Question: marks) considering a $50,000 project that will generate an annual cash flow of $10,000 for the red The firm has the following financial data Debt/equity

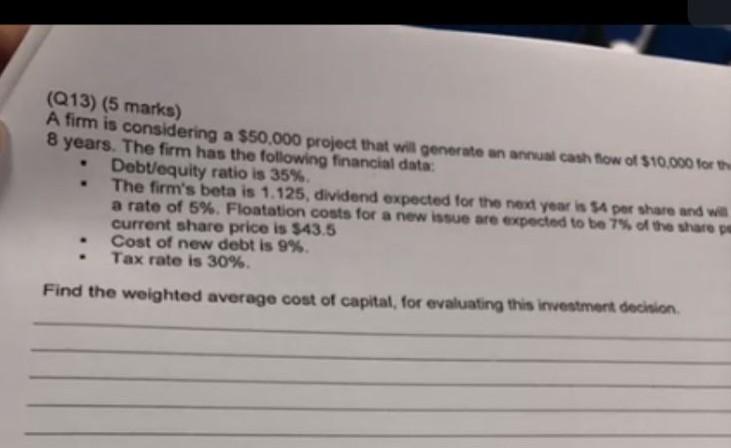

marks) considering a $50,000 project that will generate an annual cash flow of $10,000 for the red The firm has the following financial data Debt/equity ratio is 35%. The firm's beta is 1.125, dividend expected for the next year is 14 per share and grow at a rate of 5%. Floatation costs for a new issue are expected to be 7% of the share price. The current share price is $43.5 Cost of new debt is 9%. Tax rate is 30% weighted average cost of capital, for evaluating this investment decision. marks) considering a $50,000 project that will generate an annual cash flow of $10,000 for the red The firm has the following financial data Debt/equity ratio is 35%. The firm's beta is 1.125, dividend expected for the next year is 14 per share and grow at a rate of 5%. Floatation costs for a new issue are expected to be 7% of the share price. The current share price is $43.5 Cost of new debt is 9%. Tax rate is 30% weighted average cost of capital, for evaluating this investment decision. (Q13) (5 marks) A firm is considering a $50,000 project that will generate an annual cash flow of $10,000 for the 8 years. The firm has the following financial data: . Debt/equity ratio is 35%. . The firm's beta is 1.125, dividend expected for the next year is $4 per share and will a rate of 5%. Floatation costs for a new issue are expected to be 7% of the share pe current share price is $43.5 . Cost of new debt is 9%. . Tax rate is 30%. Find the weighted average cost of capital, for evaluating this investment decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts