Question: Mason's management is aware that majority-owned subsid- iaries must be consolidated. The president, Penny Mason, per suades the board to form a subsidiary that would

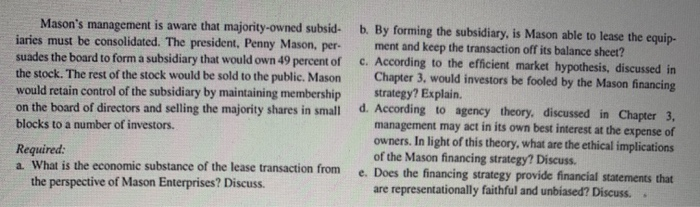

Mason's management is aware that majority-owned subsid- iaries must be consolidated. The president, Penny Mason, per suades the board to form a subsidiary that would own 49 percent of the stock. The rest of the stock would be sold to the public. Mason would retain control of the subsidiary by maintaining membership on the board of directors and selling the majority shares in small blocks to a number of investors. Required: a. What is the economic substance of the lease transaction from the perspective of Mason Enterprises? Discuss. b. By forming the subsidiary, is Mason able to lease the equip ment and keep the transaction off its balance sheet? c. According to the efficient market hypothesis, discussed in Chapter 3. would investors be fooled by the Mason financing strategy? Explain. d. According to agency theory, discussed in Chapter 3, management may act in its own best interest at the expense of owners. In light of this theory, what are the ethical implications of the Mason financing strategy? Discuss. e. Does the financing strategy provide financial statements that are representationally faithful and unbiased? Discuss.. Mason's management is aware that majority-owned subsid- iaries must be consolidated. The president, Penny Mason, per suades the board to form a subsidiary that would own 49 percent of the stock. The rest of the stock would be sold to the public. Mason would retain control of the subsidiary by maintaining membership on the board of directors and selling the majority shares in small blocks to a number of investors. Required: a. What is the economic substance of the lease transaction from the perspective of Mason Enterprises? Discuss. b. By forming the subsidiary, is Mason able to lease the equip ment and keep the transaction off its balance sheet? c. According to the efficient market hypothesis, discussed in Chapter 3. would investors be fooled by the Mason financing strategy? Explain. d. According to agency theory, discussed in Chapter 3, management may act in its own best interest at the expense of owners. In light of this theory, what are the ethical implications of the Mason financing strategy? Discuss. e. Does the financing strategy provide financial statements that are representationally faithful and unbiased? Discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts