Question: Moving to another question will save this response. Question 31 Di, Information about three stocks (D. E, and F) and two common risk factors (1

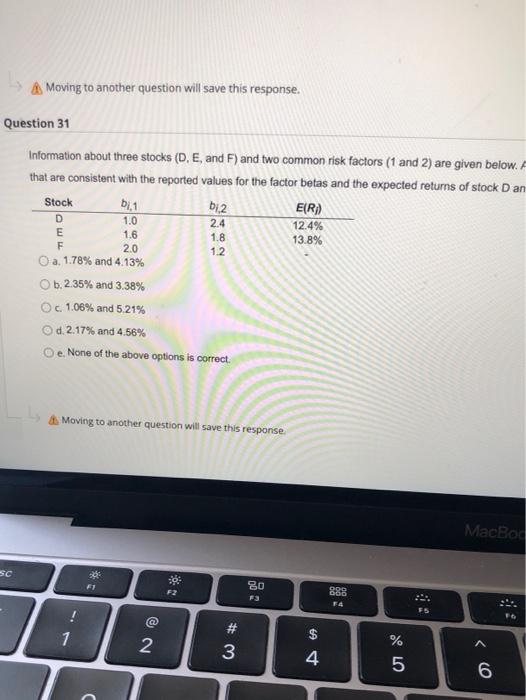

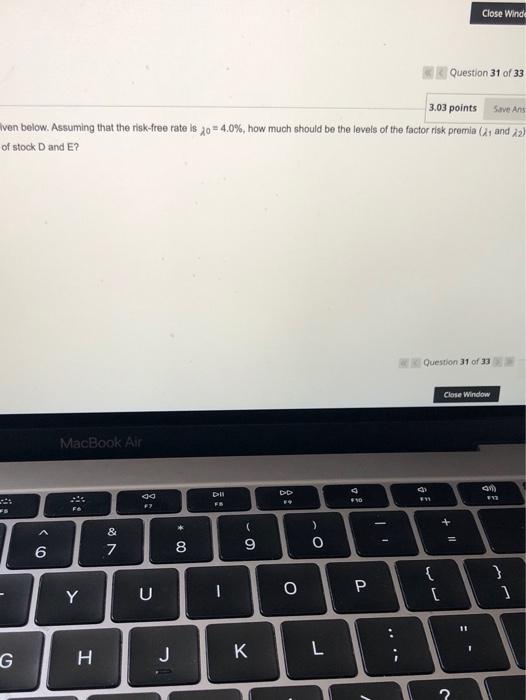

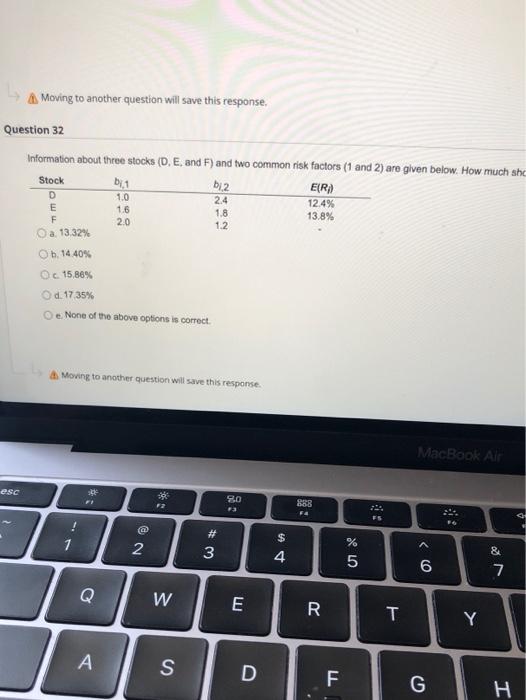

Moving to another question will save this response. Question 31 Di, Information about three stocks (D. E, and F) and two common risk factors (1 and 2) are given below. that are consistent with the reported values for the factor betas and the expected returns of stock Dan Stock biz E(R) D 1.0 2.4 12.4% E 1.6 1.8 13.8% F 2.0 1.2 a. 1.78% and 4.13% Ob. 2.35% and 3.38% Oc 1.06% and 5.21% Od 2.17% and 4.56% Oe. None of the above options is correct. Moving to another question will save this response MacBou SC F1 F2 BO 73 888 F4 ES @ 1 2 A W # A 4 % 5 6 Moving to another question will save this response. Question 32 Information about three stocks (D. E, and F) and two common risk factors (1 and 2) are given below. How much sho Stock by 1 by2 E(R) D 1.0 24 12.4% E 1.6 1.8 F 13.8% 2.0 1.2 a 13,32% AN b. 14.40% Oc 15,86% Od. 17.35% De None of the above options is correct. Moving to another question will save this response MacBook Air esc 2 SO 3 888 F A @ 1 2 # 3 $ 4 A % 5 & 6 7 Q W E 20 T Y A S D F G H k factors (1 and 2) are given below. How much should be the expected retum of stock Fas predicted by this two-factor moder? ER) 12.4% 13.8% Ques MacBook Air . . 3: . Fe 86 Oli FB $ 7 % 5 & 7 00. C 9 ) 0 6 { O 20 Y T P U F G H J L ... V B Z M - 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts