Question: Moving to another question will save this response. Question 8 Briefly explain how you would prove the stament firm's business assets is equal to the

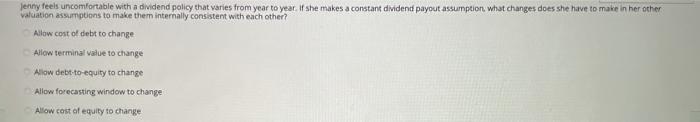

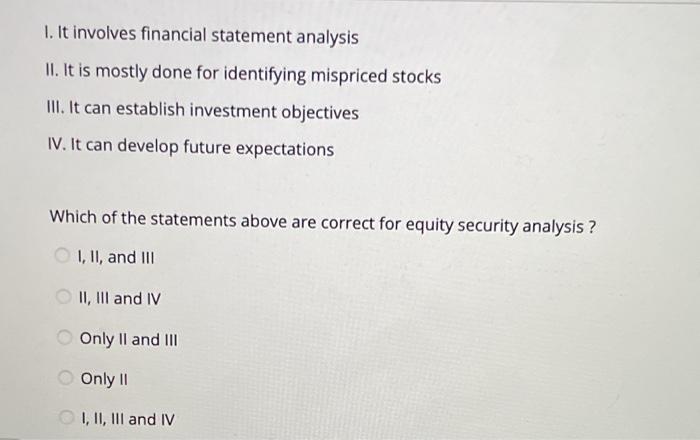

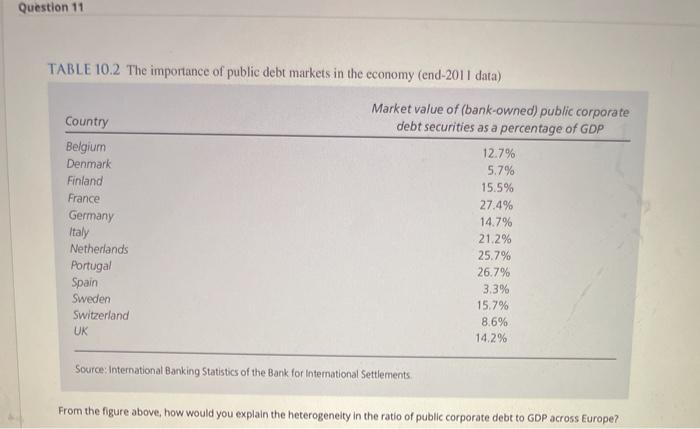

Moving to another question will save this response. Question 8 Briefly explain how you would prove the stament "firm's business assets is equal to the weighted average of its debt and equity betas". For the toolbar, press ALT F10 (PC) or ALT+FN-F10 (Mac) Jenny feels uncomfortable with a dividend policy that varies from year to year. If she makes a constant dividend payout assumption. What changes does she have to make in her other Valuation assumptions to make them internally consistent with each other? Allow cost of debt to change Allow terminal value to change Allow debt-to-equity to change Allow forecasting window to change Allow cost of equity to change 1. It involves financial statement analysis II. It is mostly done for identifying mispriced stocks III. It can establish investment objectives IV. It can develop future expectations Which of the statements above are correct for equity security analysis ? I, II, and III II, III and IV Only II and III Only 11 I, II, III and IV Question 11 TABLE 10.2 The importance of public debt markets in the economy (end-2011 data) Country Belgium Denmark Finland France Germany Italy Netherlands Portugal Spain Sweden Switzerland UK Market value of (bank-owned) public corporate debt securities as a percentage of GDP 12.7% 5.7% 15.5% 27.4% 14.7% 21.2% 25.7% 26.7% 3.3% 15.7% 8.6% 14.2% Source: International Banking Statistics of the Bank for International Settlements From the figure above, how would you explain the heterogeneity in the ratio of public corporate debt to GDP across Europe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts