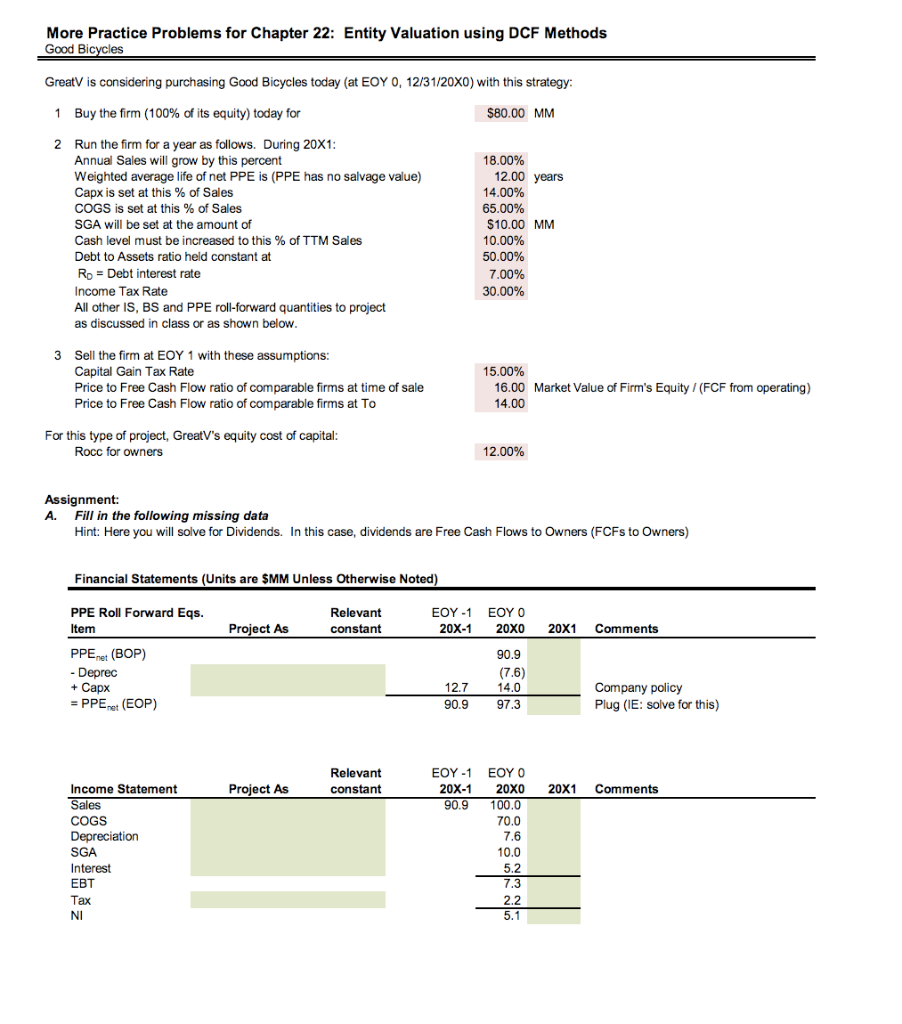

Question: More Practice Problems for Chapter 22: Entity Valuation using DCF Methods Good Bic GreatV is considering purchasing Good Bicycles today (at EOY 0,12/31/20X0) with this

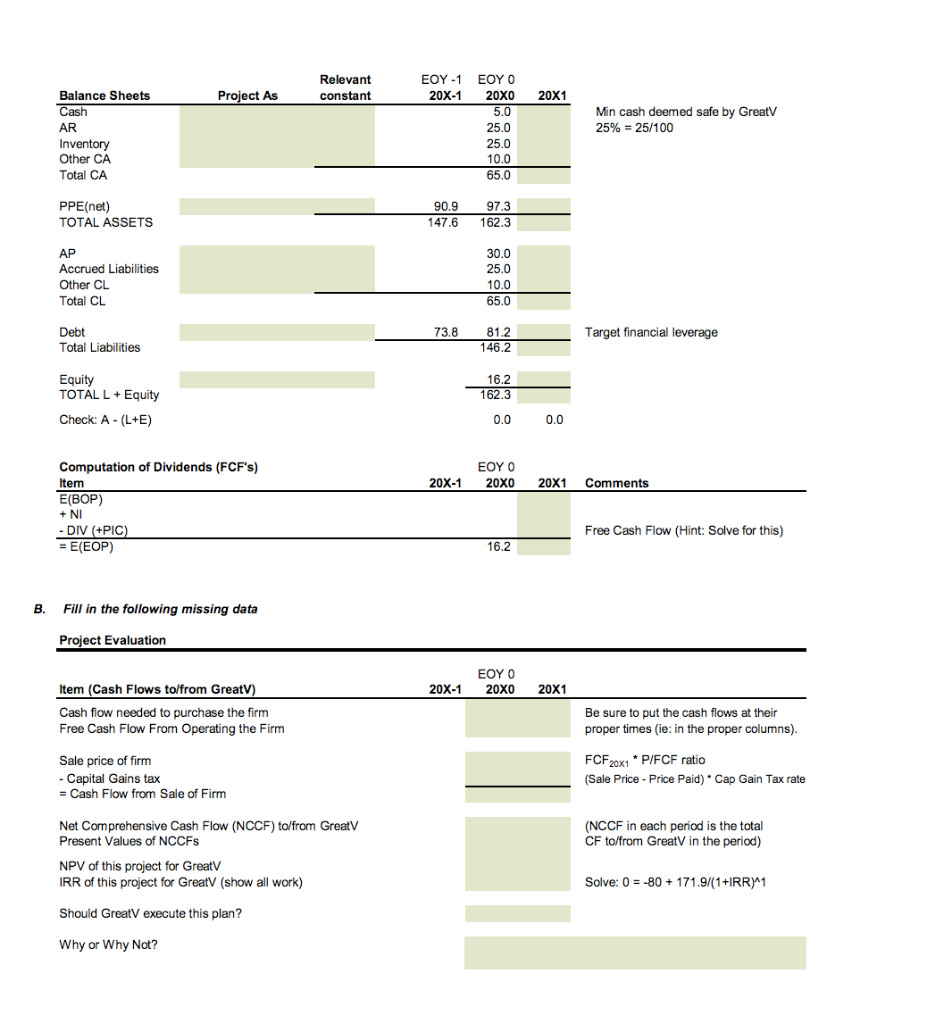

More Practice Problems for Chapter 22: Entity Valuation using DCF Methods Good Bic GreatV is considering purchasing Good Bicycles today (at EOY 0,12/31/20X0) with this strategy 1 Buy the firm (100% of its equity) today for $80.00 MM 2 Run the firm for a year as follows. During 20X1 Annual Sales will grow by this percent Weighted average life of net PPE is (PPE has no salvage value) Capx is set at this % of Sales COGS is set at this % of Sales SGA will be set at the amount of Cash level must be increased to this % of TTM Sales Debt to Assets ratio held constant at Ro-Debt interest rate Income Tax Rate All other IS, BS and PPE roll-forward quantities to project as discussed in class or as shown below 18.00% 12.00 14.00% 65.00% $10.00 10.00% 60N% 7.00% 30.00% years MM 3 Sell the firm at EOY 1 with these assumptions: Capital Gain Tax Rate Price to Free Cash Flow ratio of comparable firms at time of sale Price to Free Cash Flow ratio of comparable firms at To 15.00% 16.00 Market Value of Firm's Equity (FCF from operating) 14.00 For this type of project, GreatV's equity cost of capital 12.00% Rocc for owners Assignment: A. Fill in the following missing data Hint: Here you will solveforDividends. In this case, dividends are Free Cash Flows to Owners (FCFs to Owners) Financial Statements (Units are $MM Unless Otherwise Noted) PPE Roll Forward Eqs. Item EOY-1 EOY 0 Relevant constant 20X-1 20X0 20X1 Comments ect As PPEnet (BOP) - Deprec + Capx 90.9 (7.6) 12.7 14.0 Company policy Plug (IE: solve for this) PPEnet (EOP) 90.9 97.3 Relevant constant EOY-1 EOY O Income Statement Sales COGS Depreciation SGA Interest EBT Tax NI Project As 20X-1 20X0 20X1 Comments 0.9 100.0 70.0 7.6 10.0 5.2 7.3 2.2 5.1 EOY-1 EOY 0 Relevant constant ect As Balance Sheets Cash AR 20X-1 20X0 20X1 5.0 25.0 25.0 10.0 65.0 Min cash deemed safe by Greatv 25%-25/100 Other CA Total CA PPE(net) TOTAL ASSETS 90.997.3 147.6 162.3 AP Accrued Liabilities Other CL Total CL 30.0 25.0 10.0 65.0 Debt Total Liabilities 73.8 81.2 146.2 Target financial leverage Equity TOTALLEquity 16.2 162.3 Check: A (L+E) 0.0 0.0 EOY 0 Computation of Dividends (FCF's) Item E(BOP) + NI DIV(+PIC)Free Cash Flow (Hint: Solve for this) -E(EOP) 20X-1 20X0 20X1 Comments 16.2 B. Fill in the following missing data Project Evaluation EOY Item (Cash Flows tolfrom Greatv) 20X-1 20X0 20X1 Cash fow needed to purchase the firm Free Cash Flow From Operating the Firm Be sure to put the cash flows at their proper times (ie: in the proper columns FCF20x1 P/FCF ratio (Sale Price -Price Paid) Cap Gain Tax rate Sale price of firm Capital Gains tax Cash Flow from Sale of Firm Net Comprehensive Cash Flow (NCCF) to/from GreatV (NCCF in each period is the total CF to/from GreatV in the period) Present Values of NCCFs NPV of this project for GreatV IRR of this project for GreatV (show all work) Should GreatV execute this plan? Why or Why Not? Solve: 0-80+171.9(1+IRRA1 More Practice Problems for Chapter 22: Entity Valuation using DCF Methods Good Bic GreatV is considering purchasing Good Bicycles today (at EOY 0,12/31/20X0) with this strategy 1 Buy the firm (100% of its equity) today for $80.00 MM 2 Run the firm for a year as follows. During 20X1 Annual Sales will grow by this percent Weighted average life of net PPE is (PPE has no salvage value) Capx is set at this % of Sales COGS is set at this % of Sales SGA will be set at the amount of Cash level must be increased to this % of TTM Sales Debt to Assets ratio held constant at Ro-Debt interest rate Income Tax Rate All other IS, BS and PPE roll-forward quantities to project as discussed in class or as shown below 18.00% 12.00 14.00% 65.00% $10.00 10.00% 60N% 7.00% 30.00% years MM 3 Sell the firm at EOY 1 with these assumptions: Capital Gain Tax Rate Price to Free Cash Flow ratio of comparable firms at time of sale Price to Free Cash Flow ratio of comparable firms at To 15.00% 16.00 Market Value of Firm's Equity (FCF from operating) 14.00 For this type of project, GreatV's equity cost of capital 12.00% Rocc for owners Assignment: A. Fill in the following missing data Hint: Here you will solveforDividends. In this case, dividends are Free Cash Flows to Owners (FCFs to Owners) Financial Statements (Units are $MM Unless Otherwise Noted) PPE Roll Forward Eqs. Item EOY-1 EOY 0 Relevant constant 20X-1 20X0 20X1 Comments ect As PPEnet (BOP) - Deprec + Capx 90.9 (7.6) 12.7 14.0 Company policy Plug (IE: solve for this) PPEnet (EOP) 90.9 97.3 Relevant constant EOY-1 EOY O Income Statement Sales COGS Depreciation SGA Interest EBT Tax NI Project As 20X-1 20X0 20X1 Comments 0.9 100.0 70.0 7.6 10.0 5.2 7.3 2.2 5.1 EOY-1 EOY 0 Relevant constant ect As Balance Sheets Cash AR 20X-1 20X0 20X1 5.0 25.0 25.0 10.0 65.0 Min cash deemed safe by Greatv 25%-25/100 Other CA Total CA PPE(net) TOTAL ASSETS 90.997.3 147.6 162.3 AP Accrued Liabilities Other CL Total CL 30.0 25.0 10.0 65.0 Debt Total Liabilities 73.8 81.2 146.2 Target financial leverage Equity TOTALLEquity 16.2 162.3 Check: A (L+E) 0.0 0.0 EOY 0 Computation of Dividends (FCF's) Item E(BOP) + NI DIV(+PIC)Free Cash Flow (Hint: Solve for this) -E(EOP) 20X-1 20X0 20X1 Comments 16.2 B. Fill in the following missing data Project Evaluation EOY Item (Cash Flows tolfrom Greatv) 20X-1 20X0 20X1 Cash fow needed to purchase the firm Free Cash Flow From Operating the Firm Be sure to put the cash flows at their proper times (ie: in the proper columns FCF20x1 P/FCF ratio (Sale Price -Price Paid) Cap Gain Tax rate Sale price of firm Capital Gains tax Cash Flow from Sale of Firm Net Comprehensive Cash Flow (NCCF) to/from GreatV (NCCF in each period is the total CF to/from GreatV in the period) Present Values of NCCFs NPV of this project for GreatV IRR of this project for GreatV (show all work) Should GreatV execute this plan? Why or Why Not? Solve: 0-80+171.9(1+IRRA1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts