Question: MBA695 Strategic Management Assignment: After reading the article by Michael Porter on his Diamond of National Advantage (in addition to Dyer et al, (2020), Chapter

MBA695 Strategic Management

Assignment:

After reading the article by Michael Porter on his Diamond of National Advantage (in addition to Dyer et al, (2020), Chapter 9, p.164, Figure 9.5), apply Porters Diamond to an organization and an international geographic market where the organization currently does business.

Briefly apply the four factors of the diamond to the organization and a specific market location (country or region). You may need to do research on the company and its operations in that international market. How important do you feel the clustering of related and supporting industries might be to the company you have selected?

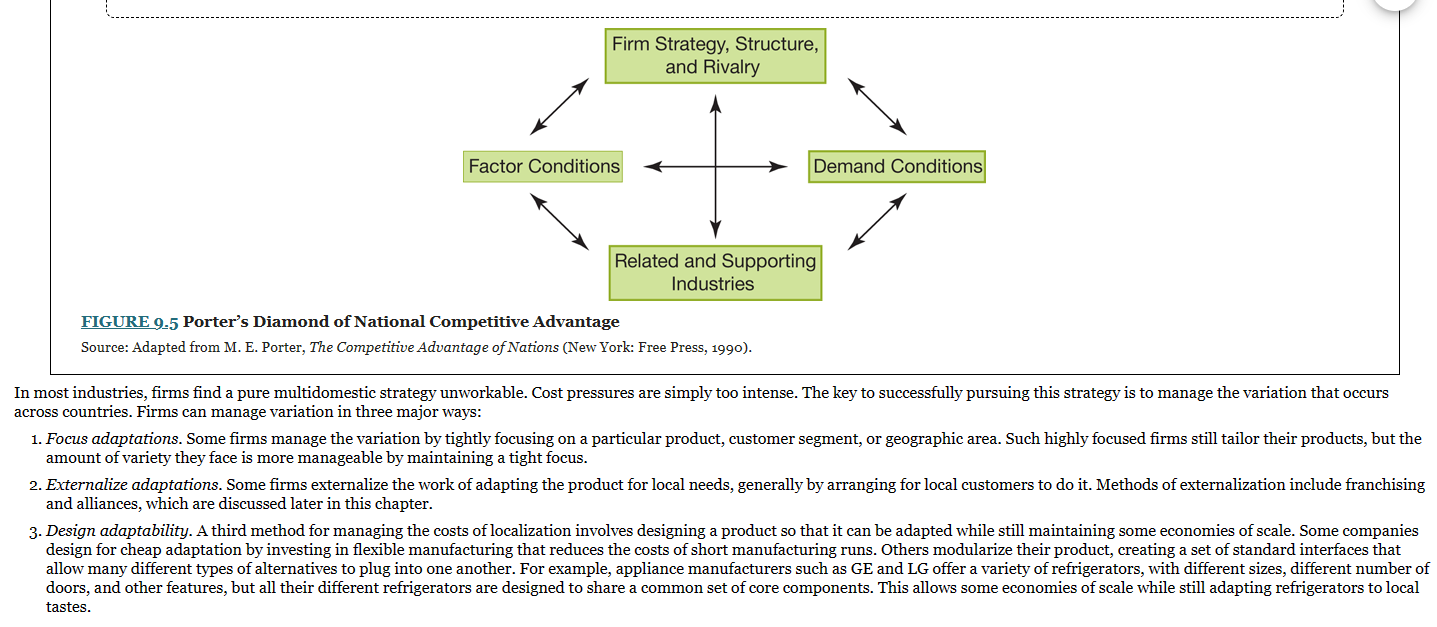

National Competitive Advantage Have you ever wondered how firms from the same country dominate their industries worldwide? For example US companies Apple, Google, and Microsoft control the worldwide industry for computer operating systems; German organizations dominate in machine tools; and Italian firms lead in the sale of leather goods. Michael Porter developed a tool, the Porter's Diamond of National Competitive Advantage, that explains how this happens. Four factors help push organizations toward greater innovation, with those companies that innovate the most having an advantage in international competition: 1. Factor conditions. An abundance of critical resources including skilled labor, a technologically advanced knowledge base, easy access to capital, and solid infrastructure provide firms with the tools they need to innovate. Germany is known for an educated, manufacturing-oriented workforce, giving it an advantage in the machine tool industry. 2. Demand conditions. The more a country's customers demand innovation, the more likely domestic firms are going to be at the forefront of innovation. Japanese consumers tend to be ahead of the curve in demanding the latest consumer electronics products, giving Japanese consumer electronics firms direction in developing new products. 3. Related and supporting industries. If a country has multiple parts of the value chain located near each other, it is easier to coordinate innovation, speeding up the pace. Italy is known not just for leatherworking but leatherworking machinery, fashion, and shoes. The four industries being co-located allows for closer coordination and faster innovation. 4. Firm strategy, structure, and rivalry. Different types of firm structure are suited to particular types of industries. Laws governing how firms are started and how they interact with labor have a large impact on the international strategies that firms pursue. Rivalry also plays a large role. While rivalry, according to the five forces model discussed in Chapter 2 and illustrated in Figure 9.5, tends to decrease profit, it also spurs innovation. Firms that survive high levels of rivalry are usually more prepared to take on international competition. factor conditions Land, natural resources, and labor that allow for production of goods and services. demand conditions The conditions in a market that determine the degree of demand for a product or service. related and supporting industries Industries that produce products or services that are inputs or complements to the industry you are studying. FIGURE 9.5 Porter's Diamond of National Competitive Advantage Source: Adapted from M. E. Porter, The Competitive Advantage of Nations (New York: Free Press, 1990). in most industries, firms find a pure multidomestic strategy unworkable. Cost pressures are simply too intense. The key to successfully pursuing this strategy is to manage the variation that occurs across countries. Firms can manage variation in three major ways: 1. Focus adaptations. Some firms manage the variation by tightly focusing on a particular product, customer segment, or geographic area. Such highly focused firms still tailor their products, but the amount of variety they face is more manageable by maintaining a tight focus. 2. Externalize adaptations. Some firms externalize the work of adapting the product for local needs, generally by arranging for local customers to do it. Methods of externalization include franchising and alliances, which are discussed later in this chapter. 3. Design adaptability. A third method for managing the costs of localization involves designing a product so that it can be adapted while still maintaining some economies of scale. Some companies design for cheap adaptation by investing in flexible manufacturing that reduces the costs of short manufacturing runs. Others modularize their product, creating a set of standard interfaces that allow many different types of alternatives to plug into one another. For example, appliance manufacturers such as GE and LG offer a variety of refrigerators, with different sizes, different number of doors, and other features, but all their different refrigerators are designed to share a common set of core components. This allows some economies of scale while still adapting refrigerators to local tastes. Global Strategy-Aggregate and Standardize to Gain Economies of Scale A global strategy centers on capturing the efficiencies that can come with expanding overseas, particularly economies of scale, learning, and leveraging firm capabilities. Most firms that pursue a global strategy standardize their products, marketing, and operational practices, and aggregate, or centralize, them in only a few locations, to achieve economies of scale.41 Individual country-level units are tasked mostly with implementing decisions made at a central headquarters, 42 and the firm uses the same tactics in most, if not every, country where it competes. global strategy A strategy involving selling standardized products, using standardized processes, around the world. The most extreme versions of a global strategy might have all functions located in the same place, with country units overseeing only local sales. For example, Red Bull, the energy drink, is manufactured in a single location next to its headquarters in Fuschl am See, Austria (did you know Red Bull was an Austrian firm?). In 2016, it produced approximately 2.5 billion cans of Red Bull, all in the same factory. And while their marketing might seem like it is tailored to different locations, it actually follows the same format everywhere Red Bull is sold-sponsoring extreme sporting events. In practice, many global firms have factories on multiple continents, producing the same product, in order to reduce transportation costs and manage risk. Moreover, when factories in different locations are producing the same products, they are more likely to share best practices, helping firms reduce the learning curve. A global strategy is typically a low-cost strategy, with low costs achieved through economies of scale. However, it can also be used effectively as a differentiation strategy that the company applies in the same way, to the same customer segment, worldwide. Apple is a great example of a firm that standardizes its products to achieve economies of scale but differentiates them from other smartphones, computers, or tablets in order to increase the price customers are willing to pay for them. Firms that pursue a global strategy tend to enter countries that have a large, ready-made market for their products. They also tend to be in industries where cost pressures are high and standardized products can meet relatively universal needs. For instance, elevators are used the same way in Hong Kong as they are in Chicago, making elevator manufacturing firms, such as Otis Elevator, prime candidates for a global strategy. The downside of a global strategy, however, is that standardized products may not meet the needs of customers in particular countries. As a consequence, global firms may not be able to compete in as many markets as multidomestic firms, and they may not be able to penetrate those markets as deeply.43 Another disadvantage is that, although global firms share knowledge between units with greater ease than multidomestic firms do, a global firm generates less knowledge overall, because it isn't as actively trying to meet a wider variety of customer needs. So, in the short term, global firms may miss sales by not being responsive, and in the long term they may miss changes in local market conditions. However, just as there are ways to manage the cost of variation in multidomestic firms, there are also methods for dealing with excessive centralization and standardization in global firms. First, a firm need not centralize all parts of the value chain. The greatest cost savings from economies of scale often occur in R\&D and manufacturing. A global firm can centralize some functions while localizing others in order to penetrate local markets more fully. For instance, in the 1980s and 1990s, the household appliance manufacturer Whirlpool pursued component manufacturing and R\&D primarily on a global scale, but carried out product design, final assembly, marketing, and sales at regional and local levels. Is Economic Arbitrage Ethical? Won't It Lead to Worker Exploitation? In recent years, numerous news reports have emerged detailing the exploitation of low-cost labor in foreign countries. China Labor Watch, a nonprofit working to raise awareness of worker exploitation issues in China, found that suppliers of Disney toys have been accused of exploiting lax enforcement of labor laws in order to keep costs low. China Labor Watch calls it the Dark World of Disney. 44 Mistreatment of workers includes: - Workers work with toxic chemicals all day long yet are given little to no training and little to no protective gear. - Workers earn only $1.38 (USD) per hour, so low that it is insufficient to pay for basic living necessities without overtime pay. Many workers live in the factory, a perk for which they pay (and need overtime to cover the cost). - Workers typically work 11 to 12 hours a day, with 90 overtime hours per month-2.5 times the upper limit set by Chinese labor law. - In the dormitories, 16 workers share a 16-square-meter (172-square-foot) room-just larger than a typical child's bedroom in the United States. - 320 workers share 24 toilets and 24 showers. No hot water. Rusted pipes. No shower heads. Workers are forced to use buckets or pans to bathe. - Cafeteria facilities are inadequate. Workers are fed inadequately. Food often has foreign matter in it. - In practice, during peak months, no leave or sick leave is approved. Such abuses are common across a wide range of industries, and not just in China but also in many low-wage countries. Indeed, in one case in Bangladesh, more than 1,10o workers were killed when an eight-story building housing multiple garment factories collapsed in 2013. The factories had not installed appropriate safety measures. Many companies, including Nike, Apple, and Walmart, have been accused of exploiting workers in foreign countries. 45 Economic arbitrage, in and of itself, is not necessarily unethical. In many cases, foreign firms pay better than average wages and bring improved safety and labor practices to their factories and their supplier's factories. 46 However, when many firms in the same industry are seeking a cost advantage by utilizing an arbitrage strategy, the pressure to decrease costs can be immense, and firms have to be vigilant that workers aren't exploited. To that end, companies such as Nike and Apple have developed a supplier code of conduct, which they use to audit their overseas suppliers.47 Although this doesn't always work, because suppliers sometimes find ways around the audits it does decrease the incidence of unethical exploitation of workers. 49 An arbitrage strategy is the third of the three primary international strategies. While the other two strategies view foreign markets as sales opportunities with the need to manage differences between countries, the essence of arbitrage is taking advantage of those differences. Arbitrage, at its simplest, is defined as using differences between markets to buy low in one location and sell high in another. arbitrage strategy A strategy involving buying where costs are low and selling where prices are high. It can involve economic, cultural, administrative, or capital arbitrage. One of the most common modern forms of arbitrage is also one of the basic reasons firms expand internationally, to find the lowestcost source of labor or raw materials. This is called economic arbitrage, and it often involves offshoring manufacturing or R\&D to countries with low labor costs. However, some firms also practice For example, CEMEX, a Mexican cement manufacturer, operates plants in Spain so that it can raise capital in the European Union, where interest rates are often lower than they are in Mexico. economic arbitrage Capitalizing on differences in costs by buying where costs are low and selling where prices are high. This is the traditional, age-old definition of arbitrage. capital arbitrage Capitalizing on differences in the cost of capital by acquiring capital where it is less expensive. Not all arbitrage involves sourcing low-cost resources, however. Some forms of arbitrage take advantage of differences between countries to sell products. Cultural arbitrage trades on the culture of one nation to sell in another. US-based fast-food restaurant chains are popular worldwide partly because they embody US culture. Likewise, for centuries the French were able to sell wine at a premium price because it came from France. Some firms also utilize what is known as taking advantage of differences between countries that are created by laws and government regulations. Many companies incorporate in the Cayman Islands because of low corporate tax rates. Likewise, nearly one-third of all foreign capital flowing into China actually originates in China, but the investors process their financial transactions through Hong Kong in order to avoid government regulation. cultural arbitrage Capitalizing on differences in culture between countries by actively using the culture of one country as a selling point for products being marketed in another country. administrative arbitrage Capitalizing on differences in taxes, regulations, and laws between countries by operating where they are lower or more lax. FIGURE 9.4 International Strategies and Local Responsiveness Versus Standardization Each strategy is appropriate for a different set of industry dynamics and firm capabilities. We'll discuss each in turn as well as discussing combining strategies. The three primary strategies are not mutually exclusive. Some firms are successful at pursuing two at the same time, although it becomes increasingly complicated to manage operations and maintain strategic focus when doing so. At the end of the chapter we'll introduce a tool for determining which strategy is best for any given firm. Multidomestic Strategy-Adapt to Fit the Local Market The multidomestic strategy centers on tailoring products and operations to individual markets. 39 Firms in industries where customer needs and preferences vary widely from country to country, such as food or media, often use this strategy. By tailoring their products and services to better meet the needs of local customers, firms can maximize their responsiveness, increasing their sales and market share in each country. They usually succeed through a differentiation strategy rather than a cost leadership strategy. Unilever uses this strategy. It sells more than 10oo brands worldwide. In most of the countries it enters it uses different brand names (i.e., in the case of bar soap-Dove in the United States, Block \& White in the Philippines, and Gessy in Brazil). multidomestic strategy A strategy involving tailoring products or services to local markets. As firms enter more countries and the differences between the home country and each foreign country increase, firms must expand the degree of tailoring, or adaptation. Consequently, many firms that pursue a multidomestic strategy put autonomous decision-making authority into the hands of managers in charge of individual regions or countries.40 To enable such autonomous decisions, significant parts of the value chain have to be replicated in each country. For instance, each country may have a product development and design lab, manufacturing plants, and sales and distribution personnel. Replicating these different functions in each country comes at a significant cost. Not surprisingly, firms find it hard to tap into economies of scale if they are designing and producing something different in each country. As companies decentralize their operations to be locally responsive, it also makes it difficult to share valuable knowledge across the firm globally. As a consequence, firms that pursue a multidomestic strategy often find it difficult to develop a worldwide competitive advantage. At best, they produce a series of local competitive advantages. Strategy in Practice National Competitive Advantage Have you ever wondered how firms from the same country dominate their industries worldwide? For example US companies Apple, Google, and Microsoft control the worldwide industry for computer operating systems; German organizations dominate in machine tools; and Italian firms lead in the sale of leather goods. Michael Porter developed a tool, the Porter's Diamond of National Competitive Advantage, that explains how this happens

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts