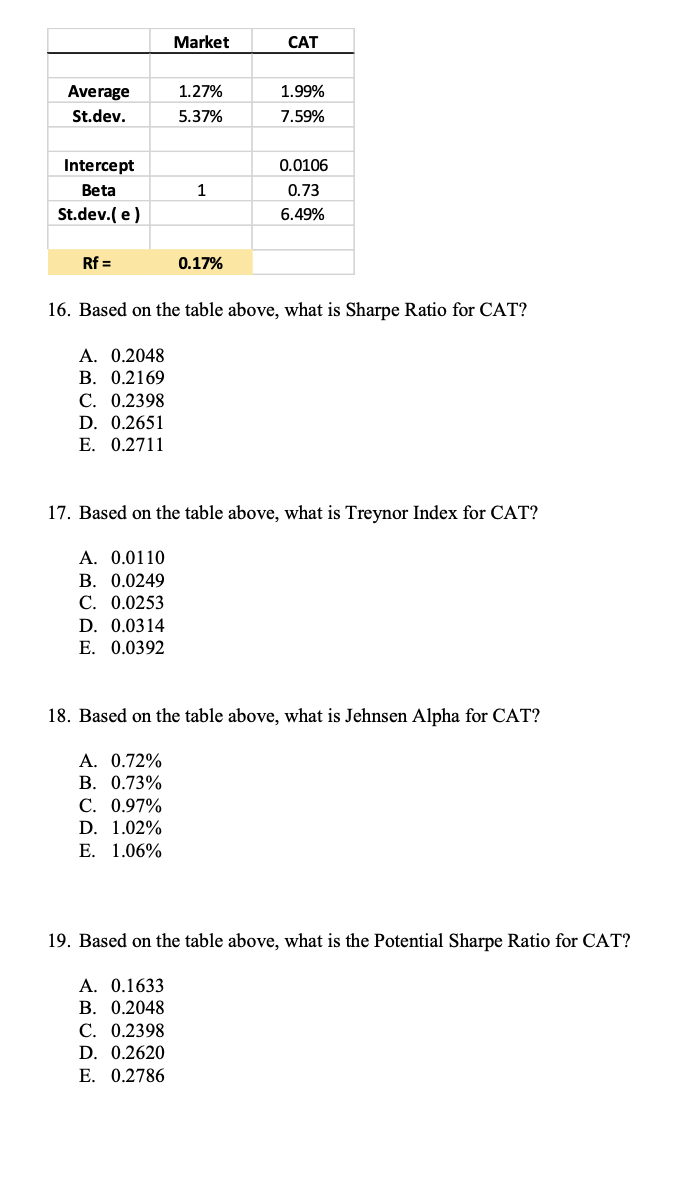

Question: Market CAT Average St.dev. 1.27% 5.37% 1.99% 7.59% Intercept Beta St.dev.( e ) 1 0.0106 0.73 6.49% Rf = 0.17% 16. Based on the table

Market CAT Average St.dev. 1.27% 5.37% 1.99% 7.59% Intercept Beta St.dev.( e ) 1 0.0106 0.73 6.49% Rf = 0.17% 16. Based on the table above, what is Sharpe Ratio for CAT? A. 0.2048 B. 0.2169 C. 0.2398 D. 0.2651 E. 0.2711 17. Based on the table above, what is Treynor Index for CAT? A. 0.0110 B. 0.0249 C. 0.0253 D. 0.0314 E. 0.0392 18. Based on the table above, what is Jehnsen Alpha for CAT? A. 0.72% B. 0.73% C. 0.97% D. 1.02% E. 1.06% 19. Based on the table above, what is the Potential Sharpe Ratio for CAT? A. 0.1633 B. 0.2048 C. 0.2398 D. 0.2620 E. 0.2786

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock