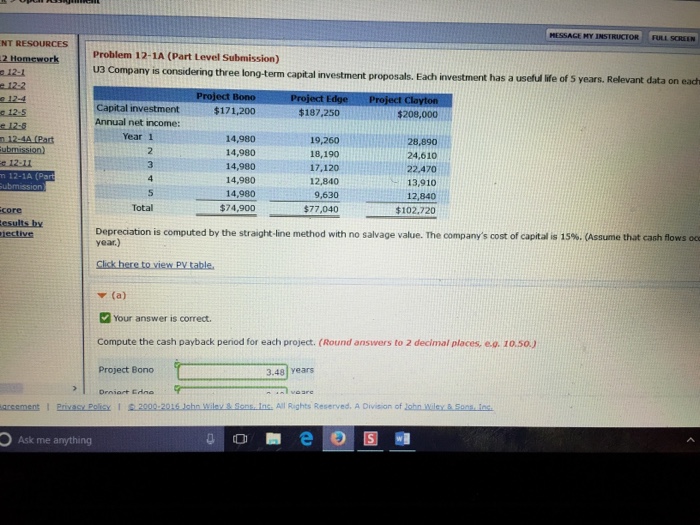

Question: MESSACE MY INSTRUCTOR FULL SCREEN NT RESOURCES Problem 12-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each a 12-1 22

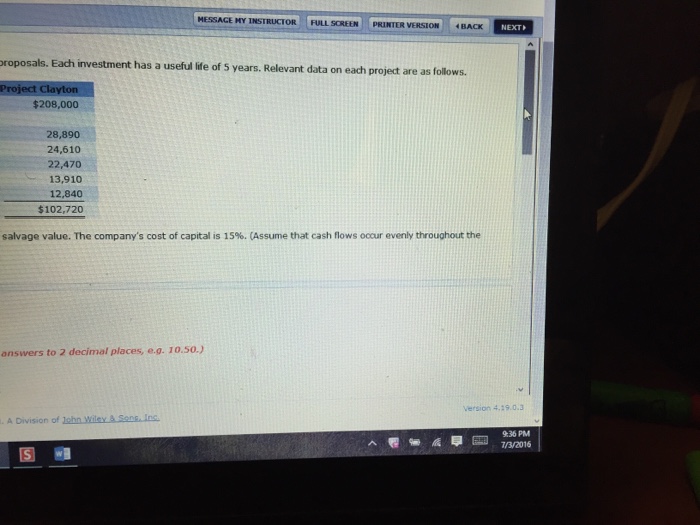

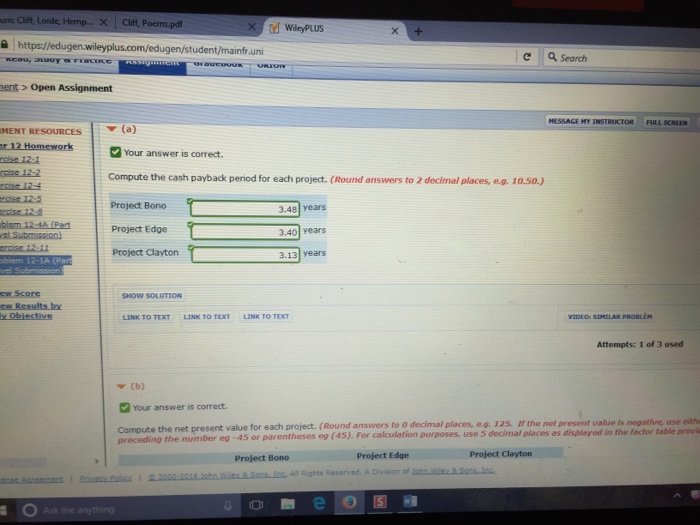

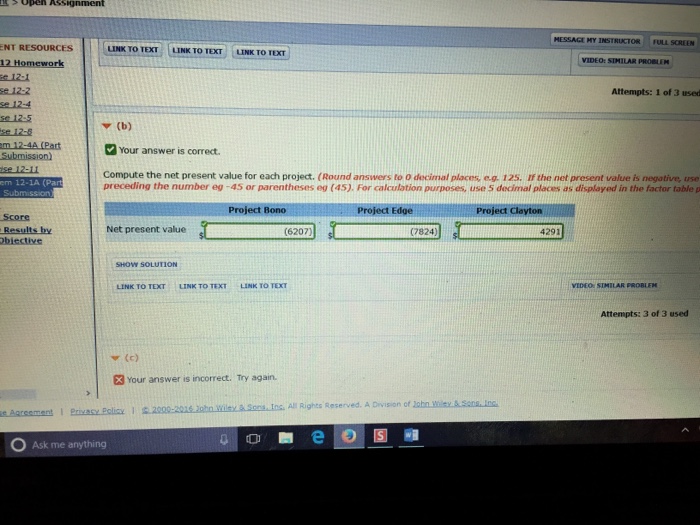

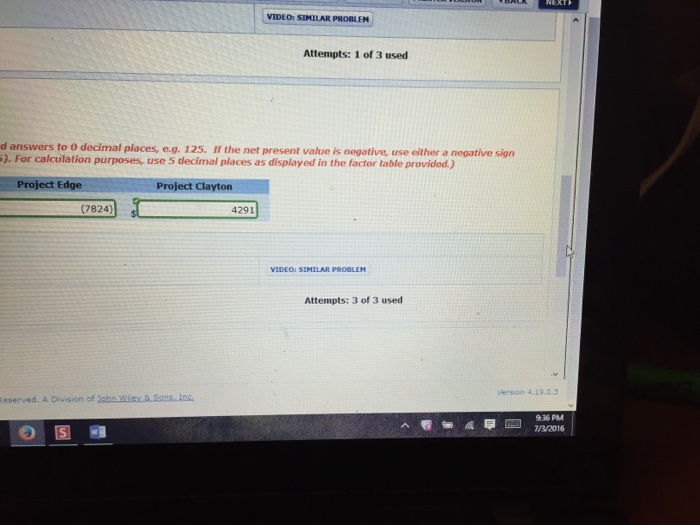

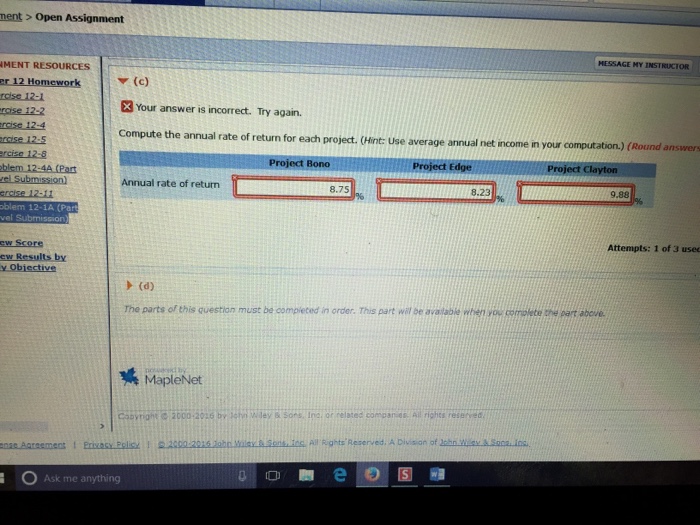

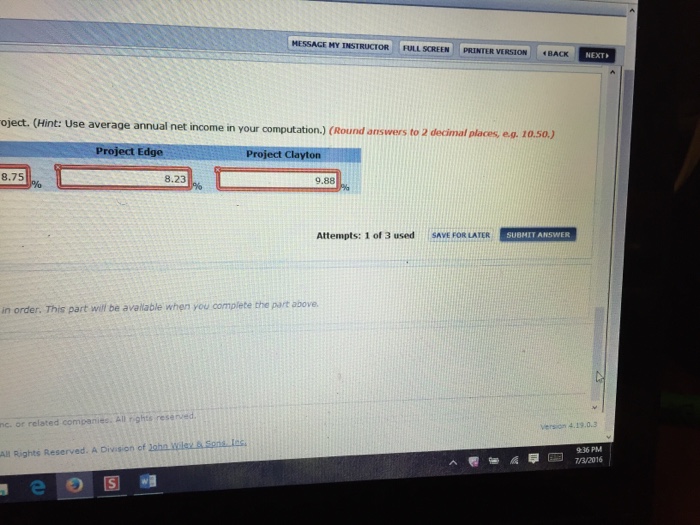

MESSACE MY INSTRUCTOR FULL SCREEN NT RESOURCES Problem 12-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each a 12-1 22 12-4 investment has a useful life of 5 years. Relevant data on eadh Capital investment Annual net income: Year 1 $171,200 $187,250 $208,000 14,980 14,980 14,980 14,980 14,980 $74.900 19,260 18,190 17,120 12,840 9,630 $77,040 28.890 24,610 22.470 13,910 12,840 $102,720 m 12-1A (Par Total Total$74,900 core Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital-is%. year.) Assume that cash flows oo (a) Your answer is correct. Compute the cash payback period for each project. (Round answers to 2 declmal places, eo. 10.50) Project Bono 3.48 years gresment l PrivaerPolicy 2000-2016echny levtsons Inc All Rights Reserved. A Division of lohn winasanaina Ask me anything

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts