Question: Moving to another question will save this response. Question 1 Maroon Inc. has 30 million shares outstanding, which are trading at S30 per share. Maroon

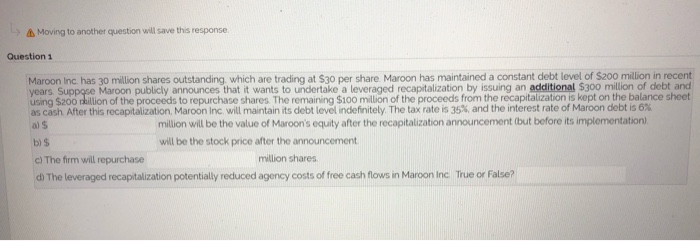

Moving to another question will save this response. Question 1 Maroon Inc. has 30 million shares outstanding, which are trading at S30 per share. Maroon has maintained a constant debt level of $200 million in recent years. Suppose Maroon publicly announces that it wants to undertake a leveraged recapitalization by issuing an additional $300 million of debt and using $200 million of the proceeds to repurchase shares. The remaining $100 million of the proceeds from the recapitalization is kept on the balance sheet as cash After this recapitalization, Maroon Inc will maintain its debt level indefinitely. The tax rate is 35%, and the interest rate of Maroon debt is 6% al $ million will be the value of Maroon's equity after the recapitalization announcement (but before its implementation), b) $ will be the stock price after the announcement c) The firm will repurchase million shares di The leveraged recapitalization potentially reduced agency costs of free cash flows in Maroon Inc. True or False? Moving to another question will save this response. Question 1 Maroon Inc. has 30 million shares outstanding, which are trading at S30 per share. Maroon has maintained a constant debt level of $200 million in recent years. Suppose Maroon publicly announces that it wants to undertake a leveraged recapitalization by issuing an additional $300 million of debt and using $200 million of the proceeds to repurchase shares. The remaining $100 million of the proceeds from the recapitalization is kept on the balance sheet as cash After this recapitalization, Maroon Inc will maintain its debt level indefinitely. The tax rate is 35%, and the interest rate of Maroon debt is 6% al $ million will be the value of Maroon's equity after the recapitalization announcement (but before its implementation), b) $ will be the stock price after the announcement c) The firm will repurchase million shares di The leveraged recapitalization potentially reduced agency costs of free cash flows in Maroon Inc. True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts