Question: Midway Mask Co. is considering two capital structures. The key information follows. Assume a 40 percent tax rate, interest rates on the debt as labeled,

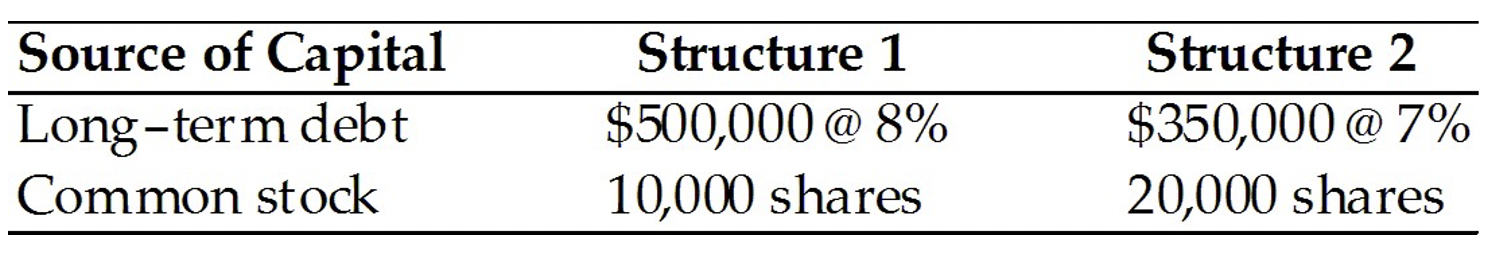

Midway Mask Co. is considering two capital structures. The key information follows. Assume a 40 percent tax rate, interest rates on the debt as labeled, and expected Earnings Before Interest and Taxes (EBIT) of $50,000.

Midway Mask Co. is considering two capital structures. The key information follows. Assume a 40 percent tax rate, interest rates on the debt as labeled, and expected Earnings Before Interest and Taxes (EBIT) of $50,000.

What is the Earnings Per Share (EPS) under Structure 1 and Structure 2 at the expected EBIT level of $50,000?

Source of Capital Long-term debt Common stock - Structure 1 $500,000 @ 8% 10,000 shares Structure 2 $350,000 @ 7% 20,000 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts