Question: May I get help with questions A and B UESTION TWO (a) It has been suggested that structural breaks occurred in many key macroeconomic and

May I get help with questions A and B

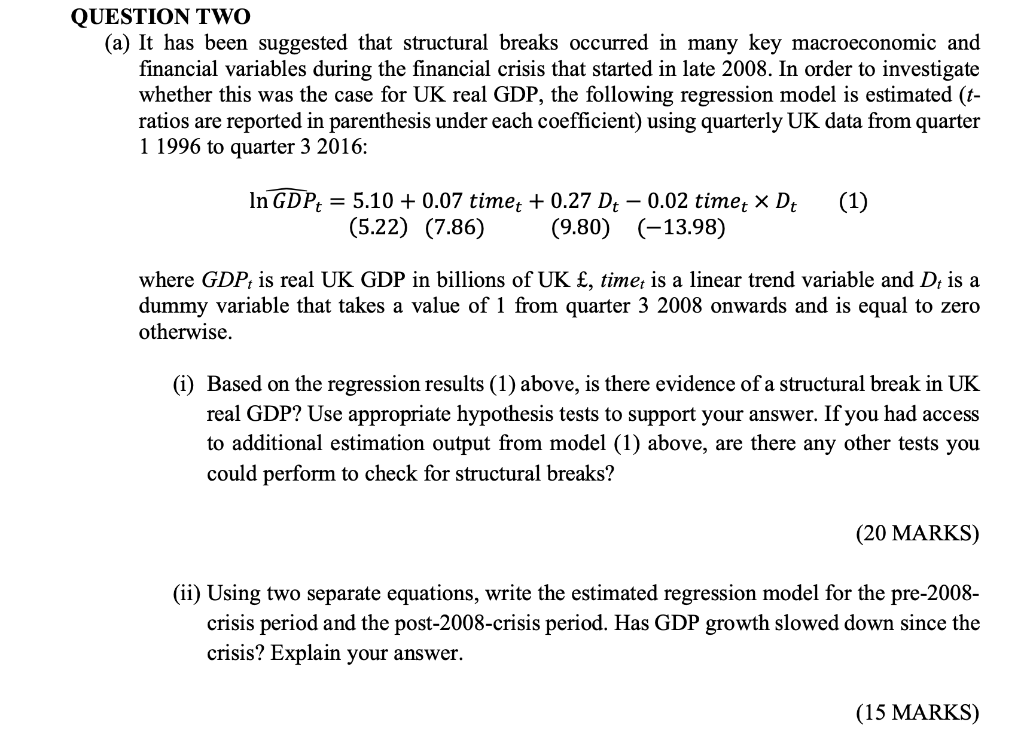

UESTION TWO (a) It has been suggested that structural breaks occurred in many key macroeconomic and financial variables during the financial crisis that started in late 2008. In order to investigate whether this was the case for UK real GDP, the following regression model is estimated (t ratios are reported in parenthesis under each coefficient) using quarterly UK data from quarter 11996 to quarter 32016 : lnGDPPt=5.10+0.07timet+0.27Dt0.02timetDt(5.22)(7.86)(9.80)(13.98) where GDPt is real UK GDP in billions of UK, time et is a linear trend variable and Dt is a dummy variable that takes a value of 1 from quarter 32008 onwards and is equal to zero otherwise. (i) Based on the regression results (1) above, is there evidence of a structural break in UK real GDP? Use appropriate hypothesis tests to support your answer. If you had access to additional estimation output from model (1) above, are there any other tests you could perform to check for structural breaks? (20 MARKS) (ii) Using two separate equations, write the estimated regression model for the pre-2008crisis period and the post-2008-crisis period. Has GDP growth slowed down since the crisis? Explain your answer. (15 MARKS) (b) In addition to structural breaks, macroeconomic and financial variables may also exhibit seasonal patterns. Describe one example of seasonal effects that may occur in macroeconomic or financial variables and explain how you could test for this effect. In your answer you should write out a simple regression function to illustrate how you would perform this test and clearly define all variables that you include. UESTION TWO (a) It has been suggested that structural breaks occurred in many key macroeconomic and financial variables during the financial crisis that started in late 2008. In order to investigate whether this was the case for UK real GDP, the following regression model is estimated (t ratios are reported in parenthesis under each coefficient) using quarterly UK data from quarter 11996 to quarter 32016 : lnGDPPt=5.10+0.07timet+0.27Dt0.02timetDt(5.22)(7.86)(9.80)(13.98) where GDPt is real UK GDP in billions of UK, time et is a linear trend variable and Dt is a dummy variable that takes a value of 1 from quarter 32008 onwards and is equal to zero otherwise. (i) Based on the regression results (1) above, is there evidence of a structural break in UK real GDP? Use appropriate hypothesis tests to support your answer. If you had access to additional estimation output from model (1) above, are there any other tests you could perform to check for structural breaks? (20 MARKS) (ii) Using two separate equations, write the estimated regression model for the pre-2008crisis period and the post-2008-crisis period. Has GDP growth slowed down since the crisis? Explain your answer. (15 MARKS) (b) In addition to structural breaks, macroeconomic and financial variables may also exhibit seasonal patterns. Describe one example of seasonal effects that may occur in macroeconomic or financial variables and explain how you could test for this effect. In your answer you should write out a simple regression function to illustrate how you would perform this test and clearly define all variables that you include

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts