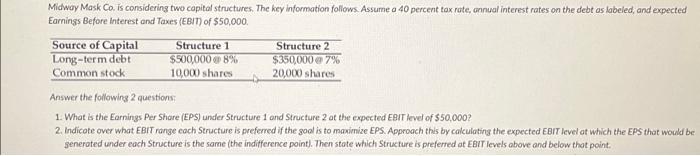

Question: Midway Mask Co. is considering two capital structures. The key information follows. Assume a 40 percent tax rate, annual interest rates on the debt as

Midwoy Mask Ca. is considering two copital structures. The hey information follows. Assume a 40 percent tox rote, onnual interest rotes on the debt as labeled, and expected Eamings Before lnterest and Taxes (EBMT) of $50,000. Answer the following 2 questions: 1. What is the Earnings Per Share (EPS) under Structure 1 and Structure 2 at the expected EGIT level of $50,000 ? 2. Indicote over what EBIT range each Structure is preferred if the soal is to maximize EPS. Approach this by cakeulating the expected EBIT level at which the EPS that would be Seneroted under each Structure is the same (the indifference point). Then state which Structure is preferred at EBIT levels above and below that point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts