Question: mework Question 4 , Problem 5 . 1 2 HW Score: 1 7 . 6 % , 4 . 4 of 2 5 ( similar

mework

Question Problem

HW Score: of

similar to

points

Points: of

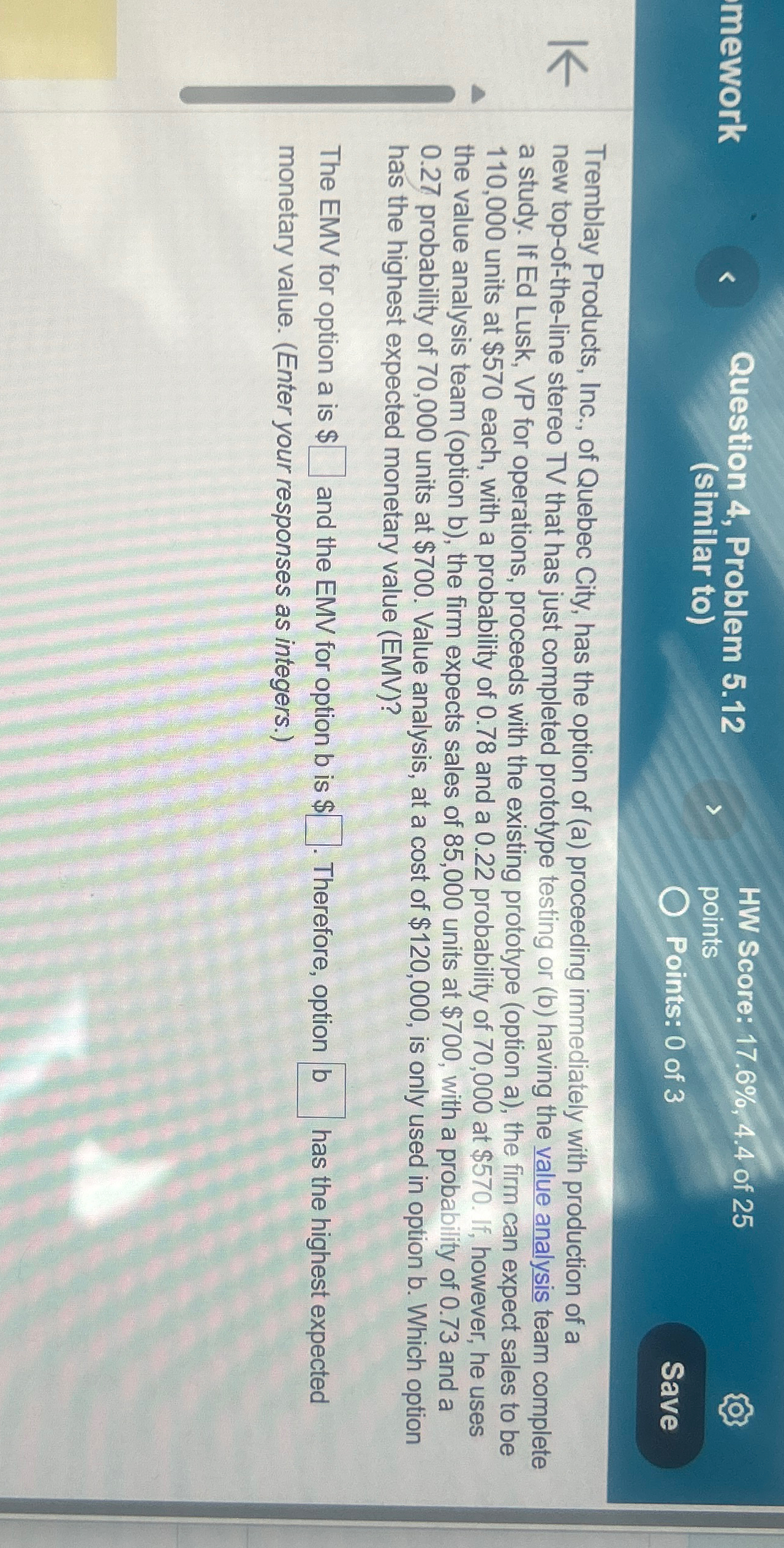

Tremblay Products, Inc., of Quebec City, has the option of a proceeding immediately with production of a new topoftheline stereo TV that has just completed prototype testing or b having the value analysis team complete a study. If Ed Lusk, VP for operations, proceeds with the existing prototype option a the firm can expect sales to be units at $ each, with a probability of and a probability of at $ If however, he uses the value analysis team option b the firm expects sales of units at $ with a probability of and a probability of units at $ Value analysis, at a cost of $ is only used in option Which option has the highest expected monetary value EMV

The EMV for option is $ and the EMV for option is $ Therefore, option has the highest expected monetary value. Enter your responses as integers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock