Question: Jeremy Duncan's Guitar Centers is enjoying a rapid growth in earnings and dividends. However, this expanded growth will end soon due to increasing competition.

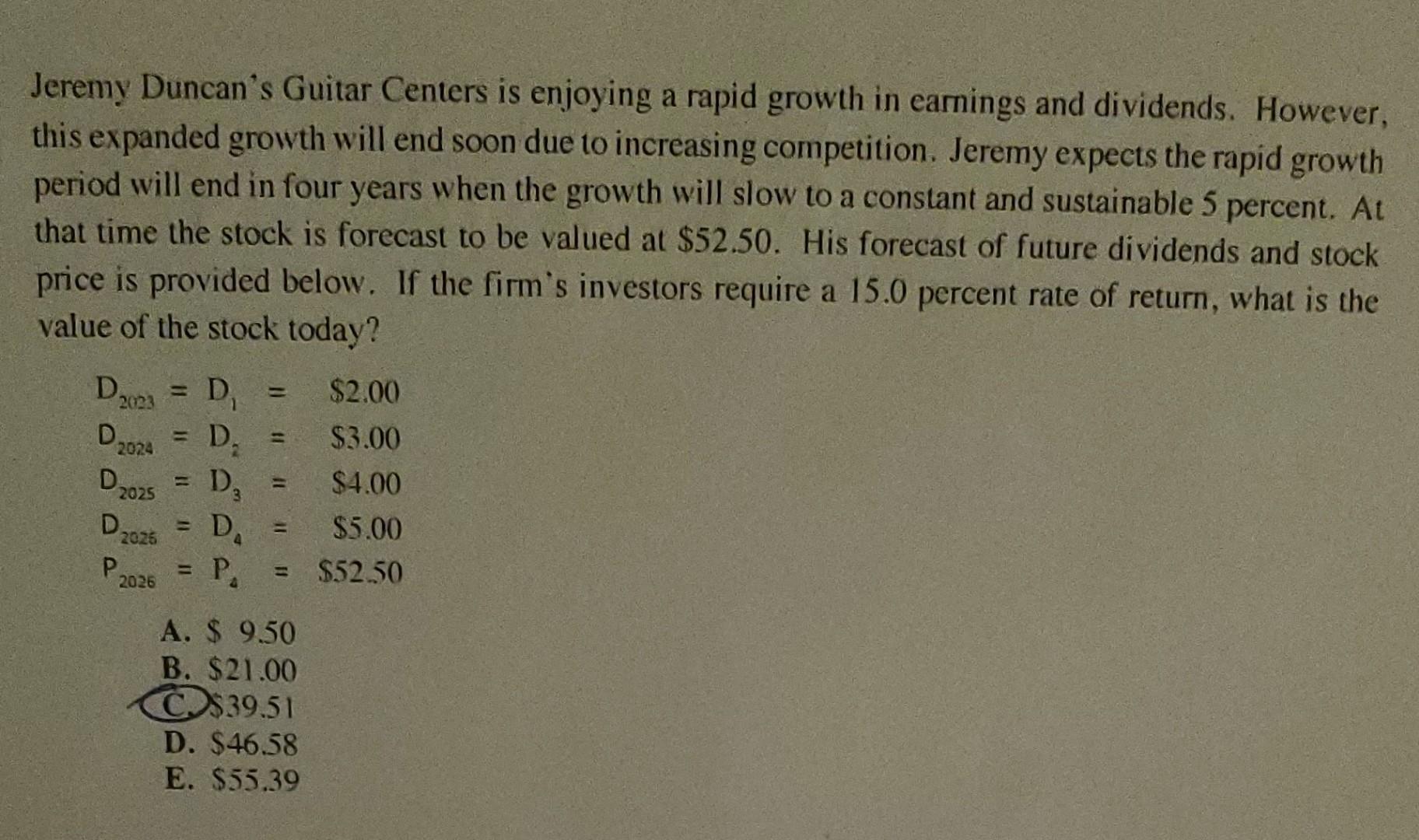

Jeremy Duncan's Guitar Centers is enjoying a rapid growth in earnings and dividends. However, this expanded growth will end soon due to increasing competition. Jeremy expects the rapid growth period will end in four years when the growth will slow to a constant and sustainable 5 percent. At that time the stock is forecast to be valued at $52.50. His forecast of future dividends and stock price is provided below. If the firm's investors require a 15.0 percent rate of return, what is the value of the stock today? D 2023 D 2024 2025 D 2025 P 2026 T D $2.00 D. = $3.00 $4.00 $5.00 $52.50 11 DA = P A. $ 9.50 B. $21.00 C$39.51 D. $46.58 E. $55.39 D3 11 = 11

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Answer D 4658 To calculate the present ... View full answer

Get step-by-step solutions from verified subject matter experts