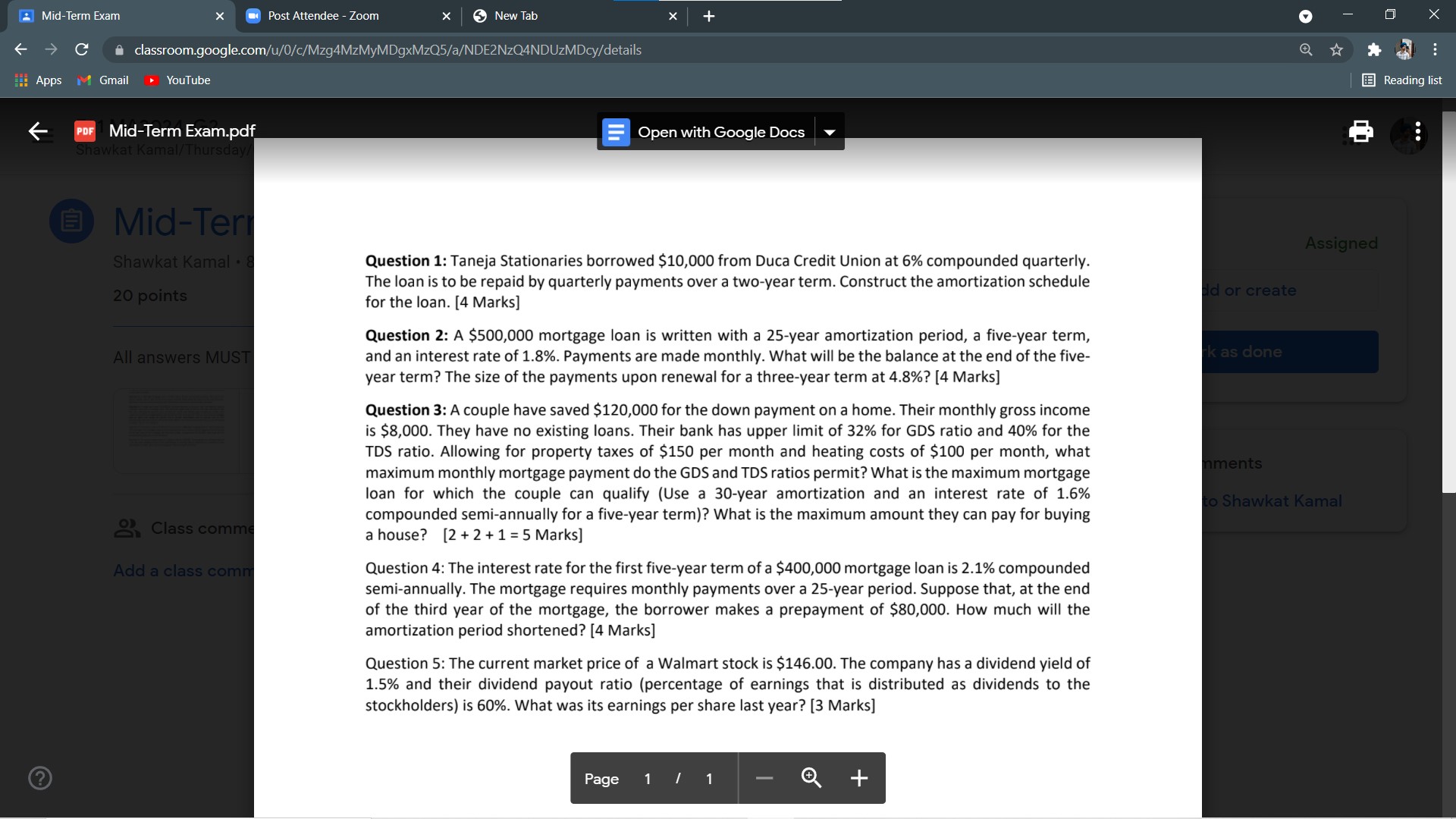

Question: ; Mid-Term Exam names-Zoom x @ Newiab (- C classroomgoogle com Apps ' Gmaik - YouTube E Readinglist 6 PW Mid-Term Exam.pdf 5 Open with

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts