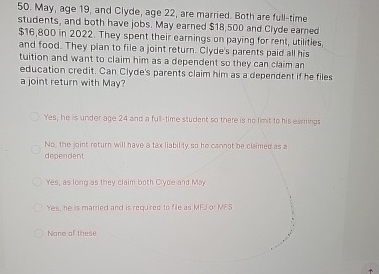

Question: May, age 1 9 , and Clyde, age 2 2 , are married. Both are full - time students, and both have jobs. May earned

May, age and Clyde, age are married. Both are fulltime students, and both have jobs. May earned $ and Clyde eamed $ in They spent their earnings on paying for rent, utilities, and food. They plan to file a joint return. Clyde's parents paid all his tuition and want to claim him as a dependent so they can claim an education credit. Can Clyde's parents claim him as a dependent if he files a joint return with May?

Yes, he is under age and a fultime student so there is no imt to his estrings

No the joint return will have a tax liatility so hecannot be clisimed as a dependent

Yes, as long as they claim both Cyoe and May

Yes, he is married and is requiced to fle as MFJ o MFS

Nane of these

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock