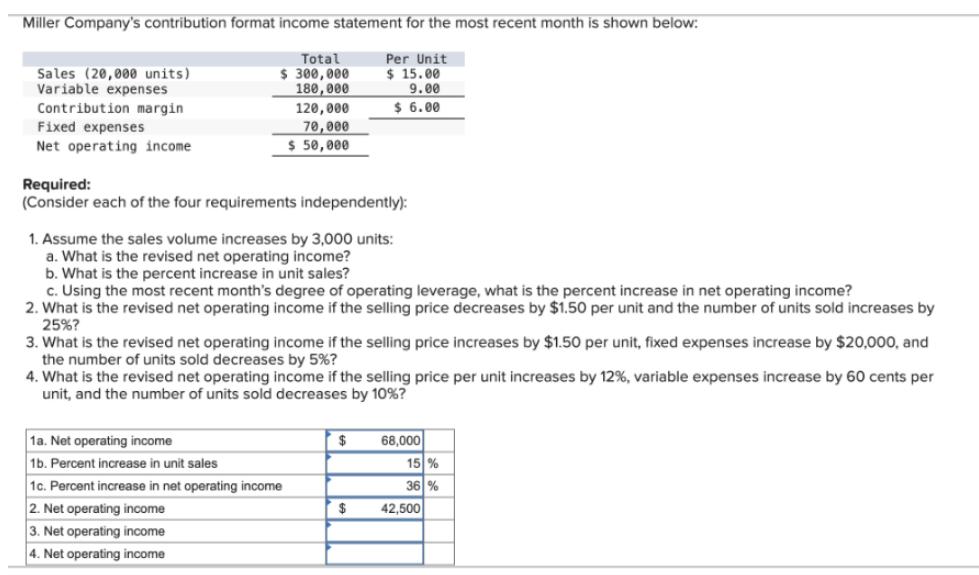

Miller Company's contribution format income statement for the most recent month is shown below: Sales (20,000...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Miller Company's contribution format income statement for the most recent month is shown below: Sales (20,000 units) Variable expenses Contribution margin Fixed expenses Total $ 300,000 180,000 120,000 Per Unit $ 15.00 9.00 $ 6.00 70,000 $ 50,000 Net operating income Required: (Consider each of the four requirements independently): 1. Assume the sales volume increases by 3,000 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 25%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%? 1a. Net operating income $ 68,000 1b. Percent increase in unit sales 15% 1c. Percent increase in net operating income 36 % 2. Net operating income $ 42,500 3. Net operating income 4. Net operating income Miller Company's contribution format income statement for the most recent month is shown below: Sales (20,000 units) Variable expenses Contribution margin Fixed expenses Total $ 300,000 180,000 120,000 Per Unit $ 15.00 9.00 $ 6.00 70,000 $ 50,000 Net operating income Required: (Consider each of the four requirements independently): 1. Assume the sales volume increases by 3,000 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 25%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%? 1a. Net operating income $ 68,000 1b. Percent increase in unit sales 15% 1c. Percent increase in net operating income 36 % 2. Net operating income $ 42,500 3. Net operating income 4. Net operating income

Expert Answer:

Related Book For

Managerial Accounting

ISBN: 978-1259307416

16th edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer

Posted Date:

Students also viewed these accounting questions

-

Evaluate yourself with regard to each of the practices listed in the table below. Circle the appropriate number for each. Add up your score and consider the following advice: Write three goals you...

-

The Fibonacci sequence is a famous sequence of numbers whose elements commonly occur in nature. The terms in the Fibonacci sequence are 1, 1, 2, 3, 5, 8, 13, 21, . . . . The ratio of consecutive...

-

Question 9: We have a random experiment with space of elementary events = {a,b,c,d,e,f}. We take = 20 and P(A) = |A for any A E. We consider X: R a map defined by the following relation: a) Prove...

-

Express the quantity of 3.225 kJ in calories.

-

Consider the resonance structures for the carbonate ion. (a) How much negative charge is on each oxygen of the carbonate ion? (b) What is the bond order of each carbon-oxygen bond in the carbonate...

-

Discuss the weight-based performance measures of Ferson and Mo (2013).

-

If you want to maintain a potential difference of \(6000 \mathrm{~V}\) between the plates of a parallel-plate capacitor, what is the minimum value of the plate separation if the space between the...

-

A time-study technician at the Southern Textile Company has conducted a time study of a spinning machine operator that spins rough cotton yarn into a finer yarn on bobbins for use in a weaving...

-

10. A skier plans to ski a smooth fixed hemisphere of radius R. He starts form rest on a curved smooth surface of height TR/4 The angle at which he leaves the hemisphere is : (a) cos Yshipma (b) cos...

-

he Boondocks. "The Passion of Rev. Ruckus." S01E15 (2006)Please consider this episode in relation to your now informed understanding of satire. Is it educative in a satirical sense? How does unstable...

-

The local electronics store is offering a promotion 1-year: same as cash, meaning that you can buy a TV now, and wait a year to pay (with no interest). So, if you take home a $1250 TV today, you will...

-

Assume the same facts in 53 except Olivia received 40 shares and the fair market value of the property she contributed was $16,000. Is the transaction nontaxable under Code Sec. 351?

-

Those who bargain ruthlessly and are intent on maximizing their personal gain are sometimes called "hawks." "Doves" give in easily, favoring peaceful accord over the potential gains from conflict The...

-

You plan to borrow $5000 from a bank. In exchange for $5000 today, you promise to pay $5400 in one year. What does the cash flow timeline look like from your perspective? What does it look like from...

-

Olivia and Tatiana form Jen Co. earlier this year. Olivia contributed services worth $24,000 and property worth $1,000 and Tatiana contributed property worth $25,000. Each received 25 shares of Jen...

-

Choose a product. Conduct a branded and unbranded experiment. What did you learn about the equity of the brands in that product class? Can you identify any other advantages or disadvantages with the...

-

Q1) What is the a3 Value Q2) What is the a7 Value Q3) What is the a4 Value Q4) What is the b3 Value Q5) What is the b2 Value Q6) What is the sign of 2nd constraint? A pastry chef at a bakery wants to...

-

Shiloh supplies equipment to the automotive and commercial vehicle markets and other industrial customers. It specializes in materials and designs that reduce vehicle weight and increase fuel...

-

Plaintiffs purchased stock warrants (rights to purchase) for blocks of Osborne Computer Corp., the manufacturer of the first mass-market portable personal computer. Because of inability to produce a...

-

Kronenberger Burgoyne, LLP, was a law firm with two equity partners who agreed to equal ownership as of 2009. Before 2009, Kronenberger had owned a majority interest in the firm, and when, in 2011,...

Study smarter with the SolutionInn App