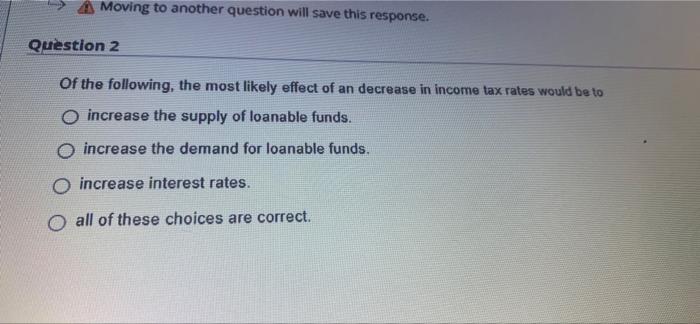

Question: Moving to another question will save this response. Question 2 Of the following, the most likely effect of an decrease in income tax rates would

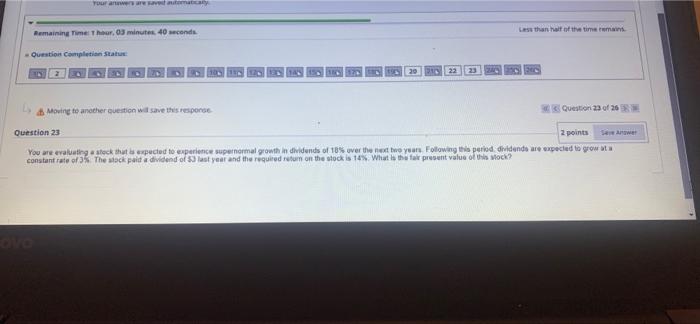

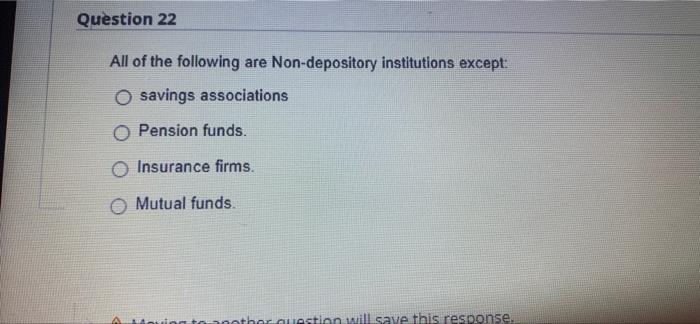

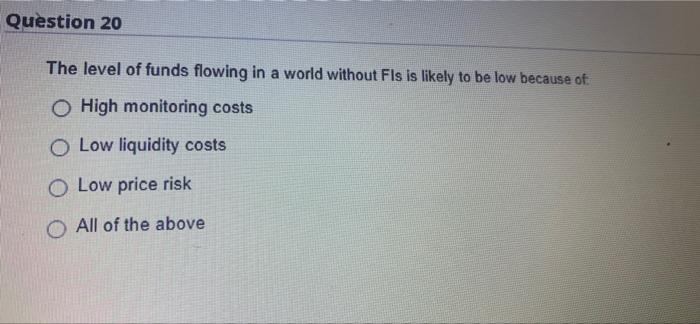

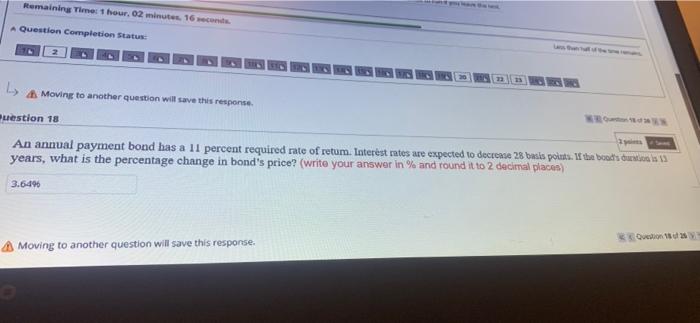

Moving to another question will save this response. Question 2 Of the following, the most likely effect of an decrease in income tax rates would be to o increase the supply of loanable funds. o increase the demand for loanable funds. o increase interest rates. O all of these choices are correct. your awesomatica Less than half of the terms Remaining Time Thur 3 minutes 40 seconds -Ouestion completion Status 23 Moving to another question will save this response Question 23 of 26 Question 23 2 points SA You are evaluating stock that is expected to experience supernormal growth individunds of 18% over the next two years. Following the period dividends are expected to grow ata constant rate of the stock pula dividend of last year and the required ruum on the stock is 14%What is the far present value of his vock? Question 22 All of the following are Non-depository institutions except: O savings associations Pension funds. O Insurance firms. Mutual funds. A Liquing to another question will save this response. Question 20 The level of funds flowing in a world without Fis is likely to be low because of High monitoring costs O Low liquidity costs O Low price risk O All of the above Remaining Time: 1 hour, 02 minutes. 16 recente A Question completion Status 2 L Moving to another question will save this response Puestion 18 An annual payment bond has a 11 percent required rate of retum. Interest rates are expected to decrease 28 basis points. the boods dis 13 years, what is the percentage change in bond's price? (write your answer in % and round it to 2 decimal placen) 3.6496 A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts