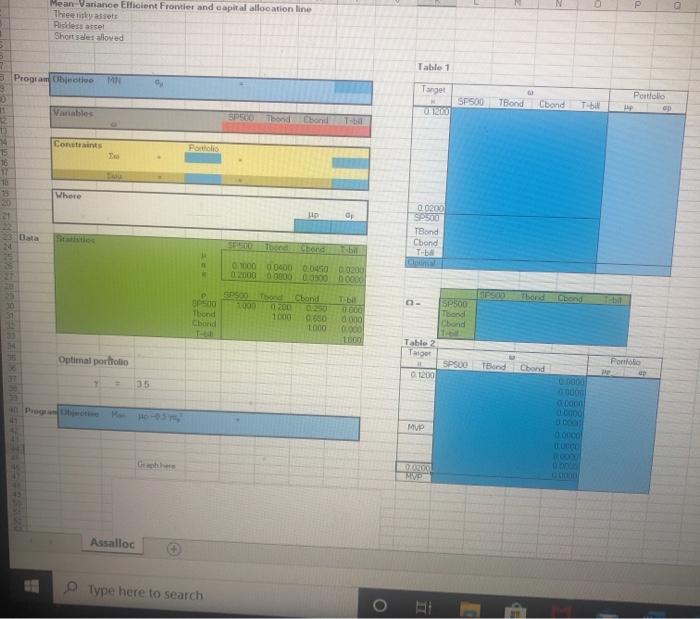

Question: Mean Variance Efficient Frontier and capital allocation line Three nitky assets Pics Short sales allowed Table 1 Program Objective MN SP500 TBond Cbond T-bil Variables

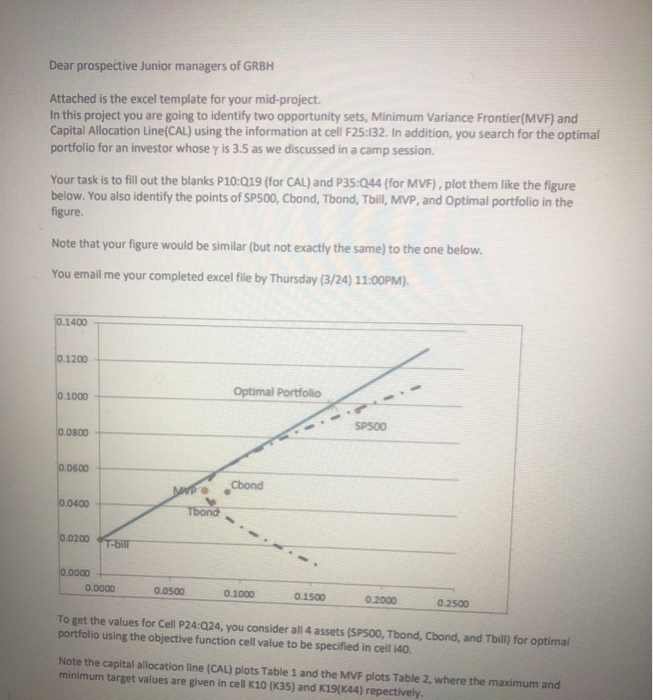

Mean Variance Efficient Frontier and capital allocation line Three nitky assets Pics Short sales allowed Table 1 Program Objective MN SP500 TBond Cbond T-bil Variables Spooo Thond Chond T-B1 Constraints Portalis 0020 I Bond Cbond SP5oo Toond Chond T-bil 000 0000 00450 00200 0200000000000000000 SABORE 0 1000 SP500 Thond Chond 0.200 0.250 0000 000000000 100 000 1500 Thond Chand Table 2 P500 TBond Cbond p Portilo ap 0 1200 Optimal portfolio = 00000 35 0 Prega t ive M -05 MUD Assalloc Type here to search Dear prospective Junior managers of GRBH Attached is the excel template for your mid-project. In this project you are going to identify two opportunity sets, Minimum Variance Frontier(MVF) and Capital Allocation Line(CAL) using the information at cell F25:132. In addition, you search for the optimal portfolio for an investor whose y is 3.5 as we discussed in a camp session. Your task is to fill out the blanks P10:019 (for CAL) and P35:044 (for MVF), plot them like the figure below. You also identify the points of SP500, Cbond, Tbond, Tbill, MVP, and Optimal portfolio in the figure. Note that your figure would be similar (but not exactly the same) to the one below. You email me your completed excel file by Thursday (3/24) 11:00PM). 0.1400 0.1200 Optimal Portfolio 0.1000 0.0800 0.0600 Cbond 0.0400 Tbond 0.0200 TB 0.0000 0.0000 0.0500 0.1000 0.1500 0.2000 0.2500 To get the values for Cell P24:024, you consider all 4 assets (SP500, Tbond, Cbond, and Tbill) for optimal portfolio using the objective function cell value to be specified in cell 140. Note the capital allocation line (CAL) plots Table 1 and the MVF plots Table 2. where the maximum and minimum target values are given in cel K10 (K35) and K19(K44) repectively. Mean Variance Efficient Frontier and capital allocation line Three nitky assets Pics Short sales allowed Table 1 Program Objective MN SP500 TBond Cbond T-bil Variables Spooo Thond Chond T-B1 Constraints Portalis 0020 I Bond Cbond SP5oo Toond Chond T-bil 000 0000 00450 00200 0200000000000000000 SABORE 0 1000 SP500 Thond Chond 0.200 0.250 0000 000000000 100 000 1500 Thond Chand Table 2 P500 TBond Cbond p Portilo ap 0 1200 Optimal portfolio = 00000 35 0 Prega t ive M -05 MUD Assalloc Type here to search Dear prospective Junior managers of GRBH Attached is the excel template for your mid-project. In this project you are going to identify two opportunity sets, Minimum Variance Frontier(MVF) and Capital Allocation Line(CAL) using the information at cell F25:132. In addition, you search for the optimal portfolio for an investor whose y is 3.5 as we discussed in a camp session. Your task is to fill out the blanks P10:019 (for CAL) and P35:044 (for MVF), plot them like the figure below. You also identify the points of SP500, Cbond, Tbond, Tbill, MVP, and Optimal portfolio in the figure. Note that your figure would be similar (but not exactly the same) to the one below. You email me your completed excel file by Thursday (3/24) 11:00PM). 0.1400 0.1200 Optimal Portfolio 0.1000 0.0800 0.0600 Cbond 0.0400 Tbond 0.0200 TB 0.0000 0.0000 0.0500 0.1000 0.1500 0.2000 0.2500 To get the values for Cell P24:024, you consider all 4 assets (SP500, Tbond, Cbond, and Tbill) for optimal portfolio using the objective function cell value to be specified in cell 140. Note the capital allocation line (CAL) plots Table 1 and the MVF plots Table 2. where the maximum and minimum target values are given in cel K10 (K35) and K19(K44) repectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts