Question: Moving to another question will save this response Question 14 of 17 Question 14 10 points Save Answer A bond with a coupon rate of

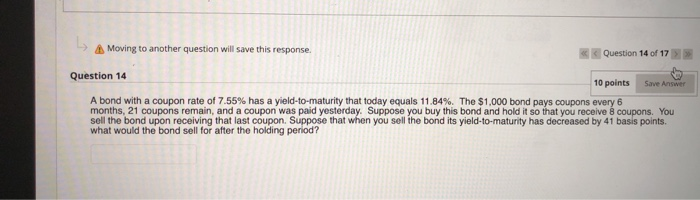

Moving to another question will save this response Question 14 of 17 Question 14 10 points Save Answer A bond with a coupon rate of 7.55% has a yield-to-maturity that today equals 11.84%. The $1,000 bond pays coupons every 6 months, 21 coupons remain, and a coupon was paid yesterday. Suppose you buy this bond and hold it so that you receive a coupons. You sell the bond upon receiving that last coupon. Suppose that when you sell the bond its yield-to-maturity has decreased by 41 basis points. what would the bond sell for after the holding period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts