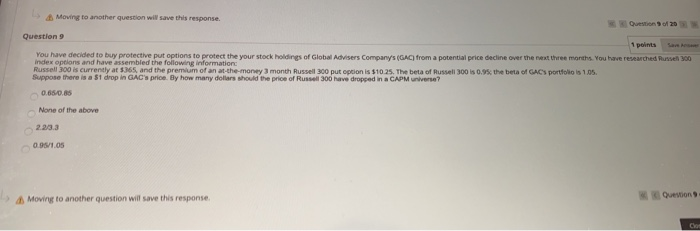

Question: Moving to another question will save this response. Question 120 Question 9 1 points You have decided to buy protective put options to protect the

Moving to another question will save this response. Question 120 Question 9 1 points You have decided to buy protective put options to protect the your stockholdings of Global Advisers Company's (GA) from a potential price decline over the next three months. You have reached Russel 300 Index options and have assembled the following information Russell 300 is currently at 5.365, and the premium of an at-the-money 3 month Russell 300 put option is $10.25. The beta of Russell 300 is 0.95, the beta of GAC portfolio is 105 Suppose there is a 51 drop in GAC's price. By how many dollars should the price of Russell 300 have dropped in a CAPM universe? 0.650.0 None of the above 2.23.3 0.951OS Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts