Question: Maps Trading Equities - S... Question 1 2 pts USE THIS INFORMATION FOR ALL THREE QUESTIONS: An investor can design a risky portfolio based on

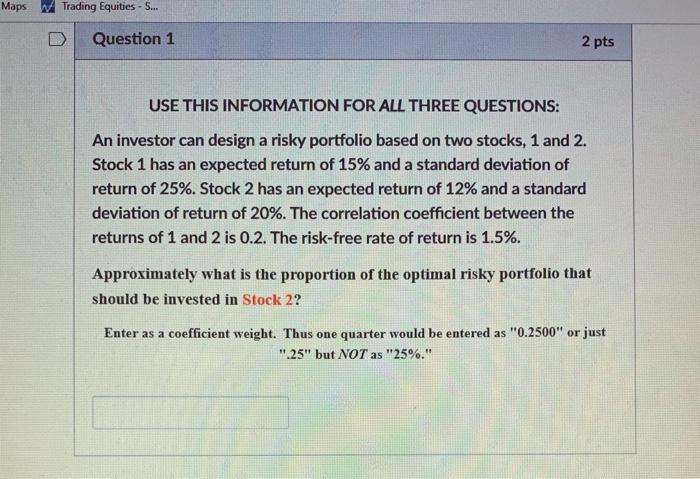

Maps Trading Equities - S... Question 1 2 pts USE THIS INFORMATION FOR ALL THREE QUESTIONS: An investor can design a risky portfolio based on two stocks, 1 and 2. Stock 1 has an expected return of 15% and a standard deviation of return of 25%. Stock 2 has an expected return of 12% and a standard deviation of return of 20%. The correlation coefficient between the returns of 1 and 2 is 0.2. The risk-free rate of return is 1.5%. Approximately what is the proportion of the optimal risky portfolio that should be invested in Stock 2? Enter as a coefficient weight. Thus one quarter would be entered as "0.2500" or just ".25" but NOT as "25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts