Question: Moss Co . issued $ 6 3 0 , 0 0 0 of five - year, 1 1 % bonds, with interest payable semiannually, at

Moss Co issued $ of fiveyear, bonds, with interest payable semiannually, at a market effective interest rate of

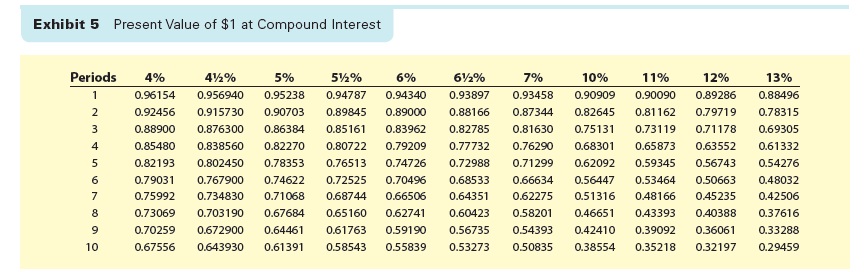

Determine the present value of the bonds payable, using the present value tables in Exhibit and Exhibit Round interim calculations to the nearest dollar.

Exhibit Present Value of $ at Compound Interest Exhibit Present Value of an Annuity of $ at Compound Interest

begintabularcccccccccccc

Periods & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf & mathbf

hline mathbf & & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

& & & & & & & & & & &

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock