Question: McGregor Co. Please Show all Work QUESTION 2 On January 1st 2019, McGregor Co. pays $3,200,000 for a tract of land with two buildings and

McGregor Co. Please Show all Work

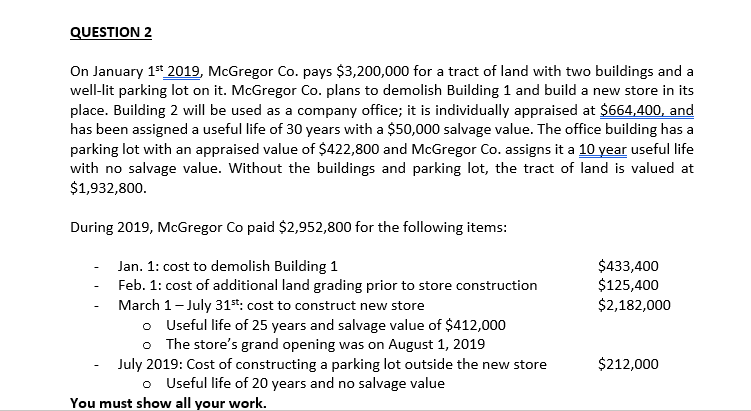

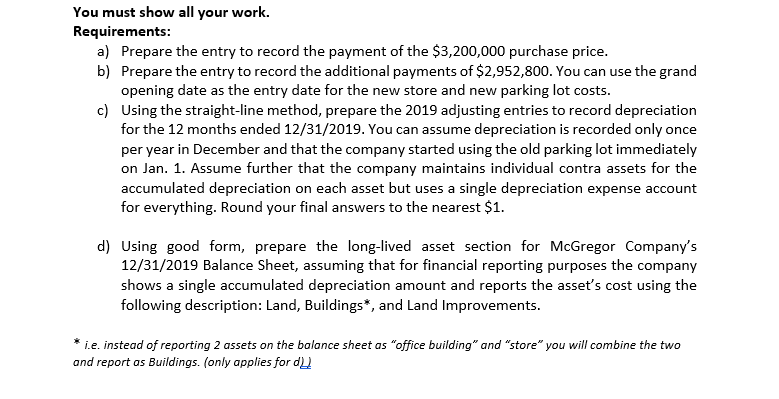

QUESTION 2 On January 1st 2019, McGregor Co. pays $3,200,000 for a tract of land with two buildings and a well-lit parking lot on it. McGregor Co. plans to demolish Building 1 and build a new store in its place. Building 2 will be used as a company office; it is individually appraised at $664,400, and has been assigned a useful life of 30 years with a $50,000 salvage value. The office building has a parking lot with an appraised value of $422,800 and McGregor Co. assigns it a 10 year useful life with no salvage value. Without the buildings and parking lot, the tract of land is valued at $1,932,800. During 2019, McGregor Co paid $2,952,800 for the following items: $433,400 $125,400 $2,182,000 - Jan. 1: cost to demolish Building 1 - Feb. 1: cost of additional land grading prior to store construction - March 1 - July 31st: cost to construct new store o Useful life of 25 years and salvage value of $412,000 The store's grand opening was on August 1, 2019 - July 2019: Cost of constructing a parking lot outside the new store o Useful life of 20 years and no salvage value You must show all your work. $212,000 You must show all your work. Requirements: a) Prepare the entry to record the payment of the $3,200,000 purchase price. b) Prepare the entry to record the additional payments of $2,952,800. You can use the grand opening date as the entry date for the new store and new parking lot costs. c) Using the straight-line method, prepare the 2019 adjusting entries to record depreciation for the 12 months ended 12/31/2019. You can assume depreciation is recorded only once per year in December and that the company started using the old parking lot immediately on Jan. 1. Assume further that the company maintains individual contra assets for the accumulated depreciation on each asset but uses a single depreciation expense account for everything. Round your final answers to the nearest $1. d) Using good form, prepare the long-lived asset section for McGregor Company's 12/31/2019 Balance Sheet, assuming that for financial reporting purposes the company shows a single accumulated depreciation amount and reports the asset's cost using the following description: Land, Buildings, and Land Improvements. * i.e. instead of reporting 2 assets on the balance sheet as "office building" and "store" you will combine the two and report as Buildings. (only applies for d2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts