Question: Manager A: A 4-year project with initial investment (Year 0) of $100,000. Year 1 projected revenue is $90,000, year 2 $105,000, Year 3 $65,000 and

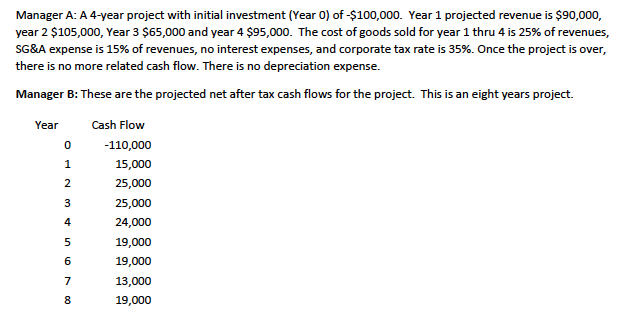

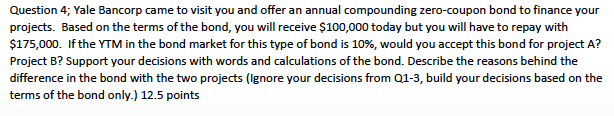

Manager A: A 4-year project with initial investment (Year 0) of $100,000. Year 1 projected revenue is $90,000, year 2 $105,000, Year 3 $65,000 and year 4 $95,000. The cost of goods sold for year 1 thru 4 is 25% of revenues, SG&A expense is 15% of revenues, no interest expenses, and corporate tax rate is 35%. Once the project is over, there is no more related cash flow. There is no depreciation expense. Manager B: These are the projected net after tax cash flows for the project. This is an eight years project. Year Cash Flow -110,000 15,000 25,000 25,000 24,000 19,000 19,000 13,000 19,000 Question 4; Yale Bancorp came to visit you and offer an annual compounding zero-coupon bond to finance your projects. Based on the terms of the bond, you will receive $100,000 today but you will have to repay with $175,000. If the YTM in the bond market for this type of bond is 10%, would you accept this bond for project A? Project B? Support your decisions with words and calculations of the bond. Describe the reasons behind the difference in the bond with the two projects (Ignore your decisions from Q1-3, build your decisions based on the terms of the bond only.) 12.5 points Manager A: A 4-year project with initial investment (Year 0) of $100,000. Year 1 projected revenue is $90,000, year 2 $105,000, Year 3 $65,000 and year 4 $95,000. The cost of goods sold for year 1 thru 4 is 25% of revenues, SG&A expense is 15% of revenues, no interest expenses, and corporate tax rate is 35%. Once the project is over, there is no more related cash flow. There is no depreciation expense. Manager B: These are the projected net after tax cash flows for the project. This is an eight years project. Year Cash Flow -110,000 15,000 25,000 25,000 24,000 19,000 19,000 13,000 19,000 Question 4; Yale Bancorp came to visit you and offer an annual compounding zero-coupon bond to finance your projects. Based on the terms of the bond, you will receive $100,000 today but you will have to repay with $175,000. If the YTM in the bond market for this type of bond is 10%, would you accept this bond for project A? Project B? Support your decisions with words and calculations of the bond. Describe the reasons behind the difference in the bond with the two projects (Ignore your decisions from Q1-3, build your decisions based on the terms of the bond only.) 12.5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts