Question: Moving to another question will save this response. Question 11 CLO4] From the investor's perspective, the exchange rate risk of international bonds is the potential

![Moving to another question will save this response. Question 11 CLO4]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6702530d64aaa_5816702530d09ceb.jpg)

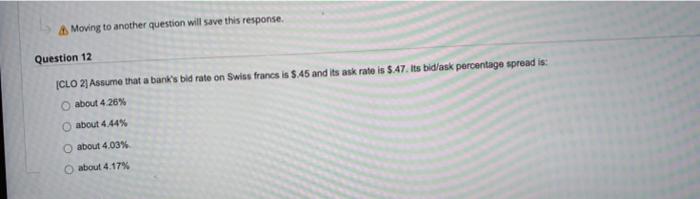

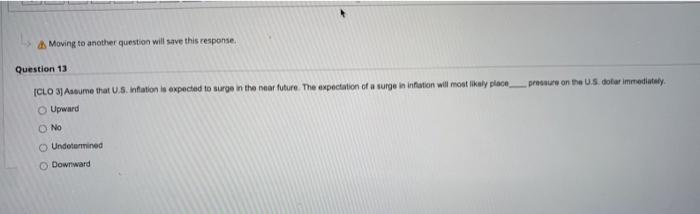

Moving to another question will save this response. Question 11 CLO4] From the investor's perspective, the exchange rate risk of international bonds is the potential for the value of bonds to decline because there is not a consistently active market for the bonds the potential for the value of bonds to decline because the currency denominating the bond depreciates against the home currency the potential for the value of bonds to decline because the currency denominating the bond appreciates against the home currency. the potential for the value of bonds to decline in response to rising long-term interest rates Moving to another question will save this response. Question 12 ICLO 21 Assume that a bank's bid rate on Swiss francs is $.45 and its ask rate is $47. Its bidlask percentage spread is: about 4.26% about 4.44% about 4,03% about 4.17% Moving to another question will save this response Question 13 pressure on the U.S.dotar immediately CLO 3) Assume that U.S.Intation is expected to surge in the near future. The expectation of a sorge in inflation will most likely place Upward No Undetermined Downward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts