Question: . . Your mutual friend asks your advice. The background assumptions are listed below. You can answer this question any way that you feel will

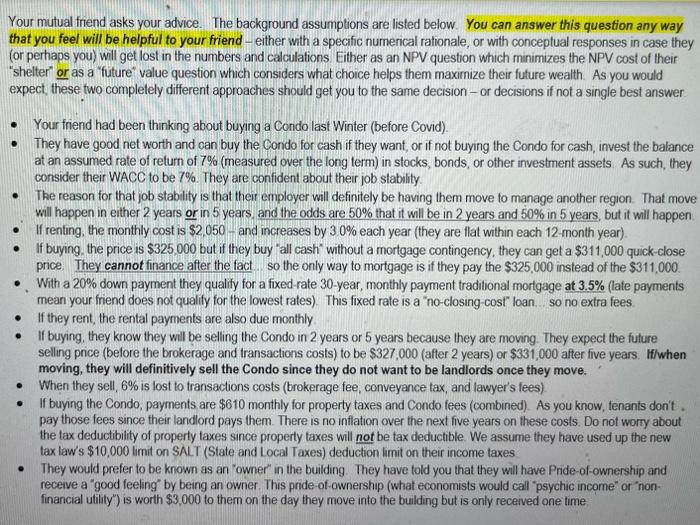

. . Your mutual friend asks your advice. The background assumptions are listed below. You can answer this question any way that you feel will be helpful to your friend - either with a specific numerical rationale, or with conceptual responses in case they (or perhaps you will get lost in the numbers and calculations Either as an NPV question which minimizes the NPV cost of their "shelter" or as a "future" value question which considers what choice helps them maximize their future wealth. As you would expect these two completely different approaches should get you to the same decision - or decisions if not a single best answer Your friend had been thinking about buying a Condo last Winter (before Covid), They have good net worth and can buy the Condo for cash if they want, or if not buying the Condo for cash, invest the balance at an assumed rate of return of 7% (measured over the long term) in stocks, bonds, or other investment assets. As such, they consider their WACC to be 7%. They are confident about their job stability The reason for that job stability is that their employer will definitely be having them move to manage another region. That move will happen in either 2 years or in 5 years and the odds are 50% that it will be in 2 years and 50% in 5 years, but it will happen If renting, the monthly cost is $2050 - and increases by 30% each year they are flat within each 12 month year) If buying the price is $325,000 but if they buy "all cash without a mortgage contingency, they can get a $311,000 quick-close price. They cannot finance after the fact so the only way to mortgage is if they pay the $325,000 instead of the $311,000 With a 20% down payment they qualify for a fixed rate 30 year, monthly payment traditional mortgage at 3.5% (late payments mean your friend does not quality for the lowest rates). This fixed rate is a "no-closing cost" loan so no extra fees. If they rent, the rental payments are also due monthly If buying, they know they will be selling the Condo in 2 years or 5 years because they are moving They expect the future selling price (before the brokerage and transactions costs) to be $327,000 (after 2 years) or $331,000 after five years. If/when moving, they will definitively sell the Condo since they do not want to be landlords once they move. When they sell , 6% is lost to transactions costs (brokerage fee, conveyance tax, and lawyer's fees) If buying the Condo, payments are $610 monthly for property taxes and Condo fees (combined) As you know, tenants don't pay those fees since their landlord pays them. There is no inflation over the next five years on these costs. Do not worry about the tax deductibility of property taxes since property taxes will not be tax deductible. We assume they have used up the new tax law's $10,000 limit on SALT (State and Local Taxes) deduction limit on their income taxes They would prefer to be known as an "owner" in the building. They have told you that they will have Pride of ownership and receive a "good feeling by being an owner. This pride of ownership (what economists would call "psychic income" or "non- financial utility) is worth $3,000 to them on the day they move into the building but is only received one time . . . . . . Your mutual friend asks your advice. The background assumptions are listed below. You can answer this question any way that you feel will be helpful to your friend - either with a specific numerical rationale, or with conceptual responses in case they (or perhaps you will get lost in the numbers and calculations Either as an NPV question which minimizes the NPV cost of their "shelter" or as a "future" value question which considers what choice helps them maximize their future wealth. As you would expect these two completely different approaches should get you to the same decision - or decisions if not a single best answer Your friend had been thinking about buying a Condo last Winter (before Covid), They have good net worth and can buy the Condo for cash if they want, or if not buying the Condo for cash, invest the balance at an assumed rate of return of 7% (measured over the long term) in stocks, bonds, or other investment assets. As such, they consider their WACC to be 7%. They are confident about their job stability The reason for that job stability is that their employer will definitely be having them move to manage another region. That move will happen in either 2 years or in 5 years and the odds are 50% that it will be in 2 years and 50% in 5 years, but it will happen If renting, the monthly cost is $2050 - and increases by 30% each year they are flat within each 12 month year) If buying the price is $325,000 but if they buy "all cash without a mortgage contingency, they can get a $311,000 quick-close price. They cannot finance after the fact so the only way to mortgage is if they pay the $325,000 instead of the $311,000 With a 20% down payment they qualify for a fixed rate 30 year, monthly payment traditional mortgage at 3.5% (late payments mean your friend does not quality for the lowest rates). This fixed rate is a "no-closing cost" loan so no extra fees. If they rent, the rental payments are also due monthly If buying, they know they will be selling the Condo in 2 years or 5 years because they are moving They expect the future selling price (before the brokerage and transactions costs) to be $327,000 (after 2 years) or $331,000 after five years. If/when moving, they will definitively sell the Condo since they do not want to be landlords once they move. When they sell , 6% is lost to transactions costs (brokerage fee, conveyance tax, and lawyer's fees) If buying the Condo, payments are $610 monthly for property taxes and Condo fees (combined) As you know, tenants don't pay those fees since their landlord pays them. There is no inflation over the next five years on these costs. Do not worry about the tax deductibility of property taxes since property taxes will not be tax deductible. We assume they have used up the new tax law's $10,000 limit on SALT (State and Local Taxes) deduction limit on their income taxes They would prefer to be known as an "owner" in the building. They have told you that they will have Pride of ownership and receive a "good feeling by being an owner. This pride of ownership (what economists would call "psychic income" or "non- financial utility) is worth $3,000 to them on the day they move into the building but is only received one time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts