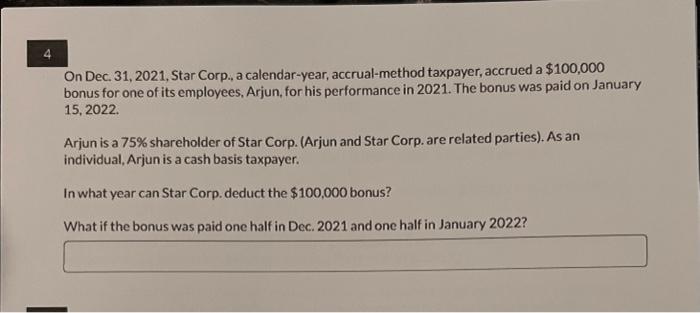

Question: Module 2. Prob Q4. On Dec. 31, 2021, Star Corp., a calendar-year, accrual-method taxpayer, accrued a $100,000 bonus for one of its employees, Arjun, for

On Dec. 31, 2021, Star Corp., a calendar-year, accrual-method taxpayer, accrued a $100,000 bonus for one of its employees, Arjun, for his performance in 2021. The bonus was paid on January 15,2022. Arjun is a 75\% shareholder of Star Corp. (Arjun and Star Corp. are related parties). As an individual, Arjun is a cash basis taxpayer. In what year can Star Corp. deduct the $100,000 bonus? What if the bonus was paid one half in Dec. 2021 and one half in January 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts