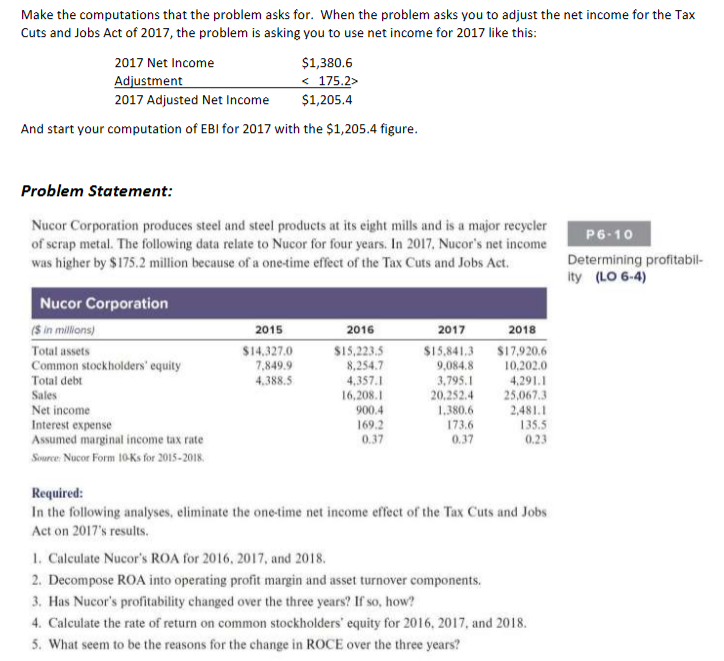

Make the computations that the problem asks for. When the problem asks you to adjust the net income for the Tax Cuts and Jobs Act of 2017, the problem is asking you to use net income for 2017 like this: And start your computation of EBI for 2017 with the $1,205.4 figure. Problem Statement: Nucor Corporation produces steel and steel products at its eight mills and is a major recycler of scrap metal. The following data relate to Nucor for four years. In 2017, Nucor's net income was higher by $175.2 million because of a one-time effect of the Tax Cuts and Jobs Act. Determining profitability (LO 6-4) Required: In the following analyses, eliminate the one-time net income effect of the Tax Cuts and Jobs Act on 2017's results. 1. Calculate Nucor's ROA for 2016, 2017, and 2018. 2. Decompose ROA into operating profit margin and asset turnover components. 3. Has Nucor's profitability changed over the three years? If so, how? 4. Calculate the rate of return on common stockholders' equity for 2016, 2017, and 2018. 5. What seem to be the reasons for the change in ROCE over the three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts