Question: Module 2 Prob Q5. On December 1, 2021, Square Inc., a calendar-year, cash-method taxpayer, pays a $12,000 premium for a 12-month commercial general liability insurance

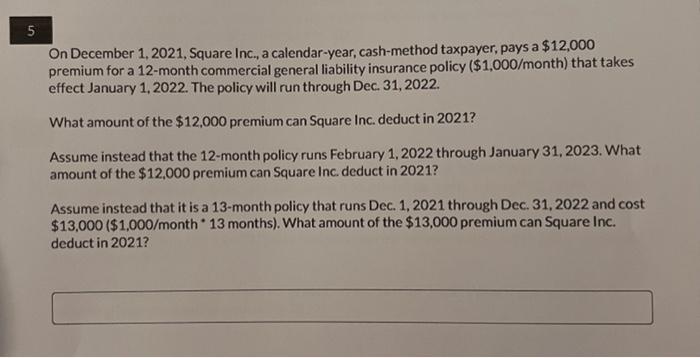

On December 1, 2021, Square Inc., a calendar-year, cash-method taxpayer, pays a $12,000 premium for a 12-month commercial general liability insurance policy ($1,000/month) that takes effect January 1,2022. The policy will run through Dec. 31, 2022. What amount of the $12,000 premium can Square Inc. deduct in 2021 ? Assume instead that the 12-month policy runs February 1, 2022 through January 31, 2023. What amount of the $12,000 premium can Square Inc. deduct in 2021 ? Assume instead that it is a 13-month policy that runs Dec. 1, 2021 through Dec. 31,2022 and cost $13,000 (\$1,000/month * 13 months). What amount of the $13,000 premium can Square Inc. deduct in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts