Question: Mortgage Preapproval. What does it mean to be preapproved for a mortgage? Why is it beneficial to get preapproved for a mortgage? ( Select the

Mortgage Preapproval. What does it mean to be preapproved for a mortgage? Why is it beneficial to get preapproved for a mortgage?

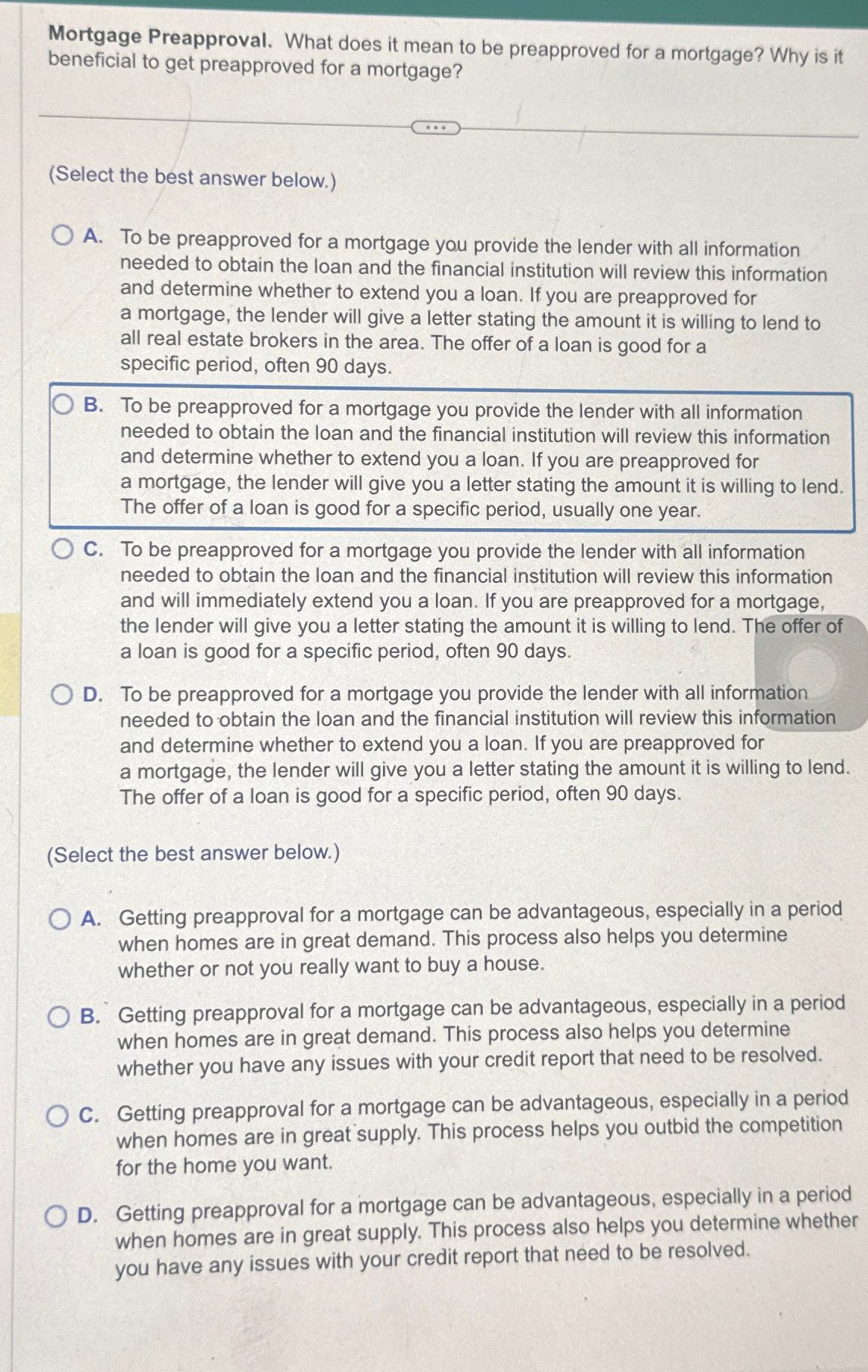

Select the best answer below.

A To be preapproved for a mortgage you provide the lender with all information needed to obtain the loan and the financial institution will review this information and determine whether to extend you a loan. If you are preapproved for a mortgage, the lender will give a letter stating the amount it is willing to lend to all real estate brokers in the area. The offer of a loan is good for a specific period, often days.

B To be preapproved for a mortgage you provide the lender with all information needed to obtain the loan and the financial institution will review this information and determine whether to extend you a loan. If you are preapproved for a mortgage, the lender will give you a letter stating the amount it is willing to lend. The offer of a loan is good for a specific period, usually one year.

C To be preapproved for a mortgage you provide the lender with all information needed to obtain the loan and the financial institution will review this information and will immediately extend you a loan. If you are preapproved for a mortgage, the lender will give you a letter stating the amount it is willing to lend. The offer of a loan is good for a specific period, often days.

D To be preapproved for a mortgage you provide the lender with all information needed to obtain the loan and the financial institution will review this information and determine whether to extend you a loan. If you are preapproved for a mortgage, the lender will give you a letter stating the amount it is willing to lend. The offer of a loan is good for a specific period, often days.

Select the best answer below.

A Getting preapproval for a mortgage can be advantageous, especially in a period when homes are in great demand. This process also helps you determine whether or not you really want to buy a house.

B Getting preapproval for a mortgage can be advantageous, especially in a period when homes are in great demand. This process also helps you determine whether you have any issues with your credit report that need to be resolved.

C Getting preapproval for a mortgage can be advantageous, especially in a period when homes are in great supply. This process helps you outbid the competition for the home you want.

D Getting preapproval for a mortgage can be advantageous, especially in a period when homes are in great supply. This process also helps you determine whether you have any issues with your credit report that need to be resolved.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock