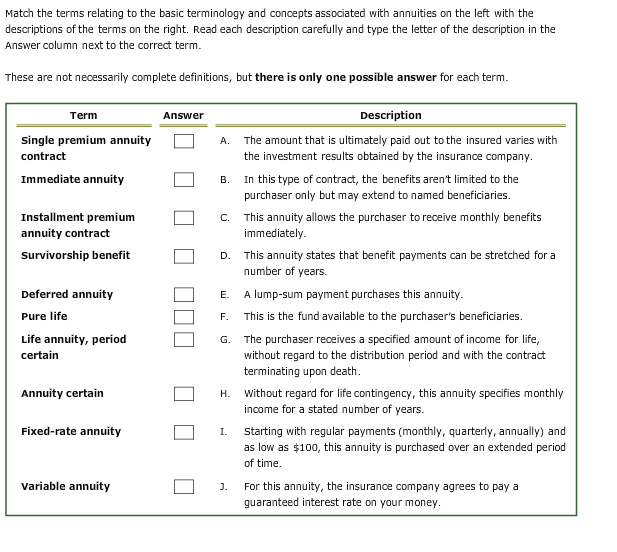

Question: Match the terms relating to the basic terminology and concepts associated with annuities on the left with the descriptions of the terms on the right.

Match the terms relating to the basic terminology and concepts associated with annuities on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term These are not necessarily complete definitions, but there is only one possible answer for each term Term Answer Description 1 single premium annuity contract The amount that is ultimately paid out to the insured varies with the investment results obtained by the insurance company A. Immediate annuity B. In this type of contract, the benefits aren't limited to the purchaser only but may extend to named beneficiaries Installment premium c. This annuity allows the purchaser to receive monthly benefits annuity contract immediately This annuity states that benefit payments can be stretched for a number of years. A lump-sum payment purchases this annuity survivorship benefit D. Deferred annuity Pure life Life annuity, period E. F. This is the fund available to the purchaser's beneficiaries ? The purchaser receives a specified amount of income for life, without regard to the distribution period and with the contract terminating upon death G. certain Annuity certain H. without regard for life contingency, this annuity specifies monthly income for a stated number of years Fixed-rate annuity I Starting with regular payments (monthly, quarterly, annually) and as low as $100, this annuity is purchased over an extended period of time. Variable annuity . For this annuity, the insurance company agrees to pay a guaranteed interest rate on your money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts